Many banking institutions now undergo annual stress tests to ensure they’re strong enough to survive another global financial crisis. Looking back, we now know that many banks appearing healthy and operational on the surface actually needed help.

Had they conducted stress tests regularly, they may have just survived.

As advisors, these bank stress tests and bank failures highlight a valuable lesson when it comes to investment plans—they too should be stress-tested to make sure they can endure future market volatility.

- Have you checked to see if your investment portfolio can survive another large market decline?

- Who performs annual stress tests on your portfolio to make sure you’re on the right track?

* The Confidence Zone is the range of probabilities that you and your advisor select as your target range for the Probability of Success result in your Plan. Source: Money Guide Pro

It’s important to know how your retirement goals and portfolio could be affected during the next market decline. Armed with this information, you can make adjustments so you’re better prepared.

Go through these 4 steps to perform a stress test on your portfolio so you know you’re prepared.

(Or click here to answer a few questions and have one of our Wealth Managers do it for you.)

1. Establish Your Retirement Needs, Wants, and Wishes

Instead of just guessing how much money you’ll spend each year, create a detailed view of your cash flow needs for each year of retirement.

As in the example below, maybe it’s important for you to earmark travel money and gifts to your grandchildren each year. Your spending goals are unique to you and your family, and it’s important to map them out very clearly as part of your plan.

Lifestyle Goals for John and Ann - Example Plan

(Click image for larger version)

Source: Money Guide Pro

2. Determine What Resources You Have to Fund Your Goals

Your assets and income streams are what fund your retirement needs, wants and wishes. For many, this means supplementing your Social Security or pension income with cash flows from your investment portfolio, or relying on other sources, like the proceeds from the sale of a house.

Step 2 is about making a list of all of these income sources and investable assets so you can test them in step 3.

3. Test How Your Asset Allocation and Spending Needs Affect Your Portfolio

Once you’ve established your cash flow needs and the resources you’ll use to fund them, you can use an investment plan to perform a stress test.

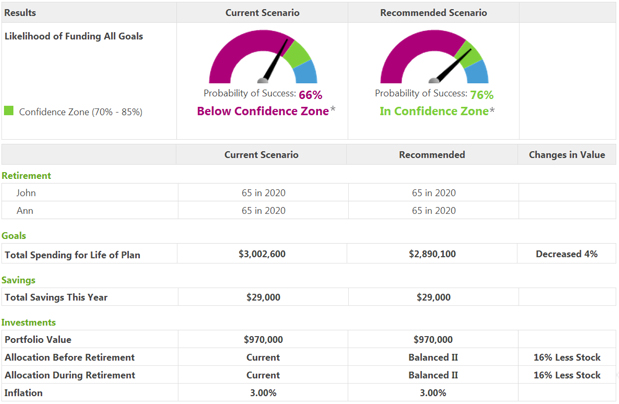

In the case below, John and Ann in the “Current Scenario” were spending too much and had their portfolio over-allocated to stocks (based on their “conservative” risk tolerance). As a result, there was only a 66% probability they could meet all of their goals throughout their retirement lives—too low a probability in our view.

Investment Plan Example Result Summary for John and Ann

(Click image for larger version)

* The Confidence Zone is the range of probabilities that you and your advisor select as your target range for the Probability of Success result in your Plan. Source: Money Guide Pro

In this example, John and Ann should make some changes to their current plan in order to give themselves a better chance of succeeding. Now - Step 4.

4. Adjustment Your Plan to Increase Your Probability of Success

Still using the example above, when John and Ann decreased their spending needs by 4% and decreased their exposure to stocks by 16%, their probability of success increased to 76%—a more acceptable outcome.

John and Ann can easily keep tinkering with their numbers—by spending less, adding more stock exposure, factoring in faster rates of inflation, etc. Keep in mind that it’s important these changes are realistic. An investment plan like this one is designed to change as your needs, wants, wishes, and market conditions change.

An Investment Plan Factors in Good and Bad Times in the Market

In the above example, the investment plan factors in thousands of trials and rates of return (both positive and negative) to see if the portfolio will succeed under various market conditions.

As a result the investment plan creates a sample size large enough to give a good idea of how often you’ll reach your goals—in this case, 76% of the time.

The higher the probability of success the better, so in this example it might be worthwhile for John and Ann to continue the conversation with their financial advisor, to see if there are other actions they can take to increase their confidence level beyond 76% probability.

What is Your Portfolio’s Probability of Success?

The Wealth Managers at our firm have the ability to create an investment plan like the one you see above, to help you determine your portfolio’s probability of success.

Get started on your investment plan by answering a few questions here.

If your probability of success is below the confidence level we’d like to see, we can work with you and recommend what adjustments you can make to improve your outlook.

Going through the above four steps will only take a few minutes, and it will provide you with important insight into how prepared you currently are for what lies ahead.

Give one of our Wealth Managers a call today 1-800-541-7774 and they’ll build you an investment plan at no charge to you. Together, we can map out your future and help you know where you stand at every step of the way.