The stock market overcame some volatility early in the year but continued to trend higher. As the market has reached new all-time highs, many investors are wondering if it’s too late to put additional cash to work. Others have indicated they’re still waiting for a possible stock market correction before making any decisions.

One thing remains clear – despite what happens in the market and when, it’s likely you still need your portfolio growing and generating retirement income over time.

There are two types of portfolio strategies that could ease concerns about where the market’s headed while positioning your portfolio for a variety of outcomes. Tactical Strategies are designed to temper the effects of a market decline while trying to capture growth, and Dividend Income Strategies aim to generate income while reducing volatility.

Let’s take a look at both.

Dividend Income Strategies: Striving for Equity-Like Returns with Less Volatility

Dividend strategies can help generate retirement income and help cushion your portfolio during market declines.

Research from dividend money manager Federated Investors, Inc. has shown that a portfolio of high dividend-paying stocks can:

1. Produce Attractive Total Returns

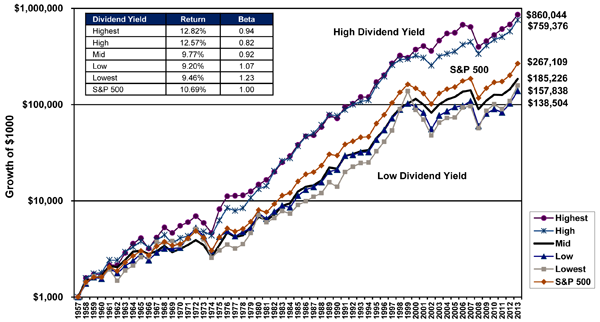

From July 1, 1996 to June 30, 2013, a high dividend paying stock strategy generated an average annualized total return of 10%, which is 2.78% higher than the 7.22% annualized return realized by the S&P 500.

Dividend Yield and Relative Performance (1957-2013)

(Click chart for larger version)

Source: Federated Investment Counseling, Jeremy Siegel, Future for Investors (2005), With Updates to 2013. Each stock in S&P 500 is ranked from highest to lowest by dividend yield on December 31st of every year and placed into “quintiles,” baskets of 100 stocks in each basket. The stocks in the quintiles are weighted by their market capitalization. The dividend yield is defined as each stock’s annual dividends per share divided by its stock price as of December 31st of that year. Beta is a measurement of an index’s trailing 36-month returns in relation to the appropriate market index. As of 12/31/13. This chart is for illustrative purposes only and is not representative of performance for any specific investment. Past performance does not guarantee future results.

2. Offer Lower Levels of Long-Term Volatility (measured by beta in the above chart)

Since high dividend-paying stocks produce some of their returns in the form of cash, they may also help cushion your portfolio’s downside when the broader market is posting losses.1

3. Generate Income in Your Portfolio

You can potentially use this income to help supplement – or even provide for – your retirement income needs.

Tactical Strategies: Designed to Limit Portfolio Losses

Often, investors who are acutely focused on avoiding market declines will take an overly “protective” approach to investing, limiting the growth potential of their portfolios. Others feel they either have to be fully invested in the stock market or waiting on the sidelines. This is where tactical strategies, designed to provide you with exposure to equities during good times, while maintaining the ability to go to cash or cash equivalents, could make sense.

Put simply, tactical strategies should aim to “protect and participate” – protect on the downside, while participating in the upside.

Next Steps: Evaluating and Adjusting Your Portfolio

A dividend income strategy and a tactical strategy could make sense as part of your overall portfolio if you’re unsure about where the market is headed or concerned about your portfolio in the current market environment. These strategies should be used alongside other strategies as part of your diversified investment portfolio.

If you would like for us to examine your portfolio to illustrate how adding a dividend income and/or tactical strategy could benefit your portfolio, please let us know by answering a few questions here.

Sources:

2 Federated Investors

There are no guarantees that dividend paying stocks will continue to pay dividends. In addition, dividend paying stocks may not experience the same capital appreciation potential as non-dividend paying stocks.