There seems this growing feeling that the market is on shaky ground. As an investor, you may feel it too: the presidential election is unique to the point of being wild, Europe appears to be in disarray, corporate profits have seen better days, GDP growth in the U.S. has been lower than average.

There seems this growing feeling that the market is on shaky ground. As an investor, you may feel it too: the presidential election is unique to the point of being wild, Europe appears to be in disarray, corporate profits have seen better days, GDP growth in the U.S. has been lower than average.

Perhaps that is why a recent Bloomberg survey of forecasters said they expect the S&P 500 to finish the year 1% lower. They cited some of the concerns mentioned above, but also pointed to negative sentiment tied to rising interest rates, elevated stock valuations, and the aging business cycle.1 The question for investors is: is it time to rethink portfolio strategy, perhaps favoring a defensive posture?

It May Not Always Be Best to Follow the Herd

According to one Bloomberg columnist, when the consensus starts to focus on widely known market fears and negative sentiment, it may actually signal a time to be more positive. In a Barry Ritholtz article titled, “Bullish News from Wall Street’s Bearish Seers,” he points out that “based on a long history of forecasting failures, it’s a long shot the groups’ forecast will be correct.”

Two of the key points he cites in the article revolve around prevailing concerns over rising interest rates and overvalued stocks. On the interest rate front, he correctly reminds us that investor concern is focused on incremental interest rate hikes off the zero bound. Are we really fearing that interest rates will rise to 1% over the next year? Is that so bad? Ritholtz notes that in the 20 years before the financial crisis, short-term rates averaged 4.85%. When thought of in that context, a move from 0-0.25% to 1% doesn’t seem all that bad.1

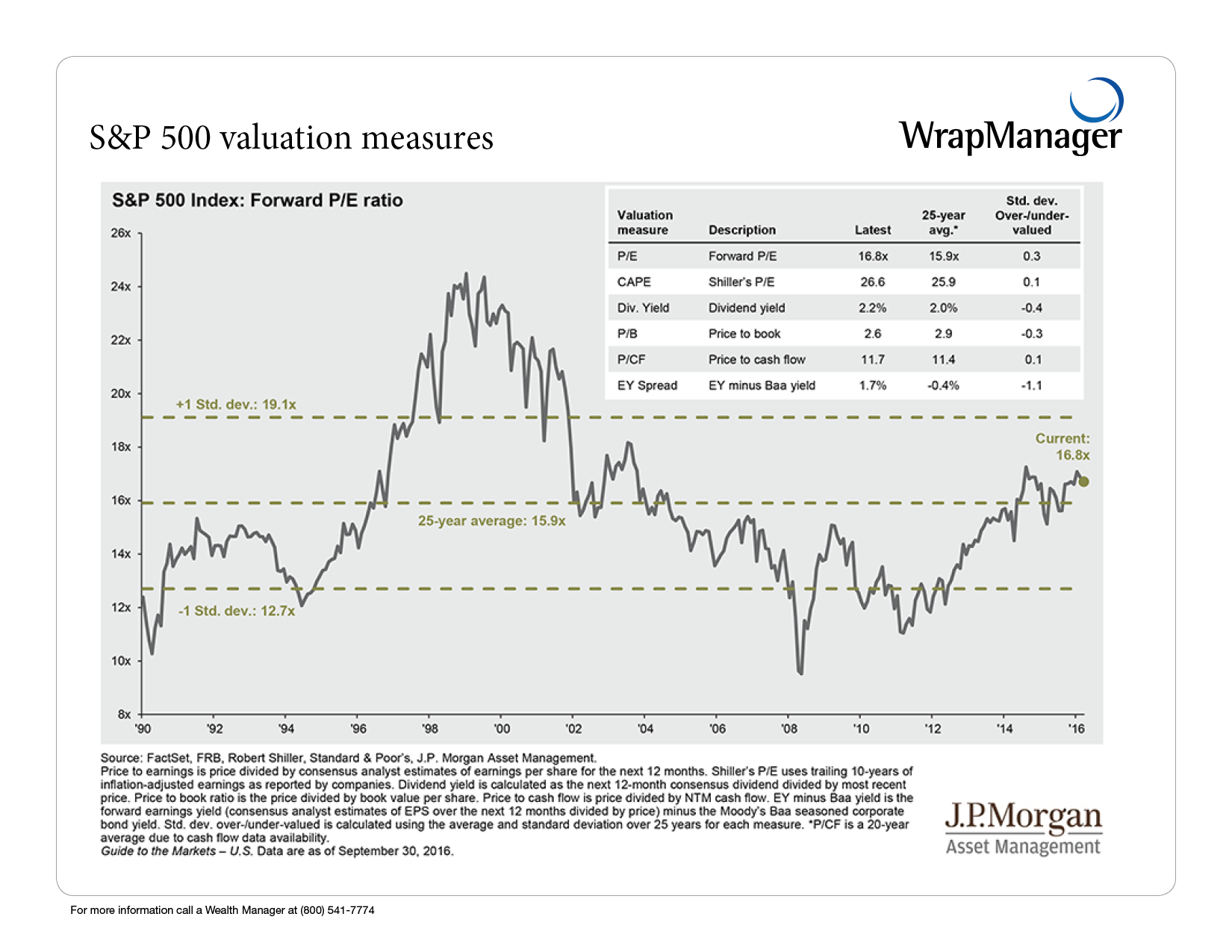

On the valuations front, he notes that while valuations are a bit high, in a historical context they are pretty close to 25-year averages. As you can see in the chart below, as of the end of Q3 valuations are about 1% higher than the 25-year average, but they are also well below the levels touched in the late 1990’s—when stocks had a pretty memorable run.

Does this mean that stocks will actually rise when most expect them to fall? Not necessarily. But it does serve as a reminder that stocks are quite capable of going up even when negative sentiment seems to rule the day. In fact, it is so common for stocks to behave that way that there is a name for it the columnist reminds us of: the “wall of worry.” If stocks ignore the negative headlines, so should you.

Find Middle Ground with a Diversified Portfolio

In a world of uncertainties, investors are often faced with difficult choices about how to manage an investment portfolio. But one time-tested approach is to build a diversified portfolio that gives you exposure to different strategies and asset classes. That way, if one area of the market does poorly while another area does well (stocks versus bonds, for instance), you can smooth out the effects on your portfolio. While diversification cannot guarantee against losses; in many cases, diversification is a good defense against volatility.

Download our free eBook: 5 Ways to Enhance Your Retirement Planning Strategy So You Can Face the Future With Confidence

When was the last time you had a financial advisor review your portfolio’s diversification? As we head into election season and the end of the year, now may be a good time to review your holdings to make sure you’re positioned appropriately relative to your goals and the market outlook. One of our Wealth Managers can help you. Call us today at 1-800-541-7774 for a free portfolio review, or feel welcome to send us an email to wealth@wrapmanager.com to get started.

Source: