With interest rates spiking unexpectedly in early 2018 and the Fed poised to continue raising interest rates throughout 2018, some bond investors have become very concerned about experiencing negative returns in their bond holdings. While rising rates will have a negative impact on the price return of a bond investment, this impact can be offset by the positive impact of coupon income.

A rising rate environment isn’t necessarily bad for bond investors in the long run because it will lead to higher coupon payments in the future. As interest rates rise, investors will demand higher coupon payments from newly issued bonds. Also, coupon payments from existing bonds can be reinvested in these newer, higher yielding bonds.

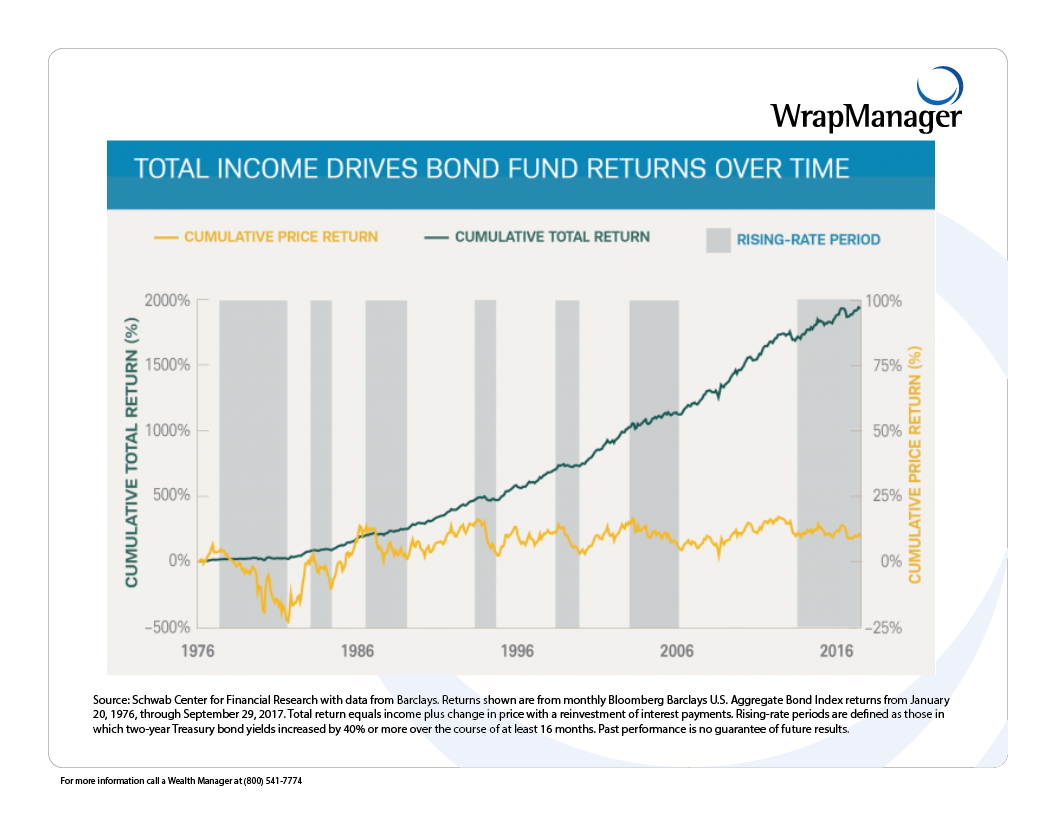

Returns for a bond investment can be broken down into two components: 1) price return and 2) coupon return. The price return on a basket of bond investments will be negatively impacted by increasing interest rates but the coupon return will be positively impacted by rising rates over time.

Price Return is the rate of return on an investment portfolio, where the return measure takes into account only the capital appreciation of the portfolio while the income generated by the assets in the portfolio, in the form of interest and dividends, is ignored.

Coupon Return (also known as Income Return) is the portion of a fund’s total return that was derived from income distributions. This is often higher than capital return for bond funds, and typically lower for stock funds.

Can the positive impact of the coupon return be enough to offset the negative impact on the price return? Since 1976, more than 90% of the total return of the Bloomberg Barclays Aggregate Bond Index has come from coupon return with less than 10% of the total return coming from price return.[1]

Of the last 42 years there have only been three calendar years where the Barclays Aggregate Bond Index has been negative. This period covers 7 different cycles of rising interest rates. Moreover, the largest annual loss in the last 42 years was a mere -2.92% in 1994*.[2]

Yes, an increase in interest rates can have a negative impact on bond returns. However, it’s important to remember that historically, negative returns have typically been short lived in nature and the negative price return has been typically eventually offset by an increase in coupon return.

