“Investors do not exist in a world of ‘100 year averages.’ Instead, they live in a world of 40 year investment horizons, where significant declines can “permanently impair retirement portfolios as investors do not necessarily have ‘more time’ to make up from large losses.”

This is one of the core tenets that applies to many of money manager Newfound Research’s risk managed investment strategies. One such strategy, the Newfound Risk Managed Small Cap Sectors, is designed to protect and participate: “Participate in the strong growth profile of long-only, un-levered small-capitalization equity portfolio, while still protecting capital through rules that allow the portfolio to move to a 100% cash position in order to protect against large losses.”

The intended benefits to you are two-fold: capture the returns of small-cap stocks over time, while having an active, tactical money manager strategy that can move to cash if it perceives increased downside risk.

Newfound’s Tactical, Rules-Based Approach to Investing

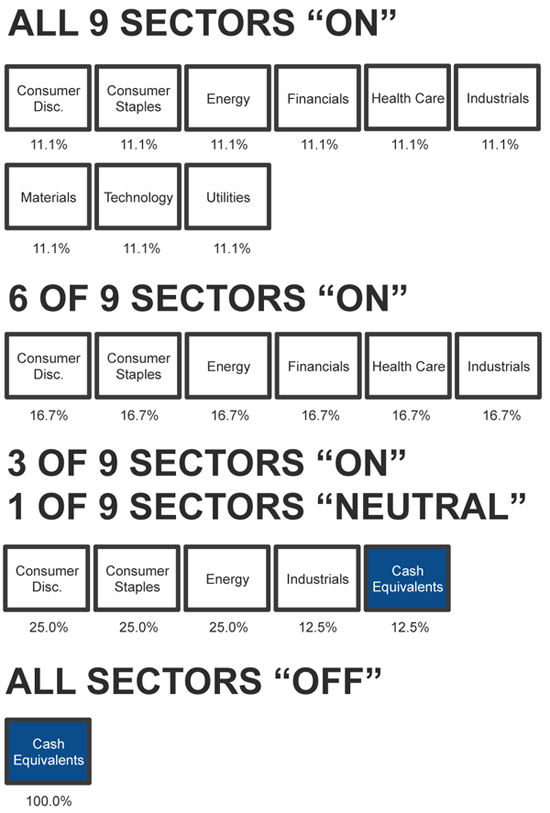

The Risk-Managed Small Cap strategy invests across 9 US Small-Cap sector ETFs plus a cash equivalent (in the event one or several of the sectors exhibits high risk).

The starting point for the strategy is to equally weight all sector exposures, and then apply their proprietary, rules-based approach to reduce or eliminate sectors deemed to be at an increased risk of loss.

Newfound Research Risk Managed Small Cap Sectors Investment Process

(Click image for larger version)

Source: Newfound Research LLC

The belief is securities that go up or down in value tend to continue going up or down in value, and securities that out- or underperform tend to continue out- or underperforming. Newfound developed a quantitative rule-based method for identifying these security and sector trends and having the portfolio react accordingly, i.e., eliminating a sector if the downside risk is high, with the ability to move to an increasing cash position.

Investing in a Tactical, Small-Cap Equity Strategy with Newfound

Before adding tactical money manager strategies to your portfolio, you should have your financial advisor review your asset allocation and your goals to determine if it makes sense.

For most investors, a small-cap strategy should only be a piece of a diversified portfolio—it is still a good idea to have exposure to other money manager strategies depending on your objectives. Including a risk-managed small-cap strategy designed to protect against large losses should enhance, but not define, your overall asset allocation.

If you’d like to learn more about Newfound’s Small Cap Sectors Strategy, give one of our Wealth Managers a call at (800) 541-7774 or request the information here.

Source:

Newfound Research LLC

Strategy descriptions listed represent a brief outline of the portfolio’s objective. There is no guarantee that any manager or product will be successful in achieving the objective described. The strategy used by the money manager listed is not suitable for all investors. This material does not represent a personalized recommendation and does not reflect individual investor’s risk and return goals nor does it serve as the receipt of, or a substitute for, personalized advice from WrapManager, Inc. or any other investment professional.