The world’s largest asset manager, BlackRock,1 conducted a survey of 17,600 investors around the globe to uncover investor perspectives on retirement. BlackRock found that nearly half of respondents had a negative outlook on their financial futures, in large part because they were unsure if their retirement savings would outlast their retirement expenses.2

Do you feel this way too?

Retirement is supposed to be enjoyed, not feared, and a solid investment plan can help wipe away those concerns. As a starting point, investors can think about ways to reduce retirement expenses to help allay concerns about having sufficient retirement savings. Here are three ideas to explore.

Manage Your Health Care Costs in Retirement

45% of the investors surveyed cited health care as their top retirement expense concern.2 A big part of controlling health care costs in retirement starts with making smart choices about your health care coverage—i.e., choosing a Medicare plan that makes sense for you and your spouse, and considering long-term care insurance as a means to protect your assets in the event you need additional care later in life.

WrapManager has written before on both Medicare and long-term care insurance, and we’d encourage you to read our pieces and/or call one of our Wealth Managers to discuss these topics further: Traditional Medicare, Medicare Parts C and D, Medigap and Medicare Advantage, Long-Term Care Insurance.

Lower Interest Expenses by Refinancing

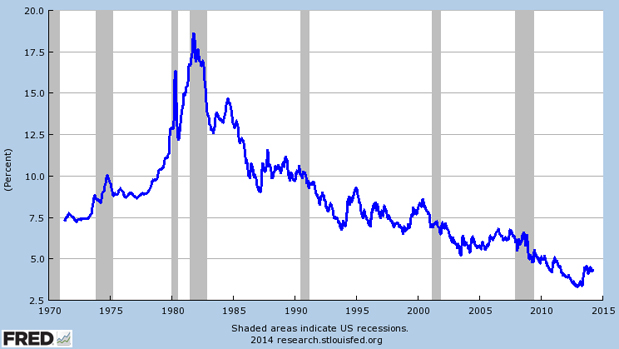

The long-term historical average for the 30-year mortgage rate is 8.57%, and current rates are well below that level:

30-Year Fixed Rate Mortgage Average in the United States

(Click chart for larger version)

Source: St. Louis Federal Reserve, Freddie Mac.

If you plan to have a mortgage payment for all or some of your retirement years, it’s a good idea to consider refinancing to a lower rate. This can reduce the amount you pay in interest over time and also reduce your monthly payment, freeing up capital for other parts of your investment plan.

Increase Retirement Income

You can lower your expenses on a relative basis by increasing the amount of income you generate in retirement. For starters, consider doing what you can to increase the size of your Social Security check. We’ve written about two methods to accomplish this, the File and Suspend Strategy and the Restricted Application for Spousal Benefits.

Step 2 involves structuring your portfolio to generate income through your investments. Bonds are one way to do it, but considering the income produced by dividend stocks can be an alternate means for accumulating extra cash. WrapManager recently profiled four dividend money manager strategies that could help you accomplish this goal.

Let WrapManager Help You Plan for Retirement

Whether it’s detailing your retirement expenses, analyzing your retirement income sources, or recommending money managers to help execute your investment plan, WrapManager can help you answer these key questions about your retirement life.

One of our Wealth Managers would be happy to discuss your goals and current situation with you, and we’ll make suggestions to you if we think parts of your investment plan can be improved upon. Give us a call today at 1-800-541-7774. Alternatively you can get started on an investment plan by answering a few questions here.

Sources:

2 BlackRock US Investor Pulse Survey 2013