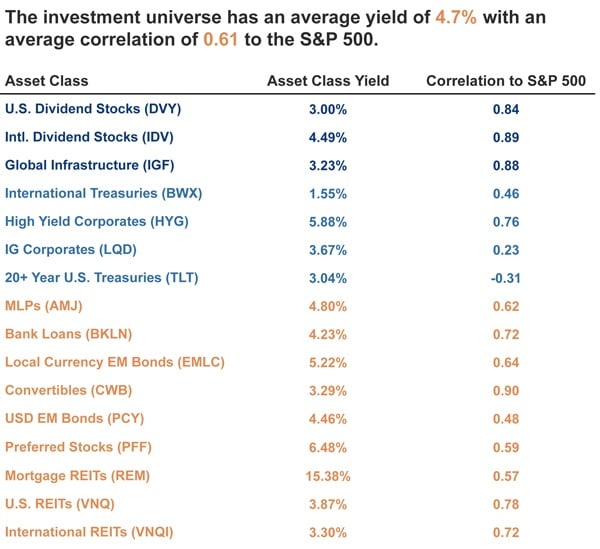

Many investors today are faced with the same problem: how do you generate income in your portfolio when interest rates are so low? In the current market, finding asset classes that generate income at significant enough levels can be difficult:

Traditional Income Generators

(Click chart for larger version)

Source: Newfound Research LLC. Short-Term U.S. Treasuries represented by SHY. Short-Term Corporates represented by CSJ. MBS represented by MBB. Intermediate Term U.S. Treasuries represented by IEF. Total U.S. Bond Market represented by AGG. Long-Term U.S. Treasuries represented by TLT. Intermediate Term Corporates represented by LQD. High Yield Corporates represented by HYG. Yields computed using smoothed trailing 252-day dividends. Starting date for graph is April 2008 because that is first date yields could be computed for all of the ETFs used in the analysis.

Source: Newfound Research LLC. Short-Term U.S. Treasuries represented by SHY. Short-Term Corporates represented by CSJ. MBS represented by MBB. Intermediate Term U.S. Treasuries represented by IEF. Total U.S. Bond Market represented by AGG. Long-Term U.S. Treasuries represented by TLT. Intermediate Term Corporates represented by LQD. High Yield Corporates represented by HYG. Yields computed using smoothed trailing 252-day dividends. Starting date for graph is April 2008 because that is first date yields could be computed for all of the ETFs used in the analysis.

Newfound Research LLC, a Boston-based tactical money manager focused on risk management, recognizes this problem and has created a distinct solution: The Newfound Risk Managed Income Strategy. The overarching goal of the investment strategy is simple: increase portfolio income in a prudent manner, by investing in traditional equity, fixed income and alternative-income vehicles in a risk-managed framework. In a fully bearish environment, the portfolio has the ability to move entirely to cash.

The Newfound Risk Managed Income Philosophy

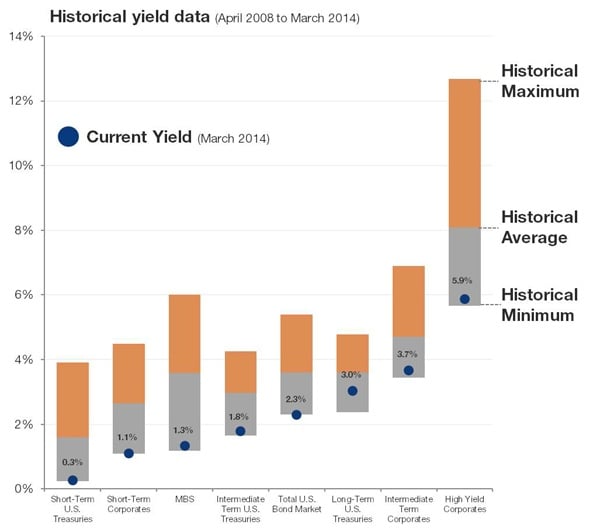

Newfound is not your traditional fixed income portfolio manager. They understand that there are many assets – traditional and non-traditional income generators – that can provide yield levels significantly above traditional fixed income.

The approach emphasizes both yield and capital protection, and uses a dynamic combination of traditional equity income exposures (e.g., dividend stocks), traditional fixed income exposures (e.g., high yield corporates, 20+ year U.S. Treasuries), and non-traditional income generators (e.g., bank loans, MLPs, U.S. REITs) in an attempt to facilitate increased portfolio income over a full-market cycle. Newfound gains exposure to these asset classes through 16 different ETFs, with a long-only approach – they do not use derivatives, leverage, or shorting.

Risk Managed Income Strategy's Income Diversifiers

(Click image for larger version)

Source: Newfound Research LLC. Yield on a given day is calculated using smoothed 12-month trailing dividends. Yield presented in the table is computed as of 3/31/2014. Correlation is calculated as Pearson correlation of monthly returns between the asset class ETF and the S&P 500 ETF “SPY” from ETF inception to 3/31/2014.

How Does the Risk Managed Income Strategy Work?

The strategy is actively managed, meaning that when an asset class starts to exhibit negative momentum characteristics, the portfolio will reduce exposure to it and instead tilt to favor asset classes exhibiting strong risk-adjusted yield.

Final portfolio allocations are adjusted based on an ETFs “yield-to-risk” ratio. ETFs that offer more yield per unit of risk receive relatively higher allocations, and vice versa. ETF exposures are eliminated altogether if they are deemed to be at increased risk of loss.

The portfolio is analyzed and rebalanced (if necessary) on a weekly basis, and a 25% allocation cap is enforced for each asset class. When fewer than four securities are in the portfolio, a position in short-term treasuries is built.

Investors Looking for Income and Yield Should Consider Newfound Risk Managed Income

If the low interest rate environment has you searching for innovative retirement income strategies, then you should speak with one of our Wealth Managers about Newfound Research LLC. We can provide you with a more detailed analysis of how their strategy works, and how it could fit in as an income-generating piece of your investment portfolio. Call us today at 1-800-541-7774 or request more information here.

Source:

Newfound Research LLC

Strategy descriptions listed represent a brief outline of the portfolio’s objective. There is no guarantee that any manager or product will be successful in achieving the objective described. The strategy used by the money manager listed is not suitable for all investors. This material does not represent a personalized recommendation and does not reflect individual investor’s risk and return goals nor does it serve as the receipt of, or a substitute for, personalized advice from WrapManager, Inc. or any other investment professional.