| Check our our post: 3 Tips for Reducing Your Taxable Income in 2016. |

According to J.P. Morgan, the average American pays more in taxes than they do for food, clothing, and housing…combined. And, that only applies to income taxes!

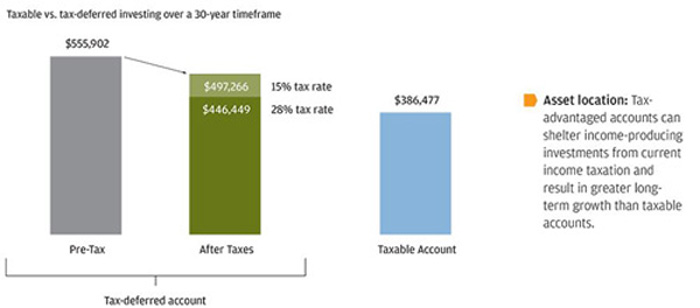

For investors, the cut often runs even deeper. Not only is your earned income reduced every year, but—J.P. Morgan also reveals that taxes on your investments can reduce an 8% annual return to as low as 5.2%.1

Without proper planning, many investors miss opportunities to reduce taxable income and ultimately end up paying Uncle Sam more than they should. Paying taxes is important, but that does not mean you should be paying more than your fair share. Here are five tips to consider in 2015, to reduce your taxable income and strive to make your financial life as tax efficient as possible.

Perhaps, you are a small business owner? A Simple or SEP IRA could be a great solution. These plans generally have lower administrative costs than 401(k)s, but still allow you and your few employees to participate in a retirement plan. If you implement a Simple IRA at your company, you can defer up to $12,500 each year of salary, and employees over 50 can defer an additional $3,000. SEP plans only allow employer contributions, but if you are self-employed it can make a lot of sense as you may be able to contribute up to 25% of your net earnings, up to $52,000.3

2.) Consider Switching from Mutual Funds to Separately Managed Accounts – Actively managed mutual funds often incur a great deal of capital gains due to frequent trading, and those gains are “passed along” to investors throughout the life of the investment. This can result in paying more in capital gains taxes.

A mutual fund manager ultimately does not know anything about your specific tax situation. Consequently, it is not taken into account when management decisions are made within the fund. With a Separately Managed Account, your financial advisor can customize management based on your specific tax needs, and may be able to avoid having unwanted capital gains passed along to you.4

3) Use an Actively Managed Strategy to Offset Capital Gains with Capital Losses. If you have a Separately Managed Account, your money manager(s) will trade your assets over the course of the year to position their strategies in the best way possible relative to market conditions. Often capital gains are realized as a result. And, for tax filers with a joint income of less than $464,850 that means a 15% tax (the tax jumps to 20% for filers over that income threshold).5

Instead of automatically assuming you have to pay that tax, you should have your financial advisor review all of your taxable accounts to look for unrealized losses. By harvesting those losses, you may be able to offset your gains on the year dollar for dollar.

4) Charitable Giving and Gifting – The IRS generally allows you to deduct donations of money or property to a qualified charitable organization. The allowable deduction can be quite sizable too—in some cases, you can deduct up to 50% of your adjusted gross income (AGI), but in other cases a 20% or 30% limit may apply.6

If you’re interested in making a charitable donation but are unsure if the organization is “qualified,” check here

5) Check if Your Long Term Care Insurance Premiums are Deductible – Premiums paid for a qualified Long Term Care (LTC) Insurance policy may qualify as “medical expenses” for the purpose of itemization with the IRS. Look into deducting these expenses to the extent that total medical expenses, including LTC premiums, exceed 10% of your adjusted gross income.7

Work with a Wealth Manager to Reduce Your Taxable Income

Everyone’s financial situation is different, and the five tips above are simply meant to get you thinking about ways to reduce your taxable income. There may be more options available to you depending on your situation, and working with a financial advisor, in particular a Certified Financial Planner can help make your financial life as tax efficient as possible.

To speak with a Wealth Manager about your situation, please contact us at 1-800-541-7774 or contact us here. We are happy to discuss how we can help you.

Sources:

1. JP Morgan

2. IRS.gov

3. IRS.gov

4. Fidelity

6. IRS.gov

7. MassMutual

WrapManager, Inc. does not advise on any income tax requirements or issues. Use of any information presented by WrapManager, Inc. is for general information only and does not represent tax or legal advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.