Total health care spending is expected to reach $4.8 trillion in 2021, up from $2.6 trillion in 2010 and $75 billion in 1970. As consumers of health care, it’s everyday investors that have to absorb these rising costs over time.1

What investors need to do: factor rising health care costs into your investment plan, so you can measure how these expenses could affect your retirement income and portfolio growth over time.

An Investment Portfolio Designed to Keep Up With Rising Health Care Costs

The simple fact is, most investors need growth in their portfolio to keep up with rising health care costs. This growth becomes even more critical as health care costs become a larger percentage of living expenses with age.

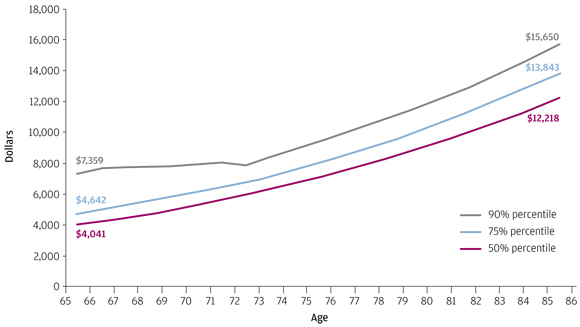

Where do you fall on the below chart? Have you factored this annual expense into your investment plan?

Estimated Annual Out-of-Pocket Health Care Costs for a 65-Year-Old Retiring in 2013

(Click the image for a larger version)

Source: For illustrative purposes only. JP Morgan Asset Management, Employee Benefit Research Institute (EBRI), July 26, 2012. Based on national average cost estimates for Medicare Parts A, B, D and Medigap Plan F. EBRI derived inflation estimates from US CBO estimates. On average, health care costs are estimated to increase 5.7% for the 50th percentile, 5.6% for the 75th percentile and 3.9% for the 90th percentile. Vision, dental and long-term care expenses are not included. Variation in costs by geographic region are not taken into account. Assumes continued implementation of the Patient Protection and Affordable Care Act. The costs at 90% actually dip down in 2019 due to the implementation of the Medicare prescription drug “donut hole” being filled in as applied to Medicare prescription drug costs.

How Much Do You Need to Save for Health Care Costs?

JP Morgan conducted a study to determine how much investors who retired in 2012 would need saved to cover medical expenses for life. The study used data from the Employee Benefit Research Institute, and included items such as Medigap, Medicare Part B premiums, and out of pocket health care costs.

The results may surprise you. In order to cover 90% of all of those expenses, the study showed that men would need $185,000 saved and women would need $210,000. That means a married couple would need close to $400,000 just to cover medical expenses.

The actual amounts you need to save could be more or less - this is just an estimate based on the data surveyed by JP Morgan. Even so, it underscores the need for investors to think seriously about how much they have saved versus how much they need for health care costs throughout retirement.2

Adjust Your Investment Portfolio if Necessary

If you think you’ll have higher health care costs, you should consider adjusting your investment portfolio to include a higher equity allocation. This could help provide the growth needed to keep up with rising expenses over time.

Be cautious, however, as additional equity exposure usually means additional volatility and downside risk. We recommend working with your financial advisor to arrive at an appropriate balance within your portfolio.

Use an Investment Plan to Help You Prepare for Rising Health Care Costs

An investment plan can help you prepare for these expenses throughout retirement.

You’ll be able to see how your increasing health care costs could affect your portfolio’s growth over time, which will help determine an appropriate asset allocation for your portfolio.

Awareness is the first step in understanding the impact of rising health care costs, and an investment plan can help bring that to light.

WrapManager Can Build an Investment Plan for You

Call one of our Wealth Managers today at 1-800-541-7774 to discuss how rising health care costs could impact your portfolio and how an investment plan can help you strategically prepare. We can analyze your current investment portfolio, discuss your estimated expenses throughout retirement, discuss your goals, and build you an investment plan to serve as your roadmap for navigating your financial future. Alternatively, you can get started by answering a few questions here.

Sources:

1 Aetna

2 JP Morgan Guide to Retirement