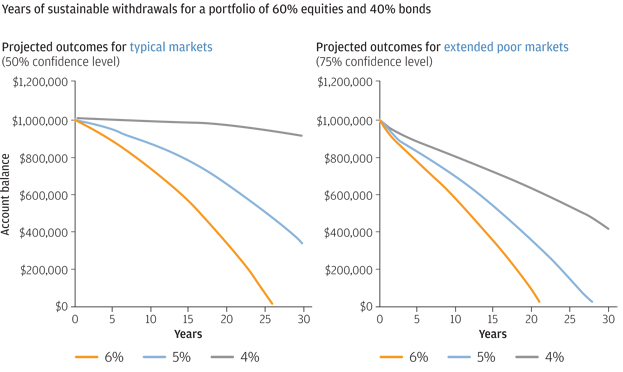

Let’s say you have a $1,000,000 investment portfolio, and you’re withdrawing $40,000 of annual income to meet your retirement spending needs.

Adjusting your withdrawals up to $50,000 a year doesn’t seem like a big move, and in percentage terms it’s not – you’re only increasing them from 4% to 5%.

But the impact it could have on your portfolio is significant, and it can really have an adverse effect on your long-term retirement goals:

Effects of Traditional Withdrawal Rates on a Balanced Portfolio

(Click chart for larger version)

Source: JP Morgan Asset Management. These charts are for illustrative purposes only and must not be used, or relied upon, to make investment decisions. Hypothetical portfolios are composed of US Large Cap for equity and US Aggregate for fi xed income with projected compound returns projected to be 7.50% and 4.25%, respectively. J.P. Morgan’s model is based on J.P. Morgan Asset Management’s (JPMAM) proprietary long-term capital markets assumptions (10 – 15 years). The resulting projections include only the benchmark return associated with the portfolio and does not include alpha from the underlying product strategies within each asset class. The yearly withdrawal amount is set as a fi xed percentage of the initial amount of $1,000,000 and is then infl ation adjusted over the period. Allocations, assumptions and expected returns are not meant to represent JPMAM performance. Given the complex risk/reward trade-offs involved, we advise clients to rely on judgment as well as quantitative optimization approaches in setting strategic allocations. References to future returns for either asset allocation strategies or asset classes are not promises or even estimates of actual returns a client portfolio may achieve.

For the chart on the left projecting outcomes in typical markets, moving your withdrawal rate up 1% meant having significantly less money in your portfolio after 30 years. The portfolio depletes at a much faster rate and there’s a higher probability you will outlive your money.

If the investor in our example decided to up their withdrawals even further to 6% ($60,000) a year, the portfolio is projected to deplete completely in a span of less than 25 years.

Thinking about what might happen under less favorable market conditions (chart on the right) is even more concerning – the portfolios deplete at faster rates.1

Generate More Retirement Income Using Other Methods

An investor might be able to increase their retirement income without actually increasing the amount they withdraw from their portfolio. A good start would be to try and maximize your Social Security income, and from there you could look at other ways to increase your retirement income by exploring options like dividend paying stocks or income producing securities.

We encourage you to talk with your financial advisor about what other options might make the most sense.

Use an Investment Plan to See How Distributions Affect Your Retirement Savings

An investment plan can help you avoid the less desirable outcomes illustrated in the charts above. The plan can show you the potential impact different levels of withdrawal rates can have on your portfolio. It can also show you how the portfolio responds to different asset allocations. The example cited above shows a 60% equity / 40% fixed income portfolio, but increasing the equity exposure may lead to better results over time. An investment plan can show you how.

Have One of Our Wealth Managers Build an Investment Plan for You

With just a bit of your time, one of our Wealth Managers can create an investment plan for you that is based on your financial situation and goals. Talk to us about what you want to get out of retirement, and we’ll give you ideas about how to get there. Call us today at 1-800-541-7774, or click here to get started.

Sources: