As we enter the second half of the year, there are three main things you should be factoring-in to your portfolio strategy:

As we enter the second half of the year, there are three main things you should be factoring-in to your portfolio strategy:

1) The Possibility of a Stock Market Correction

A significant amount of time has passed since the last sizable market pullback (10% or more), and history tells us one could be on the way.1

2) You May Not Have Enough International Exposure

International stocks have not rebounded as quickly as US stocks during the recovery, and the case for international growth looks strong at the moment. Yet, many US investors remain under-allocated to international equities.1

3) Adjusting Your Portfolio from a Risk-Managed Perspective

This is a constant with investing, but as we enter the 5th year of this bull market it becomes increasingly important. Consider tactical money manager strategies with the ability to go to cash in the event of a prolonged market downturn.1

Is a Stock Market Correction on the Way?

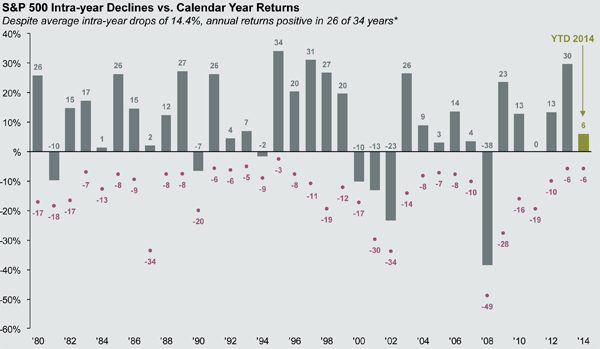

According to JP Morgan research, the market experiences average intra-year corrections of -14.4%. We have not seen a pullback bigger than 10% since mid-2012.1 As Bloomberg columnist Michael Regan put it, “like going two years without changing a car’s oil.”2 Does this mean we are due?

Past Stock Market Corrections and Declines

(Click chart for larger version)

Source: Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. *Returns shown are calendar year returns from 1980 to 2013 excluding 2014 which is year-to-date. Guide to the Markets – U.S. Data are as of 6/30/14.

It’s certainly possible. In the last two or so years, there has not been a big “shock” that might incite a correction. The market shrugged off the government shutdown in 2013 (the market finished positive), and earlier this year the conflict between Russia and the Ukraine hardly caused a ripple. The market has been resilient so far, but history tells us that at some point it is likely to give way to a pullback.

Tips for Weathering a Stock Market Correction

Corrections are a normal and healthy part of bull markets, and the market usually recover relatively quickly from them – that’s what makes them corrections.2 Patience and a diversified portfolio are the best defenses.

Preparing for a stock market correction is more of a mental exercise than anything else. Corrections by definition are relatively quick, healthy drops in the market, appearing in hindsight as slight pauses in an otherwise upward trending bull market.3

And they are near impossible to time. Research by Lazlo Birinyi, president of money management firm Birinyi Associates, found that there is usually one bad day in a market correction that accounts for a quarter of the decline.2

The market is not going to give investors a clear indication of when that day will come, and trying to get out of the market at just the right time and then get reinvested when the market resumes its ascent is little more than a guessing game. As Birinyi put it, “we have always held that [investors] efforts to foretell a correction are in vain.”2

You Probably Don’t Have Enough International Exposure in Your Portfolio

368 of the world’s 500 biggest companies are domiciled outside of the US, and the US comprises just 20% of global GDP. Yet, US stocks make up 74% of US investor portfolios, indicating that US investors are under-allocated to international stocks.4

US Stocks Comprise 49% of Global Equity Market Cap - but 74% of Investors' Portfolios

(Click chart for larger version)

Source: Standard & Poor’s, MSCI, FactSet, J.P. Morgan Asset Management. Totals may not sum to 100% due to rounding. Data as of 3/31/14. Right chart includes active mutual funds, passive mutual funds and ETFs, but excludes Morningstar Sector Stock categories. Pacific/Asia ex-Japan Stock category assets split 50% into Non-U.S. Developed and 50% into Emerging Markets. World Stock category assets split 50% into U.S. and 50% into Non-U.S. Developed. Non-U.S. Developed includes Foreign Large Blend, Value, Growth; Foreign Small/Mid Blend, Value, Growth; Japan Stock; Diversified Pacific/Asia; Europe Stock. Emerging Markets includes Diversified Emerging Markets; India Equity; China Region; Latin America Stock. Data as of 3/31/14. For illustrative purposes only.

How is your portfolio allocated?

