U.S. STOCKS: SMALL- AND MID-CAPS’ HOME-COURT ADVANTAGE

U.S. STOCKS: SMALL- AND MID-CAPS’ HOME-COURT ADVANTAGE

For those concerned about developments overseas, U.S. small- and mid-cap stocks, which are positioned to benefit from strength in domestic consumer spending, may be worth considering.

Bracing for “Brexit”? Challenged by China? You’re not alone. A scan of recent headlines underscores the challenges in the global investment landscape. The United Kingdom is facing a fractious vote (June 23) on whether to leave the European Union. China is grappling with a slowing economy. The eurozone is hindered by sluggish growth and the prospect of more fiscal drama with Greece. Japan is trying to jump-start its moribund economy and counter deflation. The list goes on.

Then there’s the United States. While growth for the world’s largest economy has not been spectacular, it has been steady, with gross domestic product (GDP) expanding at an average annual rate of about 2% in recent years. Indeed, a number of U.S. Federal Reserve (Fed) officials have cited a strengthening U.S. economy as a policy consideration in the run-up to the next Federal Open Market Committee meeting on June 14-15.

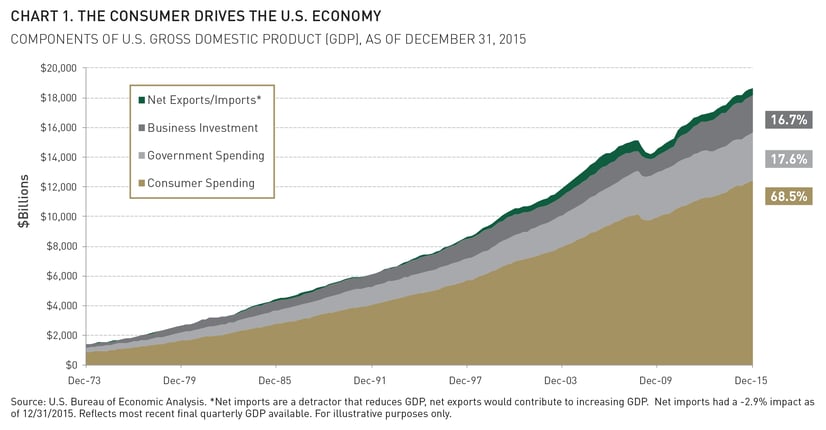

What’s behind the persistent strength of the U.S. economy? Actually, it’s not a “what,” but a “who”: the consumer. Consumption spending accounts for nearly two-thirds of U.S. GDP (see Chart 1). The U.S. economy is uniquely dependent on internal consumption, and Zane Brown, Lord Abbett Partner and Fixed-Income Strategist, noted that total U.S. exports account for only 13% of U.S. GDP. By contrast, China’s export sector makes up 23% of its economic output, while Germany’s comprises around 46%, according to World Bank data.

Is the consumer, then, likely to be the continuing booster of the U.S. economy? In a recent commentary, Brown identified five factors that should support ongoing U.S. consumer spending and, by extension, U.S. economic growth. They include:

- Faster job growth

- Rising wages

- Lower oil prices, accompanied by a stronger U.S. dollar

- Stronger household balance sheets

- Solid housing-market fundamentals

Brown noted that the U.S. economy may show “surprising strength” in the months ahead as a result of those factors.

Another positive signal comes from the May update of the University of Michigan’s consumer sentiment index, which climbed to 94.7 for the month, from 89.0 in April, the highest level in 11 months. In an accompanying release, a university economist noted that “consumers became more optimistic about their financial prospects, and anticipated a somewhat lower inflation rate in the years ahead.”

So, how might equity investors benefit from this trend?

For answers to that and the question, how did the stock market do last month, download the full report here.

![]() Download Lord Abbett's Full Commentary Here

Download Lord Abbett's Full Commentary Here