Newfound Research, LLC, a Boston-based money manager specializing in tactical asset and risk management, published some insightful research focusing on issues that affect how investors plan for retirement.

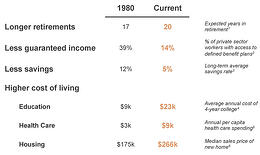

What they found is that retirees are facing somewhat of an uphill climb when it comes to successful retirement planning. People are living longer, have less guaranteed income, and are being met with an increasing cost of living.

Common Retirement Planning Issues

(Click image for larger version)

Source: Newfound Research LLC. 1 Social Security Administration, as of 2013. 2 Employee Benefit Research Institute, as of 2011. 3 Federal Reserve Bank of St. Louis, as of 2013. 4 National Center for Education Statistics, 2013 dollars, as of 2012. 5 AARP Public Policy Institute, 2013 dollars, as of 2010. 6 United States Census Bureau, 2013 dollars, as of 2013.

These issues serve to underscore the need for sound and thoughtful investment planning.

Apart from “Less Savings,” which you can boost by spending less, we’ll take a look at each of the above offer some helpful tips for addressing them.

Longer Retirements

With enhanced medical technology and healthier lifestyles, people are living longer. According to the Social Security Administration, a woman turning 65 today can expect to live to age 86, with that number being 84 for a man.1

How to address the issue:

Start by acknowledging the need for more growth in your portfolio over time, while also taking steps to protect your assets. Consider a tactical money manager strategy like the ones found at Newfound Research. They aim to provide access to equities with the ability to move to 100% cash to protect against large losses.2 While there is no guarantee that a strategy can avoid losses, it may be wise to allocate a portion of your diversified portfolio to a strategy that has the option to move to cash during certain market environments.

Less Guaranteed Income

Some would see annuities as a potential solution here, but too often we find that annuities have high fees, too many stipulations for how and when you can withdraw your money and may not be appropriate for your financial situation.

How to address the issue:

Ratchet up the amount of income your portfolio produces. There are many ways to potentially do this – one in particular is to invest in a dividend-income money manager strategy. One such strategy is the Federated Strategic Value Dividend which seeks to provide a high level of current income, long-term capital appreciation driven by dividend growth, and lower downside risk.*

Higher Cost of Living

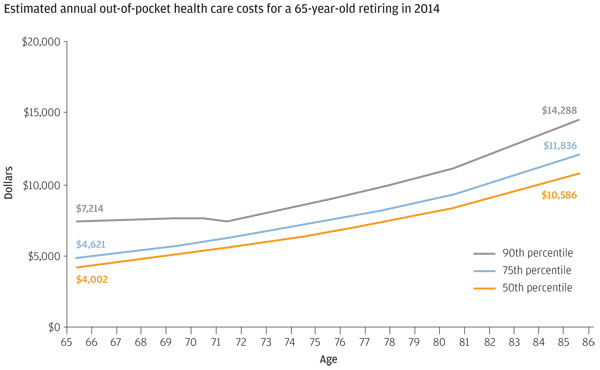

Rising cost of health care is perhaps the most impactful expense to address, especially given the possibility of unforeseen costs.

Rising Costs of Healthcare

(Click image for larger version)

Source: JP Morgan Asset Management. For illustrative purposes only. Source: Employee Benefi t Research Institute (EBRI), January 17, 2014. Based on national average cost estimates for Medicare Parts A, B, D and Medigap Plan F. EBRI derived inflation estimates from US CBO estimates. On average, health care costs are estimated to increase 5.0% for the 50th percentile, 4.8% for the 75th percentile and 3.5% for the 90th percentile. Vision, dental and long-term care expenses are not included. Assumes continued implementation of the Patient Protection and Affordable Care Act. The costs at 90th percentile actually dip down in 2019 due to the implementation of the Medicare prescription drug “donut hole” being fi lled in as applied to Medicare prescription drug costs.

How to address the issue:

Have your financial advisor run stress tests on your investment portfolio to make sure you can handle rising costs over time. The investments themselves cannot reduce your medical costs, but at least you can measure your ability to handle expenses throughout retirement and make any necessary changes. What you find may affect how you invest, how you spend, and how you structure your retirement income plan.

Call one of our Wealth Managers today at 1-800-541-7774 to focus on solutions. We build investment plans for our clients designed to address your growth and income needs throughout retirement, and we make recommendations for money managers we think can help meet your needs. You can get started on your investment plan by answering a few questions here.

Source:

1 Social Security Administration

2 Newfound Research LLC

*There are no guarantees that dividend paying stocks will continue to pay dividends. In addition, dividend paying stocks may not experience the same capital appreciation potential as non-dividend paying stocks.

Strategy descriptions listed represent a brief outline of the portfolio’s objective. There is no guarantee that any manager or product will be successful in achieving the objective described. The strategy used by the money manager listed is not suitable for all investors. This material does not represent a personalized recommendation and does not reflect individual investor’s risk and return goals nor does it serve as the receipt of, or a substitute for, personalized advice from WrapManager, Inc. or any other investment professional.