The first half of the year was positive for stocks and most of the fixed income markets, and economies around the world showed signs of continued recovery and expansion – a good start to the year.1

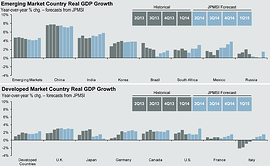

Global Economy Performance and Outlook

(Click chart for larger version)

Source: J.P. Morgan Global Economic Research, J.P. Morgan Asset Management. Forecast and aggregate data come from J.P. Morgan Global Economic Research. Historical growth data collected from FactSet Economics. Guide to the Markets – U.S. Data are as of 6/30/14.

As we look ahead to the back half of the year, there are three topics many investors are wondering about. We break those down below and assess what we think the market impact could be.

3 Factors that Could Affect the Investment Landscape

-

Will Interest Rates Start to Rise?

Interest rates are currently near historical lows, and actually fell slightly in the second quarter.1 However, Federal Reserve policy discussions indicate they could potentially tick higher over the course of the year. As always, it’s important to understand how rising interest rates would affect your fixed income portfolio.

-

The (Non) Effects of Mid-Term Elections

Attention will increasingly turn to the potential outcomes of the mid-term elections, and how they could affect the legislative landscape. Will it affect the stock market too?

-

The Possibility of a Stock Market Correction

A significant amount of time has passed since the last sizable market pullback, and history tells us one could be on the way.1

A Look at Interest Rates and Portfolio Strategy

Interest rates are currently at historically low levels, and it’s possible they could remain flat, or start to rise in line with the Federal Reserve’s latest outlook.

Historical Nominal and Real Interest Rates

(Click chart for larger version)

Source: JP Morgan Asset Management. Federal Reserve, BLS, J.P. Morgan Asset Management. Real 10-year Treasury yields are calculated as the daily Treasury yield less year-over-year core CPI inflation for that month except for June 2014, where real yields are calculated by subtracting out May 2014 year-over-year core inflation. All returns above reflect annualized total returns, which include reinvestment of dividends. Corporate bond returns are based on a composite index of investment grade bond performance. Guide to the Markets – U.S. Data are as of 6/30/14.

Minutes from the Federal Reserve’s last meeting confirmed that Fed officials intend to stop the bond-buying programs by October of this year (Quantitative Easing), and 13 of 16 officials indicated they expect to see a higher federal funds rate sometime next year. In their comments, the central bank acknowledged some improvement in economic activity over the past three months, even though harsh winter conditions adversely impacted GDP in the first quarter.2

However, Federal Reserve Chair Janet Yellen recently indicated that rates are likely to stay low for a “considerable” period after the bond-buying program ends, possibly in October. Speaking to the Senate Banking Committee on July 15th, Yellen said “[a] high degree of monetary policy accommodation remains appropriate. Although the economy continues to improve, the recovery is not yet complete.”3

What Do Rising Interest Rates Mean for Your Portfolio?

As interest rates gradually rise, bond prices start to fall. This could mean that bonds (particularly Treasuries) enter a period of weaker performance. It is not assured that Treasuries will underperform, but it makes sense to review your fixed income allocation with your Wealth Manager to make sure you are properly diversified.

If you own bonds to also produce income for your portfolio, there are even more options for you to consider. Dividend-paying stocks are viable income-generators that may also help cushion your portfolio from downside volatility.4

Whatever the approach, having a diversified fixed income allocation can create various income sources for you and potentially temper the effects of interest rate risk.

Mid-Term Elections and the Stock Market

As campaigning starts to heat up in the political spectrum, the market looks on curiously. Will Republicans win enough seats in the Senate to establish a majority, or will Democrats hold their ground? How will the market respond to a Republican-controlled Congress with a Democratic president?

One possibility is that little changes in terms of who controls the House and Senate, leading to more of a gridlock situation. In this environment, arguably fewer laws and regulations would be passed, which the markets and businesses could like as it represents less change and more of the same.

Right now, Democrats control the Senate while Republicans control the House, and both are trying to keep it that way. The outcome to watch out for is if the Democrats gain control of the House and therefore Congress. This would mean increased chances of legislation passing, which could ultimately affect the markets.

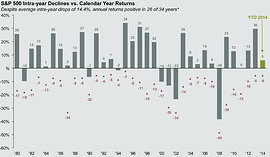

Is a Stock Market Correction on the Way?

According to JP Morgan research, the market experiences average intra-year corrections of -14.4%. We have not seen a pullback bigger than 10% since mid-2012.1 As Bloomberg columnist Michael Regan put it, “like going two years without changing a car’s oil.” Does this mean we are due?5

Past Stock Market Corrections and Declines

(Click chart for larger version)

Source: Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. *Returns shown are calendar year returns from 1980 to 2013 excluding 2014 which is year-to-date. Guide to the Markets – U.S. Data are as of 6/30/14.

It’s certainly possible. In the last two or so years, there has not been a big “shock” that might incite a correction. The market shrugged off the government shutdown in 2013, and earlier this year the conflict between Russia and the Ukraine hardly caused a ripple. The market has been resilient so far, but history tells us that at some point it is likely to give way to a pullback.

How Investors Should Prepare for a Stock Market Correction

Corrections are a normal and healthy part of bull markets, and the market usually recovers relatively quickly from them – that’s what makes them corrections.5 Patience and a diversified portfolio are the best defenses.

Preparing your portfolio for a stock market correction is more of a mental exercise than anything else. Corrections by definition are relatively quick, healthy drops in the market, appearing in hindsight as slight pauses in an otherwise upward trending bull market.6

And they are near impossible to time. Research by Lazlo Birinyi, president of money management firm Birinyi Associates, found that there is usually one bad day in a market correction that accounts for a quarter of the decline.5

The market is not going to give investors a clear indication of when that day will come, and trying to get out of the market at just the right time and then get reinvested when the market resumes its ascent is little more than a guessing game. As Birinyi put it, “we have always held that [investors] efforts to foretell a correction are in vain.”5

Schedule a Quarterly Review with Your Wealth Manager

As always, we look forward to discussing your portfolio strategy with you while sharing our views on the markets and the economy. If scheduling some time to speak is easier for you, please do not hesitate to reach out to us at (800) 541-7774 to let us know.

Gabriel is the President of WrapManager, Inc. and Chairman of WrapManger's Investment Policy Committee.

Sources: