Are you thinking of retiring soon, but are still unsure about when you should take Social Security retirement benefits? Here’s something you may not have known before: the Social Security retirement benefit system is set up to incentivize people to delay collecting benefits.

If your financial situation enables you to delay collecting benefits, it could make a lot of sense for you to wait. Here’s a great introductory graphic that can help frame your thinking:

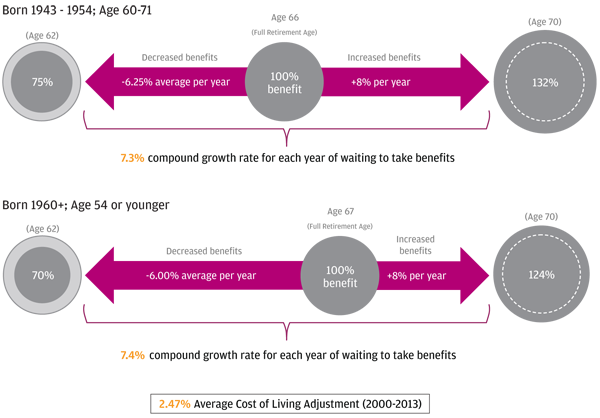

Social Security Timing Tradeoffs

(Click chart for larger version)

Source: Social Security Administration, J.P. Morgan Asset Management. For illustrative purposes only. For 1955 - 1960, two months are added to the Full Retirement Age each year.

Wait Longer, Get Bigger Social Security Checks

For those currently aged 60 and over who are willing and/or able to wait until age 70 to start collecting benefits, waiting to claim could mean receiving bigger monthly checks than if you start collecting at the retirement age of 66.

For those born after 1960, the increase in benefit received by waiting to age 70 is smaller – since the retirement age moves to 67 – but there’s still a nice boost that can add up over time.1

Deciding When to Take Your Social Security Retirement Benefits

Everyone’s financial situation is different and warrants evaluation of many options – your health and health care costs, other sources of income and assets, and how and when your spouse elects to take Social Security, amongst other factors.

Social Security retirement benefits are just one piece of your investment plan, and your financial advisor should show you how timing the receipt of your benefits affects your cash flows and the ability to meet your needs over time. You want your investment plan to operate as efficiently as possible, so making this choice carefully is important.

Need Help Planning Your Social Security Timing Strategy?

Call one of our Wealth Managers today at 1-800-541-7774 to have them review your investment accounts and provide you with knowledgeable guidance. Or, get started here by answering a few questions and one of our Wealth Managers will be in touch shortly.

Sources: