If you’ve been tracking your fixed income performance this year, you’re probably wondering what’s going on. Depending on your goals, a fixed income allocation should generate income, help preserve your principal, hopefully provide stability during more volatile times or provide a combination of all three. Recently, these benefits have been challenged by the exceptional volatility and trend in interest rates, which has resulted in less than desirable performance for many fixed income portfolios.

Take this as an opportunity to have a financial advisor evaluate or re-evaluate your fixed income portfolio to help you ensure that it’s properly diversified and working for you and your goals.

Importance of Having a Properly Diversified Fixed Income Strategy

Investors should approach fixed income investing much like they approach equity investing. Just as there are different categories and styles of equities (large cap, small cap, value, growth, etc…), there are also various types of fixed income, all of which have different characteristics and perform differently each year. Diversifying your fixed income portfolio is crucial, just as it is for stocks.

Many investors are familiar with the following chart, but normally it’s displaying performance results for various equity categories. The less common version of this chart highlights various fixed income classes and their performance.

Fixed Income Performance Varies

Source: Barclays Capital, FactSet, J.P. Morgan Asset Management. Past performance is not indicative of future returns. Fixed income sectors shown above are provided by Barclays Capital and are represented by: Barclays Capital U.S. Aggregate Index; MBS: Fixed Rate MBS Index; Corporate: U.S. Corporates; Municipals: Muni Bond 10-Year Index; Emerging Debt: Emerging Markets USD Index; High Yield: Corporate High Yield Index; Treasuries: Barclays Capital U.S. Treasury; TIPS: Barclays Capital TIPS. The “Asset Allocation” portfolio assumes the following weights: 10% in MBS, 20% in Corporate, 15% in Municipals, 10% in Emerging Debt, 10% in High Yield, 25% in Treasuries, 10% in TIPS. Asset allocation portfolio assumes annual rebalancing. “Guide to the Markets – U.S.” Data are as of 9/30/13. Click here to see disclosure page at end for index definitions.

As you can see, performance varies each year and highlights the importance of having a properly diversified fixed income portfolio. Failing to do so could adversely affect your portfolio and overall retirement plans.

For example, a portfolio weighted heavily to long-term bonds could suffer with just a 1% rise in interest rates. The chart below shows how a 1% rise or fall would potentially affect different types of fixed income.

How a 1% Move in Interest Rates Can Affect Bond Performance

(click chart for larger version) Source: U.S. Treasury, Barclays Capital, FactSet, J.P. Morgan Asset Management. Fixed income sectors shown above are provided by Barclays Capital and are represented by – Broad Market: Barclays U.S. Aggregate; MBS: Fixed Rate MBS Index; Corporate: U.S. Corporates; Municipals: Muni Bond Index; EMD ($): Emerging Markets (USD); High Yield: Corporate High Yield Index; TIPS: Treasury Inflation Protection Securities (TIPS). EMD (LCL): Barclays Emerging Market Local Currency Government; Floating Rate: Barclays FRN ( BBB); Convertibles: Barclays U.S. Convertibles Composite. Treasury securities data for # of issues based on U.S. Treasury benchmarks from Barclays Capital. Yield and return information based on bellwethers for Treasury securities. Sector yields reflect yield to worst, while Treasury yields are yield to maturity. Correlations are based on 10-years of monthly returns for all sectors except Floating Rate and EMD (LCL), which are based on monthly returns from May 2004 and July 2008, respectively, due to data availability. Change in bond price is calculated using both duration and convexity according to the following formula: New Price = (Price + (Price * - Duration * Change in Interest Rates))+(0.5 * Price * Convexity * (Change in Interest Rates)^2). *Calculation assumes 2-year Treasury interest rate falls 0.33% to 0.00%,as interest rates can only fall to 0.00%. Chart is for illustrative purposes only. Past performance is not indicative of future results. “Guide to the Markets – U.S.” Data are as of 9/30/13. Click here to see disclosure page at end for index definitions.

Source: U.S. Treasury, Barclays Capital, FactSet, J.P. Morgan Asset Management. Fixed income sectors shown above are provided by Barclays Capital and are represented by – Broad Market: Barclays U.S. Aggregate; MBS: Fixed Rate MBS Index; Corporate: U.S. Corporates; Municipals: Muni Bond Index; EMD ($): Emerging Markets (USD); High Yield: Corporate High Yield Index; TIPS: Treasury Inflation Protection Securities (TIPS). EMD (LCL): Barclays Emerging Market Local Currency Government; Floating Rate: Barclays FRN ( BBB); Convertibles: Barclays U.S. Convertibles Composite. Treasury securities data for # of issues based on U.S. Treasury benchmarks from Barclays Capital. Yield and return information based on bellwethers for Treasury securities. Sector yields reflect yield to worst, while Treasury yields are yield to maturity. Correlations are based on 10-years of monthly returns for all sectors except Floating Rate and EMD (LCL), which are based on monthly returns from May 2004 and July 2008, respectively, due to data availability. Change in bond price is calculated using both duration and convexity according to the following formula: New Price = (Price + (Price * - Duration * Change in Interest Rates))+(0.5 * Price * Convexity * (Change in Interest Rates)^2). *Calculation assumes 2-year Treasury interest rate falls 0.33% to 0.00%,as interest rates can only fall to 0.00%. Chart is for illustrative purposes only. Past performance is not indicative of future results. “Guide to the Markets – U.S.” Data are as of 9/30/13. Click here to see disclosure page at end for index definitions.

Your fixed income portfolio should also adapt with both your goals and market conditions. Your financial advisor should be able to accomplish this, in part by regularly reviewing your fixed income portfolio on a quarterly basis at a minimum.

