In the context of retirement planning, most people are naturally drawn to talking about travel, hobbies, grandchildren, and leisure activities. And for good reason – that’s what retirement is supposed to be all about!

In the context of retirement planning, most people are naturally drawn to talking about travel, hobbies, grandchildren, and leisure activities. And for good reason – that’s what retirement is supposed to be all about!

There is a necessary distinction between retirement and retirement planning, however. Planning must go beyond the ‘fun’ items and consider all expenses we may incur over time and throughout life. One of those expenses – and a major one – is the cost of health and home care later in life.

A recent poll from the Associated Press and the National Opinion Research Center found that 77% of older Americans would prefer to receive care in their own homes. That marks a fairly broad majority of older Americans, but we’re curious what would happen to the numbers if the people surveyed were first told how much home health care actually cost.

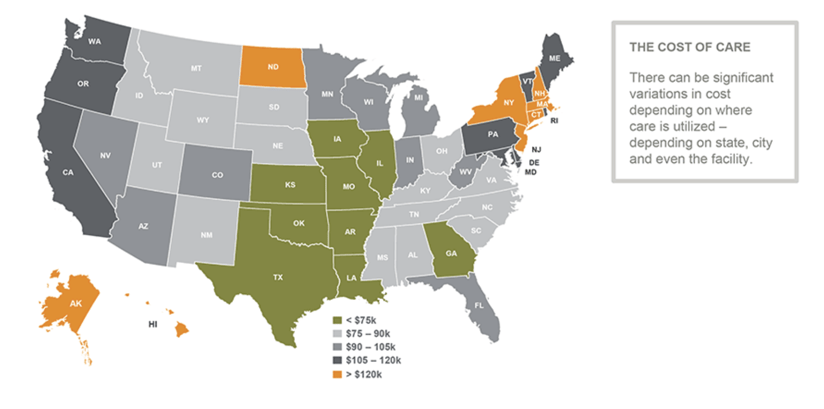

According to the Genworth 2017 Cost of Care Survey, the national (US) median cost for homemakers’ services for the elderly was $4,000 a month, or $48,000 a year, with a similar median cost for home health aides. Those costs assume about six hours of care per day, so adjusting the hours up or down would presumably shift the costs. But it’s also key to remember that a median means that half the places surveyed were more expensive, so it very much depends on where you live. Interestingly, according to the survey, some unexpected places like Iowa and Kentucky had annual costs of $100,000 for a 44-hour week of care. J.P. Morgan created this map of the United States that breaks down the cost of care by state. As you can see, many states in the Northeast along with North Dakota, Alaska and Hawaii have costs that can exceed $120,000 per year.

Methodology document: here. Source: Genworth 2016 Cost of Care Survey, conducted by CareScout®, April 2016. Annual median costs based on 365 days of care. © 2016 Genworth Financial, Inc. All rights reserved.

How to Approach Planning for the Cost of Care

A recent article by asset management firm Lord Abbett, titled “When Home Care Costs Go Through the Roof,” offered some anecdotes and ideas from money managers and advisors around the country.

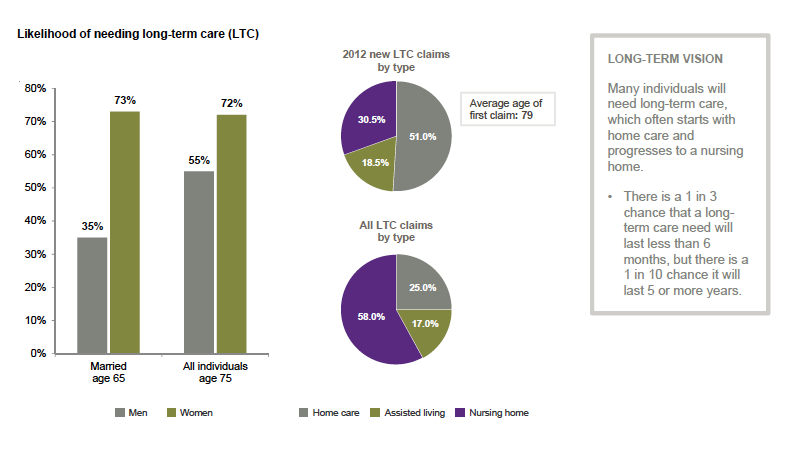

One solution discussed was the value of long-term care insurance. J.P. Morgan finds that for individuals over the age of 75, there is at least a 50% chance of needing long-term care.

Note: Annualized historical inflation for nursing home (private room): 3.5%; assisted living (one-bedroom): 2.2%; home health aide: 1.3%. 5- year CAGR represents the compound annual growth rate based on Genworth Cost of Care Survey. Genworth 2016 Cost of Care Survey, conducted by CareScout®, April 2016. © 2016 Genworth Financial, Inc. All rights reserved. Methodology document: here. Source: American Association for Long-Term Care Insurance 2014 Sourcebook. www.aaltci.org.

Another tactic suggested was selling a home and moving into a smaller, less expensive place. According to the Lord Abbett article, up to $250,000 of a gain from the sale of a home can be tax exempt for individuals, with that number rising to $500,000 for married couples. Recently widowed clients also may qualify for the larger exemption, provided they sell their home within two years of their spouse’s death.

Another neat idea offered by Lord Abbett was for the children to purchase the home from the parents, and then subsequently have the parents ‘rent’ the house from the children. This could keep the asset in the family and potentially free up the needed cash for care.

Discuss Home Care Solutions with a Wealth Manager

There may be other creative ways to address the cost of home care later in life. For younger people still planning for retirement, it is important to consider these costs in retirement income projections so that your savings and investment decisions today reflect the existence of these costs in the future. For those who are already retired and may not have fully considered the costs of home care, there’s no need to panic – but it could be worthwhile to sit down with a Wealth Manager to look at options and create a plan. Reach out to us today to start the conversation either by calling 1-800-541-7774 or by sending an email to wealth@wrapmanager.com.

Source