According to data from BlackRock’s 2013 Investor Pulse Survey, investors of all types in the US hold 48% of their investable assets in cash, with 18% in stocks and 7% in bonds.1

Steady gains in the stock market have influenced some sidelined investors to reinvest over the last few years, but the BlackRock study makes clear that most investors remain risk averse following the most recent financial crisis. It’s understandable – many investors took a hit and don’t want to see that happen again.

The cautious approach is understandable, but is being mostly in cash actually costing you in retirement? The answer: probably.

Holding Cash Can Hurt Your Retirement

It depends on your personal financial situation and goals, but if you’re an investor with a longer term goal of growing your portfolio, the opportunity cost of holding cash can be significant:

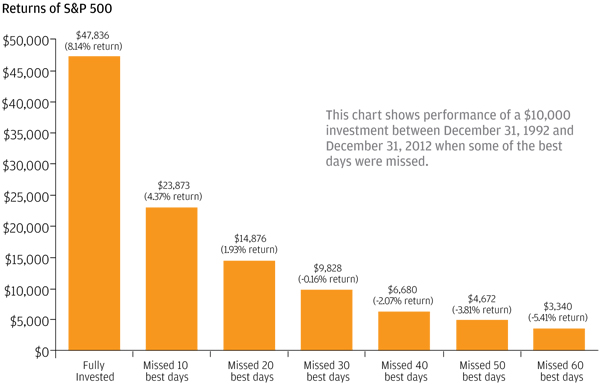

Over the last 20 years, missing just the 30 best days in the market meant having a negative return on your assets. Compare that to the investor who remained fully invested during that time, and the differences are close to astounding.2

Impact of Being Out of the Stock Market

(Click chart for larger version)

This chart is for illustrative purposes only and does not represent the performance of any investment or group of investments. Source: Prepared by J.P. Morgan Asset Management using data from Lipper. 20-year annualized returns are based on the S&P 500 Total Return Index, an unmanaged, capitalization-weighted index that measures the performance of 500 large capitalization domestic stocks representing all major industries. Past performance is not indicative of future returns. An individual cannot invest directly in an index. Data as of December 31, 2012.

Going back further in history doesn’t change the outcome, either. Since 1950, returns on stocks and bonds have far outstripped returns on cash.2

With so much complexity, fear, and uncertainty in the market today, it is tempting to invest in money markets or cash equivalents. But these instruments will barely help you cover inflation.

Over time, stocks and bonds have provided better returns, though of course achieving those returns has come with the necessity to accept greater risk. As investors, it’s important to understand these trade-offs, and to speak with your financial advisor about how much risk you’re willing and can afford to take with your assets.

Unsure How to Invest Your Cash on the Sidelines?

This is not to say that all investors should take their sidelined cash and invest it in stocks with a “buy-and-hold” approach. Investors should consider time horizon, long-term goals, cash flow needs, comfort with risk, and quality of money manager strategies before investing.

WrapManager can build an investment plan for you to help you determine an appropriate asset allocation for your portfolio, and we can recommend money managers suited to your needs that can get your cash to work for you.

Call one of our Wealth Managers today at 1-800-541-7774 to get started, or click here.

Sources:

1 Wall Street Journal