Traditional Retirement at 65 Becoming Less Popular

It was not long ago that Americans entered into retirement at age 65 and never returned to the workforce. Times have definitely changed and it could be for the better. More and more people who have retired are returning to the labor market. Some do it to remain stimulated while others do it to make ends meet. The concept of a gradual retirement is reaching a mainstream tipping point for many reasons. For example, many people who completely stop working around age 65 experience a feeling of being left out. Abruptly ending the 40-hour work week makes some feel lost. While others believe that their life will outlast their traditional retirement savings so they either return to work after retiring or slowly reduce their working hours as they enter their golden years. It is worth noting that a surprising 34% of baby boomers have only $25,000 or less in investable assets.2People Prefer to Work in Retirement

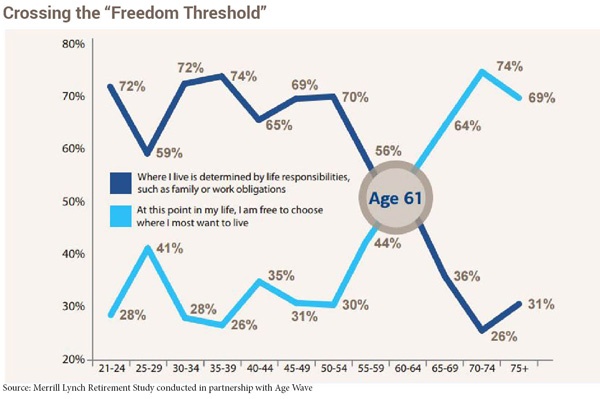

A recent “Age Wave” study conducted by Merrill Lynch revealed some interesting data about retirement. 72% of pre-retirees over the age of 50, state that their perfect retirement would include a wage or salary of some type.3 This seems contradictory on the surface. After all, isn't the point of retiring to stop working? The truth is that people want something meaningful to do in their golden years. Some want to stay involved in their communities, receive mental stimulation and lend their years of expertise to an employer. Additionally, if one does not have a substantial discretionary income during their retirement years, they won't have the funds to enjoy their retirement as they always envisioned. This is precisely why over half of those surveyed in a 2013 AARP study stated that they prefer a gradual retirement compared to a conventional retirement.4New Form of Retirement Planning

The trend toward a gradual retirement is significantly altering the retirement planning landscape. If one is willing to continue working after the age of 65, even on a part-time basis, their retirement planning will be impacted. Those who ease into retirement through a gradual dwindling of their hours throughout their golden years will not have to save as much money during their prime working years in order to retire comfortably. Phased retirement serves to soften the blow of losing one's hefty weekly paycheck. It provides older individuals with a steady stream of income, albeit limited, that reduces the financial stress often endured during a traditional retirement.

Gradual Retirement: How Everyone Will Retire in the Future?

As more and more Americans observe an increasing number of their colleagues gradually enter into a phased retirement, they will likely follow suit. It is possible that a gradual retirement will be enjoyed by the majority of workers around the world in the near future. Too many of those who completely stop working feel a sense of purposelessness. Aside from providing more money through the golden years, gradual retirement also boosts an individual's well-being. Many of those who shave a few days off the work week or work shorter days find that they enjoy their gradual retirement years more than those who go cold turkey at the age of 65. It may be time for all Americans to begin considering the option of a gradual retirement and meet with their financial advisor to discuss their retirement plan.

Individual situations will vary and should be reviewed with a financial advisor to weigh the social security and tax implications. Our wealth managers are available to discuss your unique retirement scenario along with your investment planning to achieve the goals you desire. Call us at 1-800-541-7774 or contact us here to get the conversation started

Sources:

1. CNBC

4. AARP