2015 has been a challenging year so far for many asset classes, but Emerging Markets and Commodities are two categories in particular that have felt pronounced downward pressure throughout. Emerging Markets (as measured by the iShares Emerging Markets Index ETF, ticker EEM) are down around 10% year-to-date through October 20,1 and commodities have fared even worse—in the third quarter prices cratered, with Brent Crude Oil and West Texas Intermediate down -23.6% and -23.7%, respectively, and with copper -10.7%, gold -5%, and silver -7.5% all losing ground as well.2

The questions on many investors’ minds are: is the slump over? Are these attractive levels to buy-in to Emerging Markets and commodities?

Analyzing the Data Behind Emerging Markets and Commodities Pricing

No one can say for certain when the downtrend in price will end—it may have ended already, or could even have months or years to go. But what we can do is examine valuations and pricing changes within each category, to get a relative sense of where they stand today.

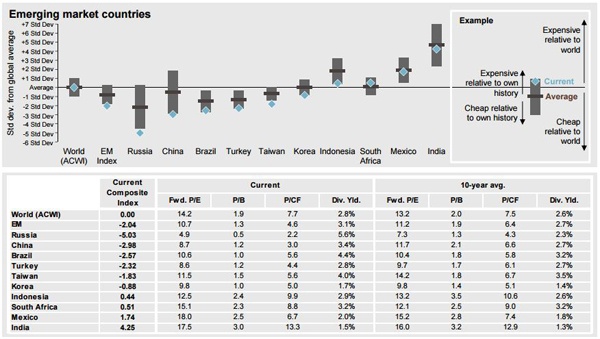

Looking at Emerging Markets, JP Morgan has produced this excellent graphic that gives you an idea of how individual countries are valued relative to the world. As you can see, countries like Russia that rely on energy exports to drive a big portion of their GDP are ‘cheap’ relative to the world on account of lower oil prices.

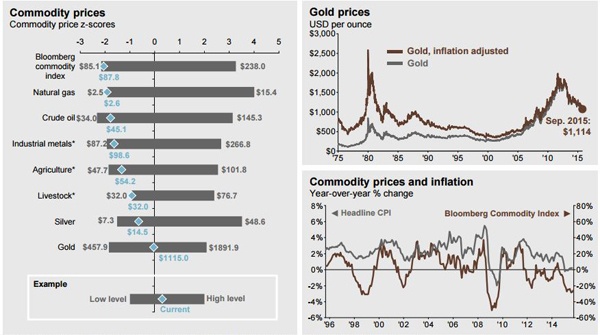

On the commodities front, this graphic gives you a good idea of how prices have moved within the range of highs and lows, and how commodities prices have changed relative to inflation. From a pure price standpoint, it’s plain to see that nearly every category is trading close to the lower end of the range. Commodities prices have been much higher across the board, the question is, can they get there again? It’s certainly possible.

The Investor Approach to Emerging Markets and Commodities

Warren Buffet once famously said to “be greedy when others are fearful and fearful when others are greedy.” One interpretation of that quote is that when prices decline precipitously as they have with Emerging Markets and commodities, it is possible that some of that downward pressure is being driven by emotional selling—the “fearful” he references. That could mean these price declines could offer opportunities for investors comfortable with the market risk.

At the end of the day, we recommend maintaining a well-diversified portfolio. In other words, if you want Emerging Markets and commodities exposure in your portfolio, you should consider making each category just a portion of your overall portfolio. While diversification cannot guarantee profit or protect against loss in declining markets, you can diversify away some of the risks inherent in being over concentrated in one area.

If you want to learn more about WrapManager’s approach to investing in Emerging Markets and commodities, give us a call at 1-800-541-7774 or start the conversation here.

Sources:

1. MSCI

2. JP Morgan Market Update

3. JP Morgan Guide to the Markets