Which Types of Fixed Income Will Perform Well From Here?

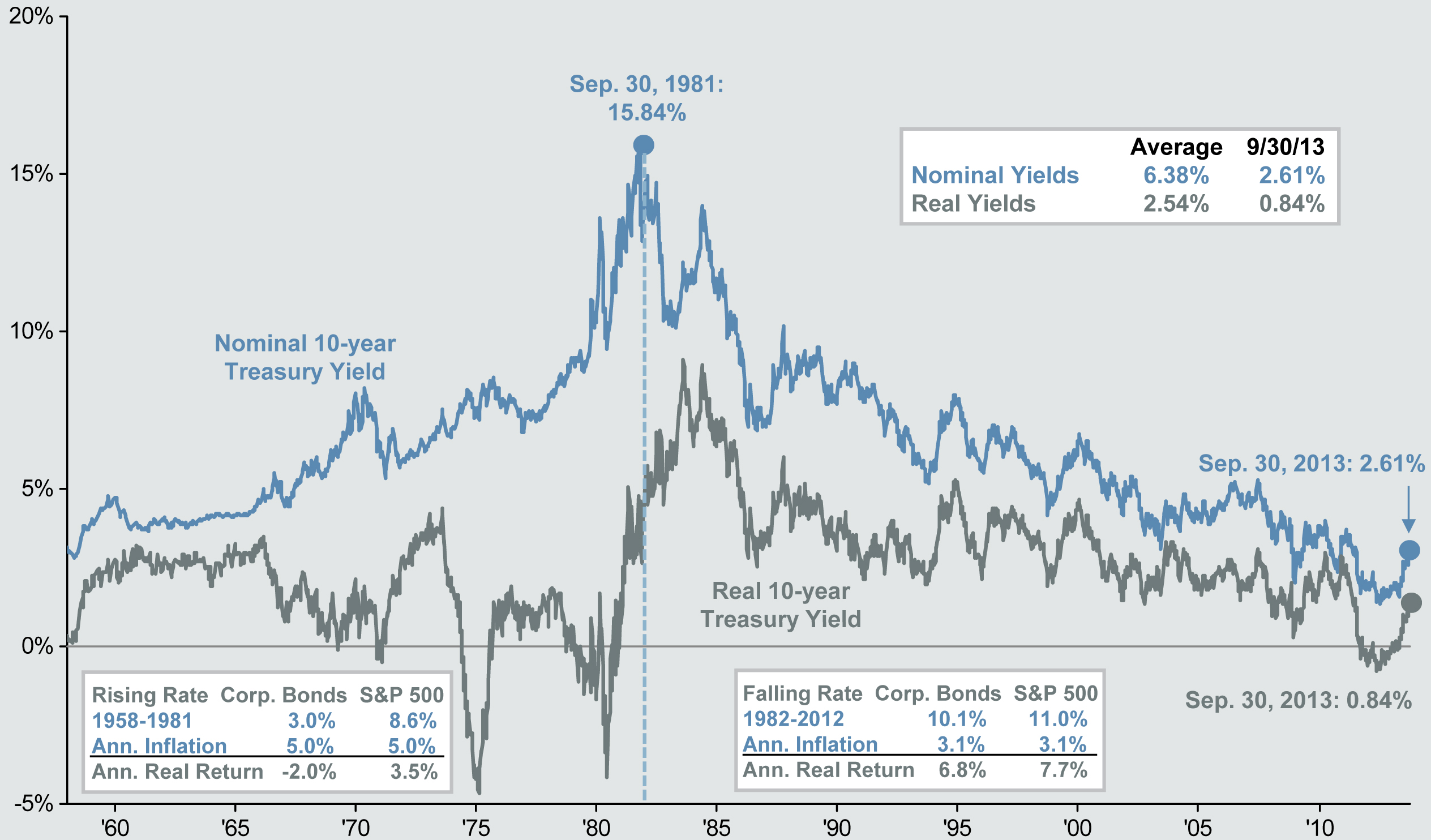

No one knows exactly how interest rates will behave in the future. With 10-year Treasuries near all-time lows, it’s plausible that interest rates could rise, hurting performance for several categories of fixed income. However, the Federal Reserve recently indicated that it intends to keep its current Quantitative Easing program the same, suggesting that interest rates could remain flat or even trend lower.

History of 10-year Treasury Yeilds: Nominal and Real

Source: Federal Reserve, BLS, J.P. Morgan Asset Management. Real 10-year Treasury yields are calculated as the daily Treasury yield less year-overyear core inflation for that month except for September 2013, where real yields are calculated by subtracting out August 2013 year-over-year core inflation. All returns above reflect annualized total returns, which include reinvestment of dividends. Corporate bond returns are based on a composite index of investment grade bond performance. “Guide to the Markets – U.S.” Data are as of 9/30/13.

As there’s no way to know, a properly diversified fixed income portfolio that is regularly reviewed can potentially help weather whatever lies ahead.

If interest rates do begin to rise, investors may want to consider shorter-term fixed income investments. As Figure 2 demonstrates, fixed income investments with shorter time frames are usually less impacted by interest rate moves compared to longer-term fixed income.

Have a Financial Advisor Review Your Fixed Income Portfolio Today

Before considering making any changes to your fixed income allocation, the first step is to have your financial advisor evaluate your fixed income portfolio. He or she should be able to determine what, if any, changes need to be made based on your retirement goals and current market environment. Going through this process can also provide valuable and actionable insight that many investors often do not get.

One of our Wealth Managers can evaluate you fixed income portfolio to help determine if it’s properly diversified and make recommendations based on your goals. Give us a call today at (800) 541-7774 to get started.

Sources: JP Morgan Asset Management