Global equity markets have experienced a pullback following heightened fears of the spread of coronavirus (COVID-19). This has left some investors wondering what actions they need to take (if any) with their portfolios.

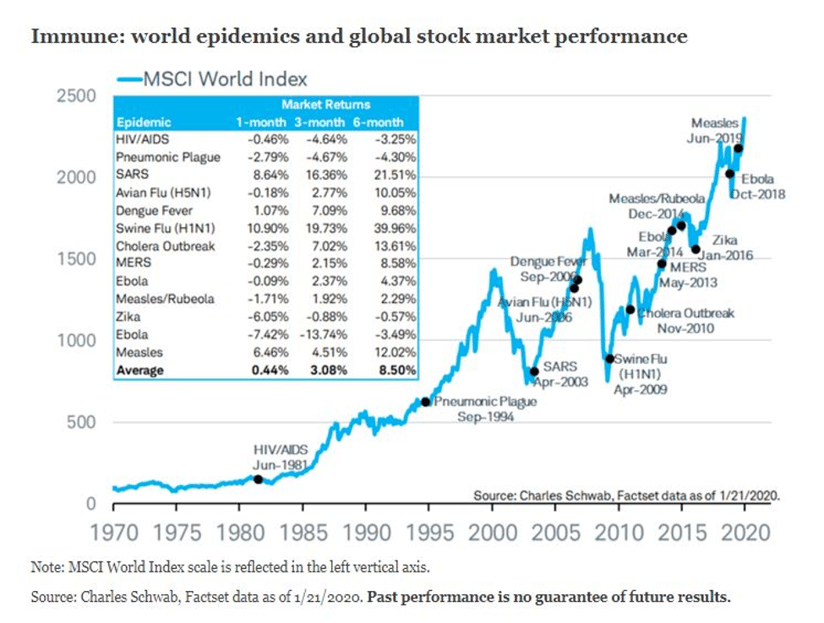

History has shown that equity markets typically rebound quickly in the event of a viral epidemic driven sell-off. The pullbacks have historically been short-lived and have typically been followed by a continued upward trend. 1

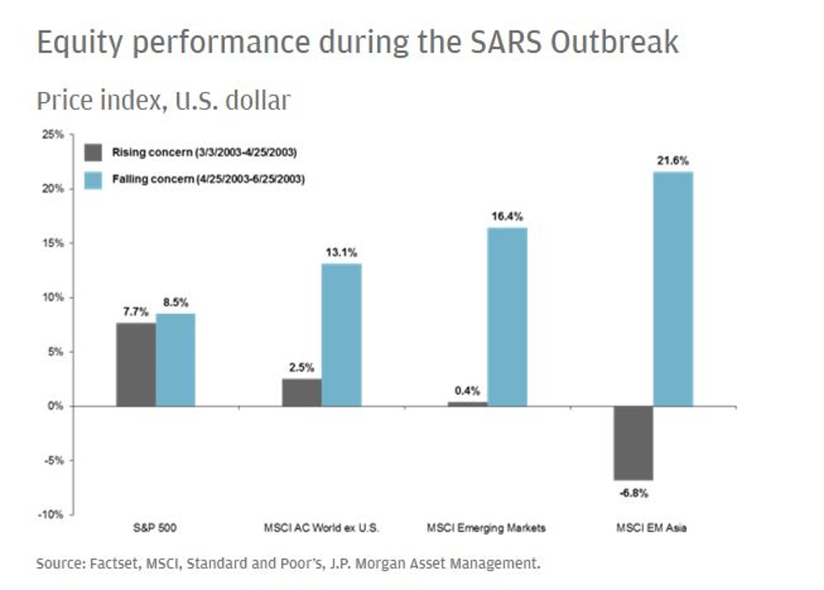

Each viral epidemic is always unique, but here is what happened in 2003 during the SARS epidemic:

There was a sharp pull-back in emerging Asian equities at the onset of the epidemic. However, once fears subsided there was a strong rebound. Meanwhile, US equity returns accelerated once fears over SARS had abated.2

This suggests that market fundamentals have typically driven long-term returns, but short-term headlines such as global health crises can cause equity markets to temporarily slow or change directions.

What to do with Your Portfolio?

It is certainly possible that the coronavirus impact will be more severe than SARS (although it is worth pointing out that coronavirus has killed an estimated 3% to 4% of people infected compared to 10% of SARS victims according to the World Health Organization).3

But, if history is any guide, there is not a large risk that the coronavirus epidemic will lead to a prolonged market decline. While past performance is not indicative of future results, long-term investors should not base their long-term investment decisions solely on short-term headlines.

About the Author: A member of the WrapManager Investment Policy Committee, Doug Hutchinson, CFA® is responsible for developing and refining our money manager due diligence and review standards. He is also responsible for monitoring and evaluating current and prospective money managers.

Doug graduated from the University of California, Santa Barbara with a BA in Business Economics. He is a CFA® Charterholder and an active member of the CFA® Society of San Francisco.

Sources:

1 Charles Schwab

2 JPMorgan

3 MarketWatch