International Equities May Have Room to Run

International stocks have not recovered from the bear market as quickly as US stocks. In fact, international stocks are valued below their historical norms in spite of improving economic fundamentals and strong corporate balance sheets.4

Unlike the S&P 500, non-US Markets Have Not Climbed Back to pre-Recession Highs

(Click chart for larger version)

Source: JP Morgan Asset Management. Standard and Poor’s, MSCI. Data as of 3/31/14. For illustrative purposes only. The chart shows the relative performance of U.S., EAFE and emerging markets stocks, including dividends, based on a common start date of October 9, 2007 — the pre-recession peak of the U.S. stock market. Initial values for all three market indexes are indexed to 100.

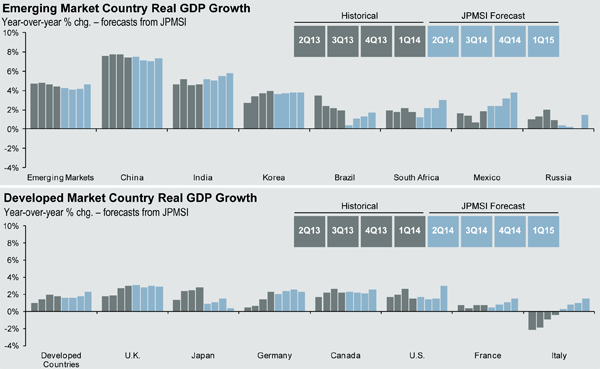

Research also shows that GDP growth is set to continue abroad and improve in some parts in Europe.

Global Economy Performance and Outlook

(Click chart for larger version)

Source: J.P. Morgan Global Economic Research, J.P. Morgan Asset Management. Forecast and aggregate data come from J.P. Morgan Global Economic Research. Historical growth data collected from FactSet Economics. Guide to the Markets – U.S. Data are as of 6/30/14.

International stocks could have room to run from here, and it makes sense for many investors to include an international money manager as part of a comprehensive investment strategy. We highlight a tactical international money manager strategy below.

Adjust Your Portfolio from a Risk-Managed Perspective

The market has performed well since 2009, and good economic data suggests it could continue. A pragmatic investor however will acknowledge that there is always the chance that the market could shift quickly and turn negative, an especially important consideration given we are now five years into this bull market. Risk-managed investing in your portfolio is therefore crucial in our view.

Risk managed investing aims to “protect and participate.” This means investing in the market in order to participate in the potential upside, while also maintaining the ability to move 100% to cash should market conditions turn less favorable. It is a risk-managed framework that seeks to limit significant capital loss.5

Having this balance can give you peace of mind and help you sleep better at night, knowing that there are tools in your portfolio that will attempt to go defensive if market conditions deteriorate.

A Potential Risk-Managed Solution: Newfound Research

Boston-based money manager Newfound Research LLC focuses on risk management. They aim to participate in rising markets while also seeking to limit capital losses when the market declines.

One of their strategies focuses on the international markets, the Newfound Risk Managed Global Sectors. This strategy provides investors access to global equities through an embedded risk-management process, essentially ‘killing two birds with one stone’ – you get international equity exposure and maintain the ability to move to cash if conditions are not so good.

For those investors generating retirement income from their portfolios, Newfound Research also offers their Risk Managed Income Strategy. Request more information about it here.

Preparing Your Portfolio for the 2nd Half of the Year

With the help of one of our Wealth Managers, you can evaluate whether your portfolio is properly diversified in the event of a stock market correction; you can check your international holdings to see if you have appropriate exposure relative to your goals; and you can learn more about adding a risk-managed component to your strategy in an effort to limit significant capital loss during a market downturn.

You can reach us today by calling 1-800-541-7774, or if you’d prefer to start the conversation over email, please send a note to Wealth@wrapmanager.com.

Gabriel is the President of WrapManager, Inc. and Chairman of WrapManger's Investment Policy Committee.

Sources:

1 JP Morgan Guide to the Markets

5 Newfound Research LLC

Strategy descriptions listed represent a brief outline of the portfolio’s objective. There is no guarantee that any manager or product will be successful in achieving the objective described. The strategy used by the money manager listed is not suitable for all investors. This material does not represent a personalized recommendation and does not reflect individual investor’s risk and return goals nor does it serve as the receipt of, or a substitute for, personalized advice from WrapManager, Inc. or any other investment professional.

Diversification does not guarantee investment returns and does not eliminate the risk of loss. International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations. Investments in emerging markets could lead to more volatility. As mentioned above, the normal risks of investing in foreign countries are heightened when investing in emerging markets. In addition, the small size of securities markets and the low trading volume may lead to a lack of liquidity, which leads to increased volatility. Also, emerging markets may not provide adequate legal protection for private or foreign investment or private property. Diversification does not guarantee investment returns and does not eliminate the risk of loss. There is no guarantee that companies that can issue dividends will declare, continue to pay or increase dividends.