If your financial advisor insisted on creating an investment plan that projected you and/or your spouse to live past 100, you might be skeptical. Few people at or near retirement expect to live to be 100.

If your financial advisor insisted on creating an investment plan that projected you and/or your spouse to live past 100, you might be skeptical. Few people at or near retirement expect to live to be 100.

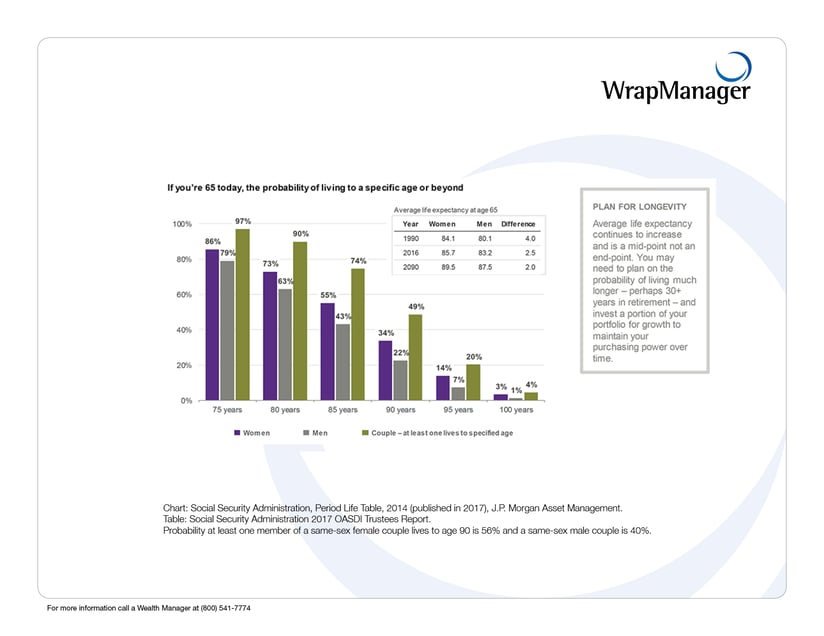

But retirees would be wise to start thinking that way! The Social Security Administration finds about one out of every four 65-year-olds today will live past age 90, and one out of 10 will live past age 95. There’s also a 4% chance one person in a couple will live past 100. That’s a low percentage, sure. But it is still a possibility very much worth planning for.

J.P. Morgan created a helpful table to show 65-year-olds the probability of living past a certain age. There’s a nearly 50% chance that one person in a couple will live past the age of 90, which of course implies that a retirement plan would need to account for at least 25 years of cash flow needs.

At issue here is that many people at or near retirement are not thinking in such lengthy terms. But in some cases, the advisory business also bears some of the blame. Many retirement systems were designed to provide financial support for 10 to 15 years of retirement, numbers that have not increased in lockstep with rising life expectancies.

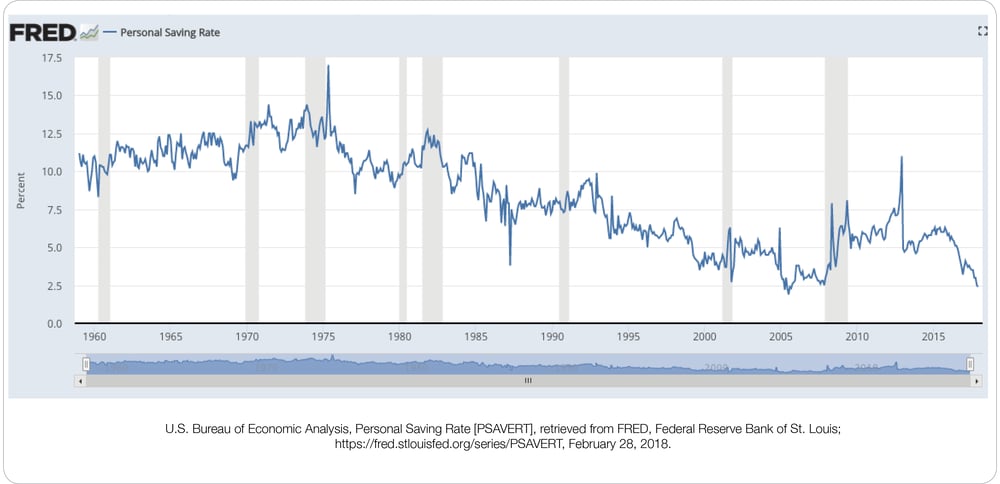

According to some grim statistics from a World Economic Forum report, a combination of rising life expectancies and declining savings rates is resulting in a growing financial shortfall in terms of retirement preparedness. Just take a look at this chart of the Personal Savings Rate in the United States from 1955 through the end of last year. It’s plain to see a starkly declining trend, at the very time when the line should be rising briskly.

Source: Federal Reserve Bank of St. Louis

Addressing the Issue Head-On

Does your current retirement plan factor-in the probability of living to age 100? Perhaps you have some health issues or family history that make living to 100 extremely remote, and that’s ok. It is still worthwhile to take a look at scenarios that account for living well beyond what you expect, to ensure a contingency plan is firmly in place. Financial advisors should be asking you about your health, family health history, and spouse’s health on a regular basis.

Establishing a plan for living longer generally means running projections for cash flow needs much later in life, where expenses tend to rise at a faster rate – largely due to increasing health care needs. This type of analysis can provide an idea of how prepared you are in your current plan to account for this possibility, and it can also reveal any shortfalls that may need to be addressed.

WrapManager can run this analysis for you today. Reach out to one of our Wealth Managers to ask about creating an investment plan that factors-in long life expectancies and get the answers you need about how prepared you are today, and what steps you can take to improve your situation. Reach us at 1-800-541-7774 or start a conversation over email at wealth@wrapmanager.com.

Sources: