How Has the Stock Market Reacted to Past Government Shutdowns?

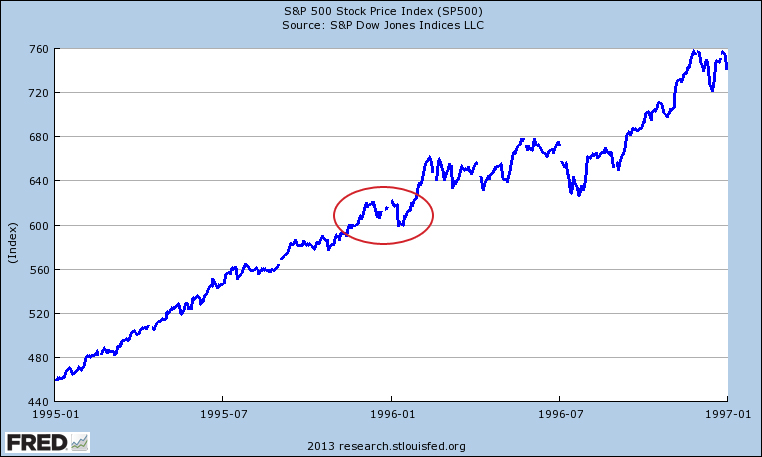

The last two government shutdowns occurred fairly closely to one another - one lasted from November 13 - November 19, 1995, and the next one spanned from December 5, 1995 - January 6, 1996.1 The S&P 500 exhibited a bit of choppiness in that general time frame, but the general trajectory of the bull market was unaffected:Government Shutdown Threats May Affect the Stock Market

In summer 2011, the government came close to shutting down, and the Congressional debate over the debt ceiling2 and funding the government resembles what we’re seeing today. The government eventually reached a deal to raise the debt ceiling and avoided shutting down. It’s possible that this debate and subsequent downgrade of the U.S. by a ratings agency contributed to the stock market correction a few months later:

Source: St. Louis Federal Reserve

Can you Prepare Portfolios for a Potential Government Shutdown?

History tells us that the stock market has weathered a government shutdown in the past. As we wrote in our newsletter titled, “Did the S&P 500 Reach All-Time Highs? Is There a Cause for Concern?” we still believe there are strong, positive fundamentals in the economy today, and that the market can continue to rise from here. A properly diversified portfolio utilizing multiple- money managers should allow investors to position themselves to participate in future gains should they occur.

A bigger issue we see today is making sure your fixed income portfolio is properly diversified given the recent interest rate fluctuations. In our most recent newsletter titled, “It’s Time to Talk to a Financial Advisor About Your Fixed Income Strategy,” we discuss this topic at length and encourage investors to have a financial advisor review the fixed income portion of their portfolio today.

If you would like to discuss government shutdowns or review the fixed income portion of your portfolio with one of our Wealth Managers, please call us today at 1-800-541-7774.

Sources:

1 Washington Post

2 CS Monitor