If you want to add more yield-producing investments to your portfolio, one option for you could be master limited partnerships (MLPs). They could help increase your portfolio’s overall yield and improve your retirement income strategy.

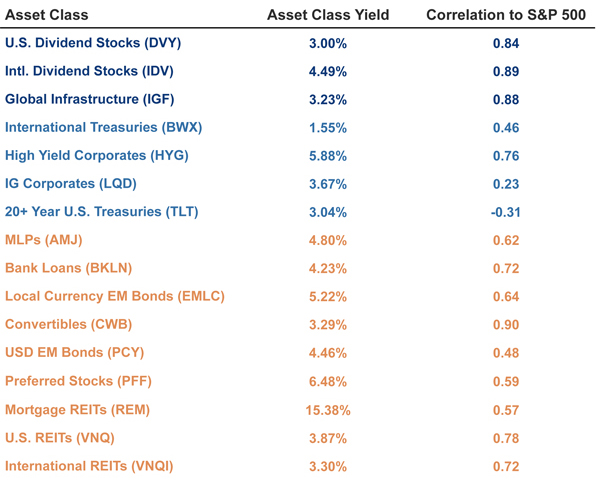

MLPs – which invest largely in oil and gas assets – are experiencing a revival and currently pay attractive yields relative to traditional income producing assets, like dividend-paying stocks and US Treasuries:1

Asset Class Yield and Correlation

(Click chart for larger version)

Source: Newfound Research LLC. Yield on a given day is calculated using smoothed 12-month trailing dividends. Yield presented in the table is computed as of 3/31/2014. Correlation is calculated as Pearson correlation of monthly returns between the asset class ETF and the S&P 500 ETF “SPY” from ETF inception to 3/31/2014.

Potential Benefits of Master Limited Partnerships

-

Attractive yields

-

Potential Tax Advantages – many of the partnership earnings can be offset by tax deductions

-

Exposure to growth and productivity of U.S. oil and gas wells

-

Tradability – can be bought and sold like stocks (though may have less liquidity than stocks)

Drawbacks Associated with Master Limited Partnerships

-

Less Diversification – since MLPs are largely contained within the energy sector, you may not get a great deal of diversification

-

Illiquidity – not traded as often as stocks and bonds

-

Volatility – since MLPs distribute most of their income to investors, they do not have much cash cushion during times of market turbulence

-

Complex Tax Structures – there are increased tax requirements for MLPs, which typically means more paperwork for investors

Ways to Invest in Master Limited Partnerships

You can purchase shares of MLPs directly or through ETFs, which would mean potentially having to address each of the drawbacks listed above as part of your overall investment strategy.1

Alternately, you can seek out income-oriented money manager strategies that invest in MLPs as part of their approach. Taking this route can help address each of the drawbacks listed above, since the money manager would be charged with controlling those risks.

One such money manager strategy is Newfound Research’s Risk Managed Income Strategy, which can invest in MLPs and has a goal of increasing portfolio income in a prudent manner, by investing in alternative-income vehicles in a risk-managed framework.2 This could be a good place for you to start if you’re trying to learn more about how to incorporate MLPs into your portfolio strategy. Click here to request more information on this strategy.

Learn More About Master Limited Partnerships and Newfound Research

Call one of our Wealth Managers at (800) 541-7774 for more information and to discuss the pros and cons MLPs and Newfound’s Risk Managed Income strategy. You can also send us an email with a request for more information to Weath@wrapmanager.com.

Source:

1 Fidelity

2 Newfound Research