To prevent a default on the nation’s debt, both houses of Congress must pass a bill that raises or suspends the debt limit and then that bill must be signed into law by the President. Currently, there is a standoff between the Republican controlled House of Representatives and the Democratically controlled Senate and White House. Republicans are trying to negotiate budget spending concessions in return for their support to increase the debt limit.

When will the Treasury Run Out of Money?

The exact date that the U.S. Treasury will run out of funds to meet its obligations (known as the “X date”) is not known with certainty. According to Treasury Secretary Janet Yellen, the X date could come as soon as June 1st. She also noted, however, that federal receipts and expenditures are “inherently variable,” and that the actual X date could actually be “a number of weeks later” than June 1st.2

Has the U.S. Ever Defaulted on its Debt Obligations?

The U.S. Treasury was late on payments of U.S. Treasury bills in late April and early May of 1979 due to technical bookkeeping glitches. The Treasury Department doesn’t consider this to be a default since it was a glitch that only impacted a small number of bonds3 and investors in those bonds were paid in full with interest.4

Other than this strange hiccup in 1979, the U.S. Treasury has never failed to make timely principal and interest payments on its debt.5

Is it Likely that this Debt Ceiling Standoff Will Lead to a Default on US Debt?

While it is impossible to predict the future with precision, analysts such as Meera Pandit of JPMorgan don’t see a default as a likely scenario:

“Still, it is not our base case that the U.S. will default. Lawmakers have raised or suspended the debt ceiling over one hundred times since WWII and under every president since 1959. It is possible that political parties agree to a short-term extension or suspension of the debt ceiling and continue to negotiate over future spending. While budget negotiations may happen given high levels of debt and deficits and rising interest costs, the stakes should not be default.”6

Dr. David Kelly, the Chief Global Strategist at JPMorgan, argues that a potential default would unleash such economic chaos that leaders in Washington would be forced to quickly agree to a temporary suspension of the debt ceiling anyway.

“If, in an act of unprecedented recklessness, Congress fails to increase or suspend the debt ceiling in time, the Treasury will likely miss an interest or principal payment on the debt. This event would likely precipitate a major stock market meltdown, a spike in Treasury interest rates and a collapse in the dollar. A further downgrade to U.S. debt would be probably occur. After a few days of chaos, Congress would likely suspend the debt ceiling for a period and get back to negotiating the budget…members of Congress won’t have the stomach to perpetuate a fiscal crisis and recession if, by the simple act of suspending the debt ceiling, they can provide relief to their constituents.”7

How Have Markets Reacted to Previous Debt Ceiling Standoffs?

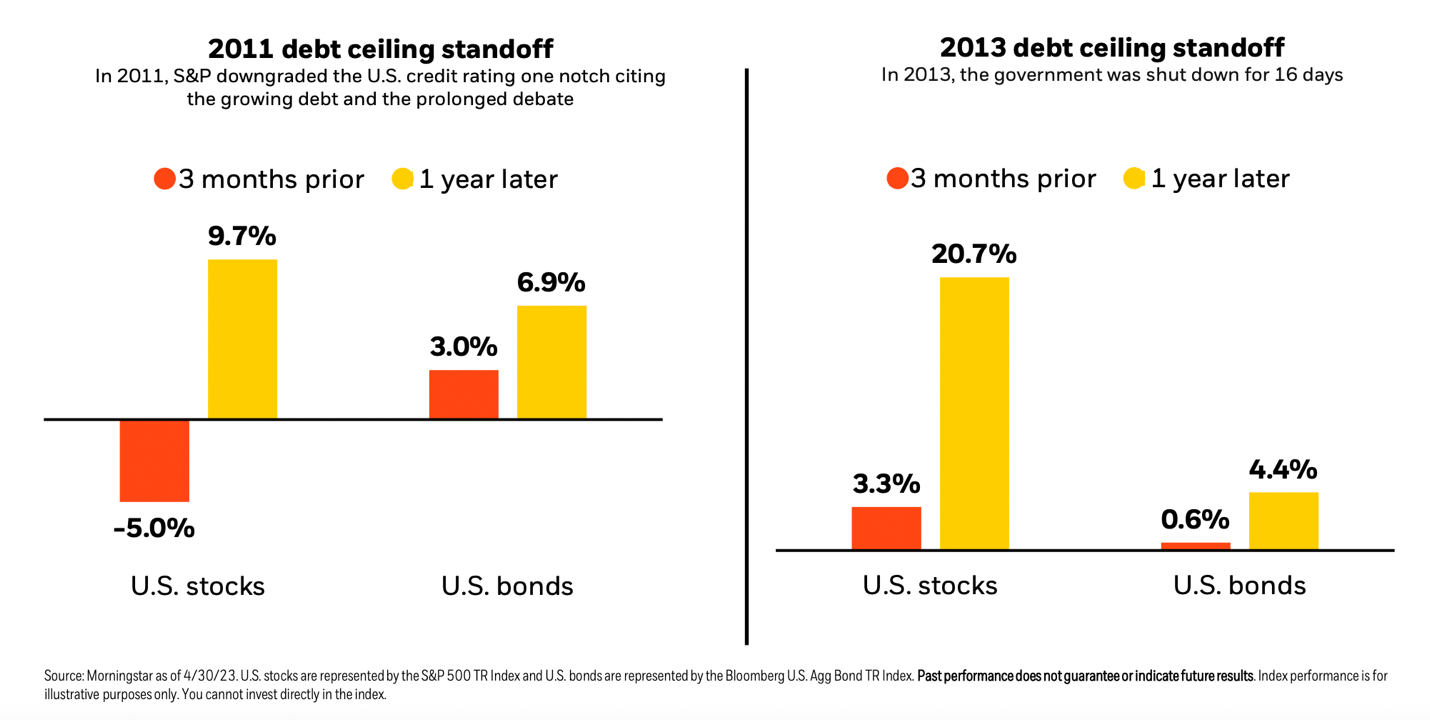

Research from BlackRock shows that the S&P 500 returned 9.7% in the 12 months following the 2011 debt ceiling standoff and 20.7% in the 12 months following the 2013 debt ceiling standoff.8

That said, investors should be prepared for the potential of increased market volatility prior to a resolution of the debt ceiling standoff. The S&P 500 returned -5% in the 3 months prior to the 2011 debt ceiling standoff and just 3.3% in the 3 months prior to the 2013 debt ceiling standoff.9

As always, reach out to your Wealth Manager to discuss this and any other concerns affecting your financial situation.

1 https://www.cbo.gov/publication/58945

2 https://home.treasury.gov/news/press-releases/jy1454

4 https://www.barrons.com/articles/debt-ceiling-us-default-history-51633473249

7 https://www.linkedin.com/pulse/debt-ceiling-cliff-dancing-david-kelly/

8 https://www.blackrock.com/us/financial-professionals/literature/investor-education/student-of-the-market.pdf (Slide 4)

9 https://www.blackrock.com/us/financial-professionals/literature/investor-education/student-of-the-market.pdf (Slide 4)

This is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.