For many investors and retirees, the task of navigating Social Security is often a tricky (and sometimes confusing) undertaking. In fact, it is complex to the point that Fidelity Investments recently brought to light several “myths” about Social Security, which are really misunderstandings more than anything else. In several surveys, Fidelity found that investors had misconceptions about some of the key features and rules surrounding Social Security Retirement Benefits. These misconceptions can cost retirees money over time, so it’s important to work with a financial advisor when making the important decisions about when and how to take your benefit.

For many investors and retirees, the task of navigating Social Security is often a tricky (and sometimes confusing) undertaking. In fact, it is complex to the point that Fidelity Investments recently brought to light several “myths” about Social Security, which are really misunderstandings more than anything else. In several surveys, Fidelity found that investors had misconceptions about some of the key features and rules surrounding Social Security Retirement Benefits. These misconceptions can cost retirees money over time, so it’s important to work with a financial advisor when making the important decisions about when and how to take your benefit.

Here are three key takeaways we found from Fidelity’s study:

1. You are NOT Required to Take Social Security at Age 62 - Unlike Required Minimum Distributions (RMDs), Social Security Retirement Benefits do not necessarily have to commence at a specific age. Fidelity found that many investors believed they were required to start taking Social Security at age 62, but that is not the case. You have the option to begin taking Social Security at 62, but you aren’t required to.

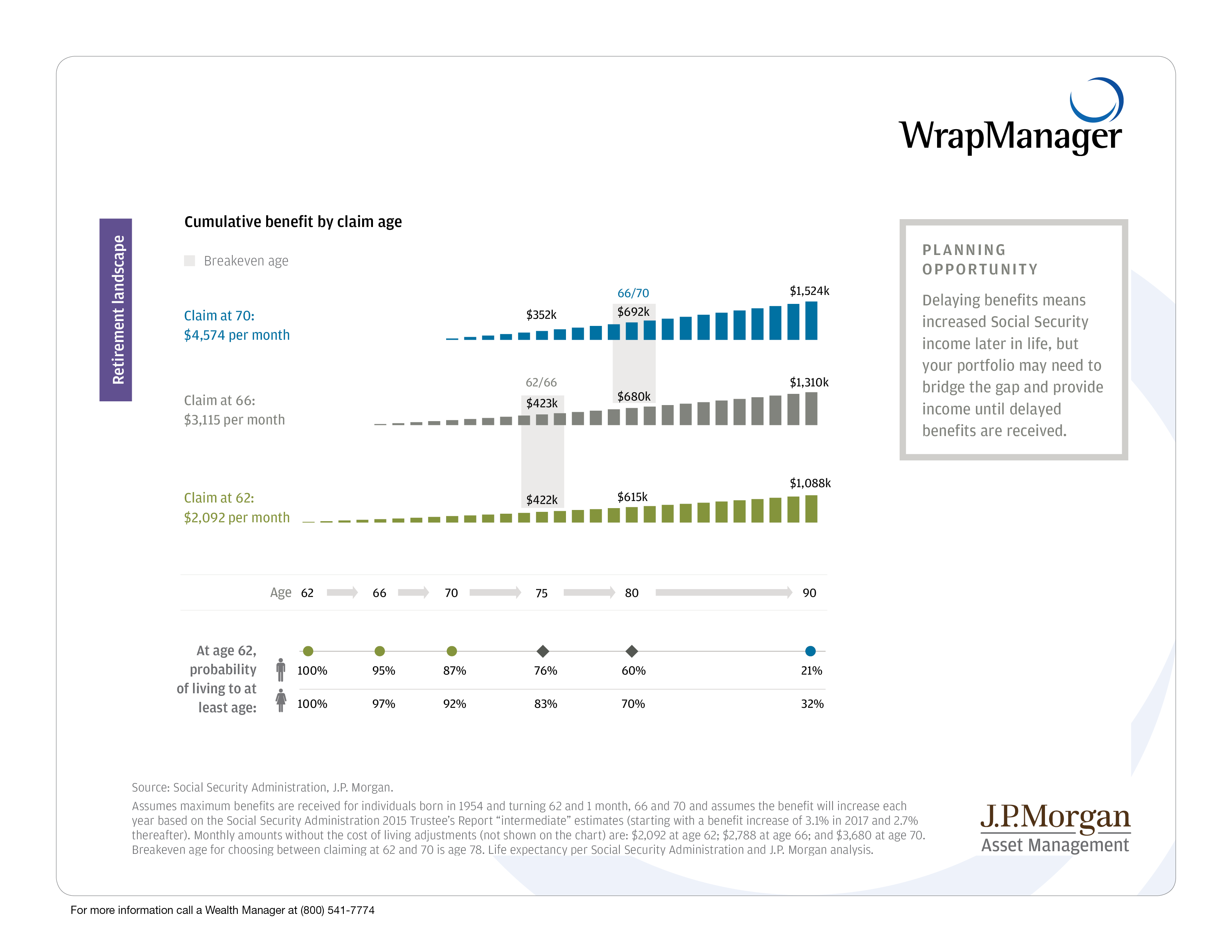

In fact, delaying the age at which you start taking benefits can help boost your income over time. Fidelity points out that starting your Social Security Retirement Benefits at age 62 can translate to a reduced income of 25% to 30% of your full benefit, which begins at your “Full Retirement Age” (to note: for those born between 1943 and 1954, your full retirement age is 66. Those born later have a full retirement age slightly above 66 or at age 67). So, if you wait to age 66 or even age 70, you will increase the monthly payout you receive, which can translate to greater total benefits over time. JP Morgan created a graphic that illustrates this point clearly:

2. Even Money You Earn After Age 65 Counts Towards Your Benefit Calculation – Your Social Security benefit is calculated based on your highest 35 years of earnings, but those earnings do not have to be in consecutive years and they do not have to be earned before age 65! If you work past 65, those earnings will be included in your benefit calculations, as long as they are high enough to be a part of your 35 highest years.

3. It is Possible to “Get Out What You Put In” – About 70% of the folks surveyed by Fidelity believed they would never receive in Social Security benefits what they contributed into the system, but many of them actually will! Longevity in the United States is rising, and those who live longer could end up receiving more benefits than they contributed to the system. Even if you live past age 100, you will continue to receive income every month.

Unsure About Other Social Security Features? Talk to WrapManager.

Everyone’s financial situation is different, and there is not necessarily a ‘cut and dry’ formula for knowing how and when to take your Social Security Retirement Benefits. We think it makes sense to evaluate every option available before making a final decision, as there is very little wiggle room available to change your mind once you’ve decided. If you want to ask some questions and discuss your options with a Wealth Manager here at WrapManager, please know we would be happy to help. You can reach us by email at wealth@wrapmanager.com or call us today at 1-800-541-7774.

Interested in learning more about retirement planning? Download our e-Book, 5 Ways to Enhance Your Retirement Planning Strategy.