Corporate earnings had a rough go of it in the second quarter—total earnings for S&P 500 companies were down -2.1% from the same period last year, on -3.4% lower revenues.1 It would be one thing if earnings were falling while revenues went up, which would indicate companies may have spent more over the quarter on fixed investments, more hires, or higher wages, for example. But the data clearly shows that top line revenues are falling alongside earnings, which means there could be an issue with softening demand.

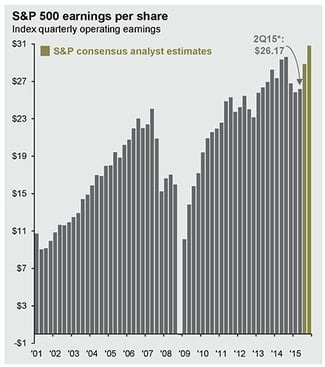

As you can see from the chart below, earnings also fell from the fourth quarter of 2014 to the first quarter of 2015. With earnings getting weaker as market volatility increases and China worries build, investors may wonder if a more cautious portfolio strategy is warranted from here.

Figure 1. Earnings Have Been on the Decline Since Late Last Year

2 Reasons Earnings Weakness May Not Be So Bad

Moving your investment portfolio into a defensive posture as a result of weak earnings may be a bit premature, and it also may not take into account two important details:- The Negative Role of Energy – the Energy sector is the main culprit for the aggregate earnings decline in Q2. The sector got pummeled in the second quarter, as earnings were down some -60% with -30% lower revenues. The Energy sector thus had a disproportionately adverse impact on aggregate earnings for the S&P 500. If you take away the Energy sector, total earnings for the S&P 500 would have been up +5.2% on +1.3% higher revenues.1

- Analysts Expect Earnings to Recover in Q3 and Q4 – as you can see above in Figure 1, analysts forecast earnings to rebound in the back half of the year. As the chart also shows in looking back at past years, there have been other instances in recent history when earnings took a step back before resuming an upward climb. It will be something to watch closely, but it looks as though earnings may recover from this week mid-year patch as well.

Keep Your Eye on Earnings Going Forward

It’s reasonable to expect that if earnings can grow quarter over quarter, that stocks have a reasonable chance of moving higher as well. But the opposite may also be true, which makes it important to keep your eye on earnings with each quarter that passes.

If you have any questions about your portfolio’s positioning ahead of earnings season or would just like to discuss your investment strategy in the current environment, the Wealth Managers at WrapManager would be happy to spend some time on the phone with you or chatting over email. Just give us a call at 1-800-541-7774 or contact us here.

Sources;

1. Zacks