In response to the 2008-2009 financial crisis and global recession, the Federal Reserve (Fed) and other central banks across the world lowered interest rates and implemented asset purchase programs meant to drive down borrowing costs for banks and consumers.

What is the Federal Reserve Trying to Accomplish?

It works in two ways. First, by lowering short-term interest rates, the Fed and other central banks give traditional banks easier access to cheap capital, which policymakers hope will spur economic activity by increasing the amount of loans banks make to businesses and consumers.

Second, the asset purchase programs, which are referred to here in the US1 as “quantitative easing,” has the Fed currently purchasing $85 billion per month of securities - divided between mortgage-backed securities and Treasury securities.i This serves two main purposes:

-

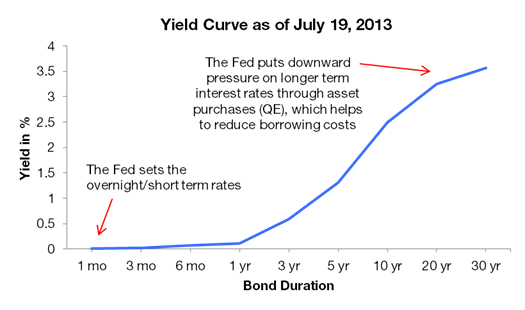

The Fed creates additional demand for bonds, which puts upward pressure on bond prices. When bond prices rise, yields fall, so the Fed’s efforts are essentially carried out in an attempt to put downward pressure on longer-term interest rates (see chart below). This approach helps to keep things like mortgage rates low, and it supports a favorable borrowing environment for businesses and consumers.

-

With the Fed working to place downward pressure on bond yields, it also means that yields on risk assets (like equities) by comparison become more attractive. In theory, investors in this environment should favor equities over bonds, which can provide a boost to stock prices.

Source: US Department of the Treasury; WrapManager Research

Has Quantitative Easing Worked? Where Do We Go From Here?

Fed policy over the last few years has arguably accomplished both of the objectives above - the housing market has reboundedii, bank lending is up from 2009 levelsiii, the economy has been expanding for four yearsiv, and the stock market has experienced a nice run since March 2009.

As the economic situation improves, however, the Fed has been increasingly vocal about their plans to reduce, or “taper,” their monthly asset purchases (QE3) later this year and on into next. They have been clear that any changes to their policies will hinge upon improving conditions in the economy and particularly the labor marketv, but all signs point to tapering in the not too distant future.

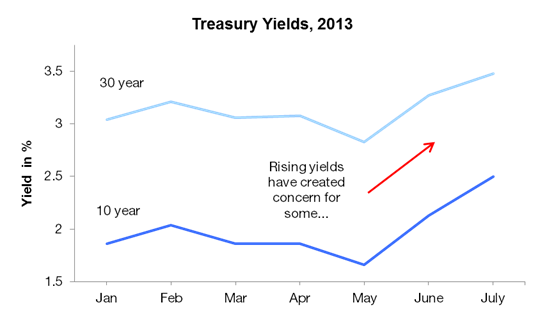

Indeed, as the Fed increasingly hints at tapering the programs, we have already started to see longer-term rates drifting higher:

Source: US Department of the Treasury2; WrapManager Research

How Does Fed Policy Affect You?

With the Fed gradually placing less pressure on the longer-term interest rates through asset purchases, fears have surfaced that rising rates could stifle the recovering economy, since borrowing costs could also gradually rise and investors may increasingly shift to bonds. So, a few questions then come to mind: What does that mean for fixed income holdings? Will the effects trickle over to the equities markets and the economy? What does this all mean for your portfolio? What can be done to control some of the risk?

Wrap Manager will explore all of these questions in our upcoming piece titled, “4 Reasons Rising Interest Rates Aren’t Necessarily a Bad Thing.”

1 Other countries such as the UK and Japan have implemented similar programs.

2 Values taken from the first trading day of each month.

Sources:

ii St. Louis Federal Reserve 1 and 2