We recently wrote a post addressing volatility in China – in just one months’ time (mid-June to mid-July), the market there lost one third of its value.1 The wild swing in Chinese equities did not necessarily send shock waves through the global markets (which remain slightly positive on the year), but it did effectively raise eyebrows amongst investors curious if the downside volatility could be contagious.

They might have a point. If you consider the ongoing Greece sovereign debt crisis, the persistent geopolitical threat posed by ISIS, concern over slowing growth rates in China, and the relative calm in the domestic equities markets (S&P 500) over the last few years, it feels like there could be an opening for increased volatility.

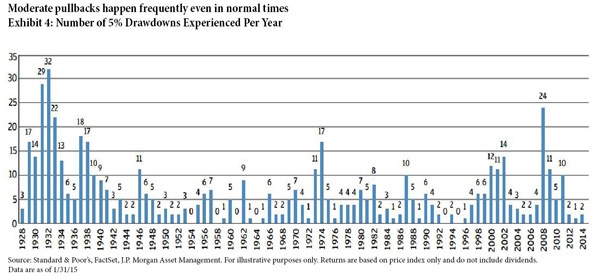

Taking a look at the chart below, you can see that from 2012 – 2014, the market has had very few 5+% pullbacks, which draws a sharp contrast to the previous three years and to history in general. Indeed, moderate pullbacks happen frequently even in normal times.

Does that mean we’re due for a big correction?

2 Tips to Help You Prepare for Volatility

No one can say for sure if, when, or for how long the market may experience downside volatility. But, to state the obvious: if you’re prepared for it, you won’t be surprised by it. JP Morgan put it succinctly in a recent paper on volatility when they wrote that “overreacting to short-term news and normal market movements often leads investors to inappropriately alter their asset allocations, potentially harming their ability to achieve long-term investment goals.”

Here are two tips to help you avoid that outcome:

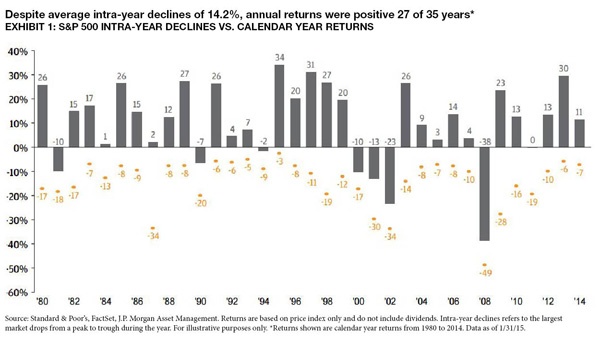

1. Put Market Volatility in Perspective – past returns do not predict future ones, but they can provide helpful insights. In the chart below, it’s plain to see that volatility is a normal, frequently occurring part of any given year in the markets. But in spite of (sometimes sharp) intra-year drawdowns, the market has finished positive in 27 of the last 35 years. That’s over 75% of the time.

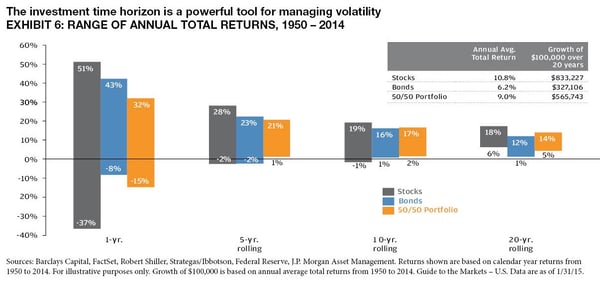

2. Focus on Your Investment Time Horizon –you need your investment portfolio to last at least you and your spouse’s lifetimes. That amount of time can depend on many factors and what stage of life you are in. As you can see below, the longer your investment horizon, the less impact drawdowns have on the value of your assets over time.2

Don’t Forget to Diversify

The above tips are helpful in keeping market volatility in perspective, but they probably won’t help you much if your portfolio is not properly well diversified! In our view, diversification is the first step in positioning a portfolio for the long-term. Diversification is an age-old tool you can use to potentially reduce your risk – and volatility – in your journey through retirement.

One of our Wealth Managers would be pleased to check your portfolio to see how well diversified you are, and to potentially make suggestions to you based on what we find. To get started, you can feel welcome to give us a call at 1-800-541-7774, or if you prefer start a conversation here.

Sources:

1. The Guardian

2. JPMorgan