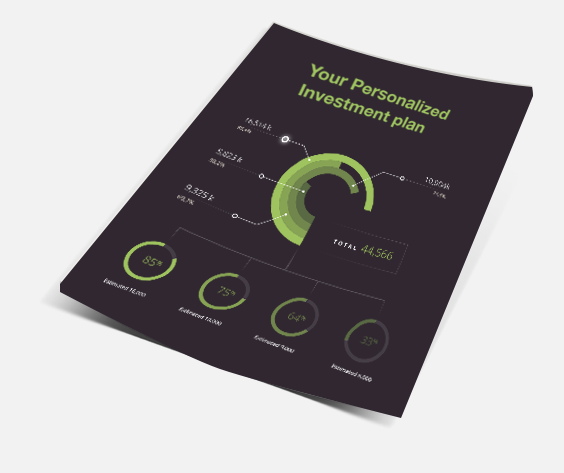

Your Personalized Investment Plan is a detailed 30+ page, easy-to-understand document that takes into consideration multiple aspects of your life. Your Plan includes Money Manager recommendations based on your particular situation and investment goals.

In addition, your plan will reveal so much more if you choose to go through our entire process - the choice is yours.

You can discover:

Making an investment plan is a very personal thing.

To do it right, we need to get to know you a bit more, personally.

We’ll get together on a one-hour call and walk you through all of the information we need to build your Personalized Investment Plan.

Why?

Because this will help us make the right recommendations for you. But more so, this data becomes a plan that is a living, breathing document that helps us manage your plan going forward.

We’ll use a statistical analysis and run simulations to determine how realistic success is for you, given your current situation and goals.

We’ll ask you…

How do you feel about it?

Are there any concerns?

We’ll make all the necessary adjustments, and we’ll take the time to review the detailed, revised version of your plan.

It's possible your plan will look wonderful...

...or,there might be a gap between your goals and your current situation.

We might be able to help:

A.

A comprehensive financial plan, plus money manager recommendations, entirely complimentary. You can use your plan to manage your own investments.

Or...

B.

If you like what you see and your experience, you can become a client and we become your close partner in managing your investments.

If we take you on as a client, we will dedicate time and attention to learning your specific investment goals and retirement dreams.

We will proactively manage your portfolio towards achieving your goals. We become your fiduciary, and that’s a good thing for you to have.

Completely Free for Qualified Investors - No Obligation

No forms to fill

All it takes is a phone call of one hour with one of our wealth managers.

You have no obligation whatsoever

If at the end of the process you decide not to become a client of ours, you can keep your Personalized Investment Plan.

During our call we’ll ask you to talk about some of the following:

Generally, the time needed is only 3 one-hour phone calls:

The process from beginning to end can take as little as one week, depending on your availability.

“Wrap” is a technical term in the financial world, but what WrapManager means to you is that you have a financial expert who wraps everything together for you.

We understand you first: your life, your family challenges, what keeps you up at night, and your goals.

Then we help create a plan for you that includes selecting money managers for you, tracking the progress of your investments, and talking to you. Your WrapManager makes life simpler for you.

A Registered Investment Advisor (RIA) is a professional advisory firm that offers personalized financial advice to its clients. RIAs typically use institutional custodians, so you’ll know where your money is held.

In working with WrapManager, you will get advice based on what’s best for you and we will do our best to make sure you understand your investments and fees. Being an RIA means we are qualified to give advice on your specific investment needs and we encourage a relationship of ongoing communication and trust.

Absolutely. Once we have your Personalized Investment Plan set up and you are seriously considering WrapManager, we can put you in contact with a few of our clients that can tell you all about their experience with us.

WrapManager does not hold your money. Our clients’ assets are held at either TD Ameritrade Institutional or First Clearing Corp., an affiliate of WellsFargo. Your money will be with one of these custodians who will accept your instructions if you decide to go in a different direction beyond WrapManager.

Not everyone puts your best interests first. We do. Remember, we are your fiduciary, someone who knows and cares about your life. And we start by getting to know you first through your investment plan.

As crucial as the investments are, they are simply the fuel to help you get to your destination. And when and if your life situation changes, we work together to adjust your plan to stay on track with your goals.

We believe that your ultimate goal isn’t to be burdened by your investments and investment decisions. What you really want is to get out and enjoy your life, no matter how it changes. If that sounds good to you, then we are a good fit for you.

We do it so you don’t have to. Clients value expertise. Even clients that used to do it themselves may have a smaller account on the side. Again, the ultimate goal is to live your life, not to devote your daily life to investment matters.

Yes. Your Personalized Investment Plan will present you the options that make the most sense for your particular investment goals. We pride ourselves in our knowledge of money managers.

Important Disclosure | Privacy Policy WrapManager, Inc., 319 Miller Avenue, Mill Valley, CA 94941 (800) 541-7774 toll-free | (415) 541-9760 fax | Click to email us © 2024 WrapManager, Inc. All Rights Reserved. WrapManager is an SEC-registered investment adviser. (1) qualified investors are those with $500K or more in investable assets