With the month of May approaching, it’s the time of year when we’re reminded of the old Wall Street saying, “sell in May and go away.” In theory, this suggests that an investor can sell out of the stock market on May 1st and get back into the market on November 1st to avoid the months where equity returns are typically depressed.

With the month of May approaching, it’s the time of year when we’re reminded of the old Wall Street saying, “sell in May and go away.” In theory, this suggests that an investor can sell out of the stock market on May 1st and get back into the market on November 1st to avoid the months where equity returns are typically depressed.

While the saying “sell in May and go away” may be catchy, is it actually sound investment advice?

Over the 50 years prior to 2016, during the 6-month period from May 1st through October 31st, U.S. stocks returned an average of 2.68%, while the 6-month period of November 1st through April 30th, U.S. stocks returned an average of 8.08%.[1]

Keep in mind that stocks have still gone up on average from May to October. If investors liquidated stocks on May 1st and bought back in to the market on November 1st they would have missed out on those positive returns and they would’ve missed out on the compounding effect from staying fully invested for the entire year.

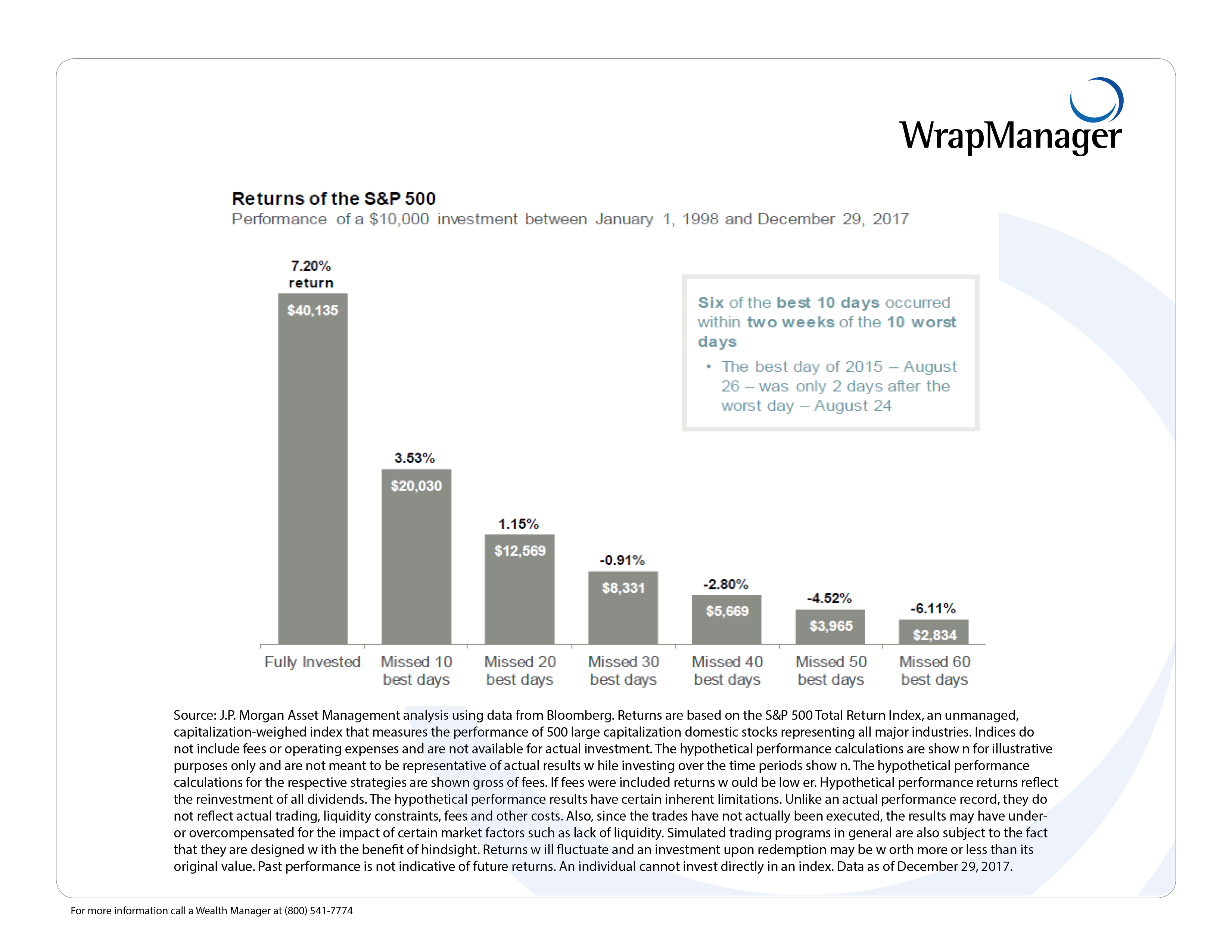

Being out of the market entirely means that you’ll run the risk of missing out on positive returns. JPMorgan found that an investor who was fully invested between January 1, 1998 and December 29, 2017 returned 7.2% annualized but an investor who missed the 10 best days of the market during this time period returned only 3.53% annually.[2]

Also, keep in mind that liquidating a portfolio every year and reinvesting 6 months later could potentially have negative tax consequences for taxable accounts and liquidating a portfolio will typically generate transaction costs.

The other main problem with the “sell in May and go away” strategy is that averages don’t tell the whole story.

Returns can vary by quite a bit from year to year. Yes, the average return from May 1st through October 31st has been 2.68% over 50 years but the returns can be much more (or much less for that matter) in any given year. For example, if you would’ve pursued the “sell in May and go away” strategy in 2009, you would’ve missed out on a 13.7% gain in the S&P 500 from May through October 2009.[3]

If you are a long-term investor, there are several factors that should influence your investment decisions. Long-term investors should consider their objectives, risk constraints, liquidity needs, time horizon, tax situation (for taxable accounts) among other factors when evaluating an investment strategy. Employing a simplistic market timing strategy that doesn’t work in every year is not sound investment advice. Investors should base their investment decisions on their personal circumstances and goals take advice like sell in May and go away with a grain of salt.

Sources

[1] BlackRock

[2] JP Morgan Guide to Retirement, 2018

[3] PSN Informa

Past performance may not be indicative of future results. Therefore, you should not assume that future performance of any specific investment or investment strategy made reference to directly or indirectly by WrapManager in its literature or otherwise will be profitable or equal the corresponding indicated performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable for your investment portfolio. Opinions expressed are subject to change without notice.