Lastly, let’s also think about why investors own investment grade bonds in the first place. Investors typically own these types of bonds to:

- Provide income and/or to

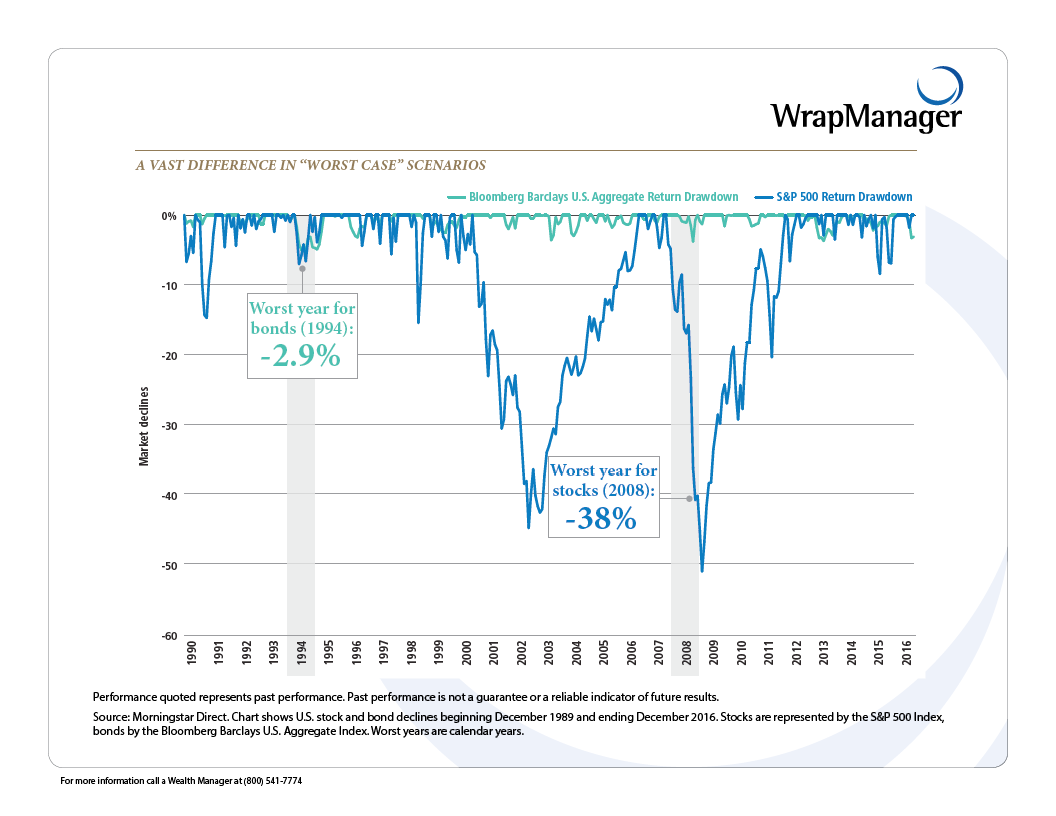

- Provide stability and attempt to offset the volatility in their portfolio caused by equity investments.

Increasing interest rates can ultimately be a net positive for providing income as income increases over time as bond issuers sell new bonds with higher coupons.

Investment grade bonds are typically far less volatile than equities and can provide stability to a balanced portfolio during times of equity market stress.

Note that the Bloomberg Barclays Aggregate Bond Index contains investment grade bonds only. High yield (or “junk”) bonds carry a greater risk of default than investment grade bonds and are more volatile in price than investment grade bonds.

Roughly 70% of the Bloomberg Barclays Aggregate Bond Index is AAA rated[3] (the highest possible bond rating with the lowest default risk). There is at least some default risk in any bond investment but investors can help mitigate this type risk by investing in a diversified basket of high quality, investment grade bonds.

Even in the face of increasing interest rates, the reasons to invest in bonds in the first place remain the same. Investors with investment grade bonds as part of their portfolio can take comfort in knowing that these bonds can still provide stability to their portfolios during times of equity market volatility and an increase in interest rates will lead to higher coupon payments in the future. As we see it now, there is no immediate need for bond investors with long time horizons to stress about interest rate increases.

[1] Charles Schwab

[2] PSN Informa

[3] Bloomberg Barclays Indices

Benchmark Definitions & Disclosures

The Bloomberg Barclays Aggregate Bond Index is a benchmark that measures the investment grade, U.S. dollar denominated, fixed rate taxable bond market. The index includes Treasuries, other government related securities, corporate securities, mortgage-backed securities, asset-backed securities, and commercial mortgage-backed securities.

The S&P 500 Index is a market value weighted US equity market index of 500 of the largest U.S. stocks.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of March 28, 2018 and may change as subsequent conditions vary. The information and opinions contained in this material are derived from sources deemed to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WrapManager, its officers, employees or agents. This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.