Investor concerns about another government shutdown were eased in late October, when Congressional leaders passed a bipartisan agreement that will provide relief from sequester cuts and avoid unnecessary debt defaults1 (yes, we just wrote the words ‘bipartisan’ and ‘agreement’ in the same sentence).

A closer look at the budget agreement, however, revealed some changes to Social Security rules that will close the window – at least for now - on some unique Social Security Retirement Benefit ‘strategies’ that we’ve written about before.

The End of the “File and Suspend” Strategy

The first is the File and Suspend Strategy. Before this budget agreement, the file and suspend option allowed one person in a married couple to file for their benefit (thereby allowing the spouse to claim their benefit) but then immediately suspend it – allowing that future benefit to increase. You file, your spouse claims, then you suspend.

According to the new rule, however, once you suspend your benefit it will suspend the spousal benefit as well. To note, if you’ve already executed this strategy and are receiving benefits, you will continue to receive them. The go into effect 180 days after the budget agreement was signed into law on November 2, 2015. Once that deadline passes, this option is off the table for everyone.

The End of “Restricted Spousal Benefits”

The second strategy is the Restricted Application for Spousal Benefits. Similar to the “file and suspend” approach, it allowed a person to file a “restricted” application for “just” spousal benefits, while allowing his or her own future retirement benefit to grow. Under the new rules, an individual cannot file for just spousal benefits – he or she will be required to file and claim for all eligible benefits.

As far as enactment goes, individuals age 62 or older at the end of 2015 will continue having the option of restricting an application to spousal benefits only. For those turning 62 in 2016 or later, you will have to claim all of your benefits upon filing.2

It Still Pays to Delay Receiving Social Security Benefits

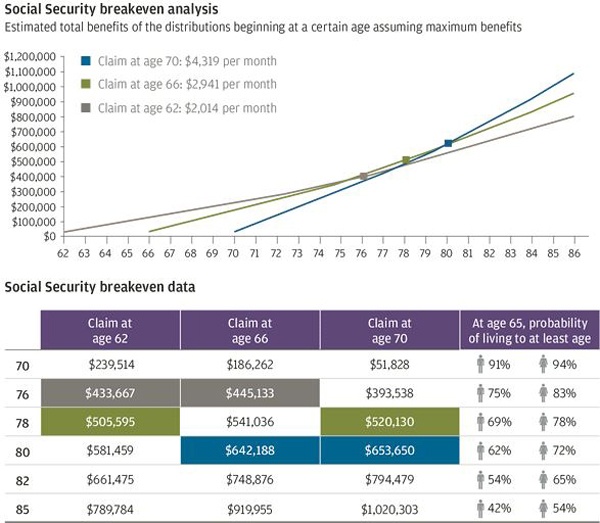

In many cases, it can still make sense to delay filing for your social security retirement benefits. The longer you wait, the greater your monthly benefit becomes, which can also mean receiving more money over your lifetime. As you can see below, it doesn’t take very long for a person who waited until age 70 to claim their benefit to “break-even” with a person who started at the full retirement age of 62. With life expectancies on the rise given advances in medicine and better health , it could provide a real economic benefit for those who delay:3

Talk to a Wealth Manager about Your Social Security Retirement Plans

If you are unsure about when to file for your Social Security Retirement benefits, and want to bounce some ideas off one of our Wealth Managers, you can feel welcome to give us a call at 1-800-541-7774 or contact us here. Often times the decision for how to time your Social Security benefits depends on your other sources of retirement income, which a Wealth Manager can help you analyze.

Sources:

2. Fidelity

3. JP Morgan