If you’re starting to get the feeling that the mutterings of a next bear market are growing, it’s because in many senses they are. A recent Bloomberg article noted that some high profile market forecasters—among them Goldman Sachs and Bill Gross—were raising warning signs about rising stocks and bonds.

But it doesn’t end there. In another article published just days before, it was noted that:

But it doesn’t end there. In another article published just days before, it was noted that:

- Profits from S&P 500 companies are mired in a five-quarter decline;

- This is the slowest economic recovery since World War II (in terms of average GDP growth rate);

- The economy is feeling pressure from falling commodity prices and a strengthening dollar;

- The S&P 500 is expensive: at 18.5 times forecast profit, the index is trading at its highest multiple in more than a decade.

Yet even with these headwinds as a factor, stocks are still positive for the year. That’s causing many investors to wonder if it’s “too good to be true,” and if a major decline is on the way.

The Bigger Risk Might Be Trying to Time the Market

As some experts start to grow more wary about the strength of the bull market, it’s tempting to take their forecasts to heart and become bearish yourself. If you find yourself growing more concerned, take a pause to note some words of wisdom from Warren Buffet: “A prediction about the direction of the stock market tells you nothing about where stocks are headed, but a whole lot about the person doing the predicting.”

If anything, his quote should remind us that no forecaster has a crystal ball, so it’s probably wise to avoid clinging to every word spoken by analysts or experts, even the most well-known ones. In times like these, sometimes it’s helpful to take a step back and remember some of the anecdotal evidence that supports taking the long-term, steady hand approach. There’s plenty of it.

Here’s one from a recent study: Fidelity Investments looked at the returns for 401(k) savers who moved out of equities at or near the market bottom in late 2008 or early 2009 and stayed out as of the end of 2015, comparing them with returns for investors who kept a stake in stocks. The key finding: the resilient investors were about $82,000 better off.

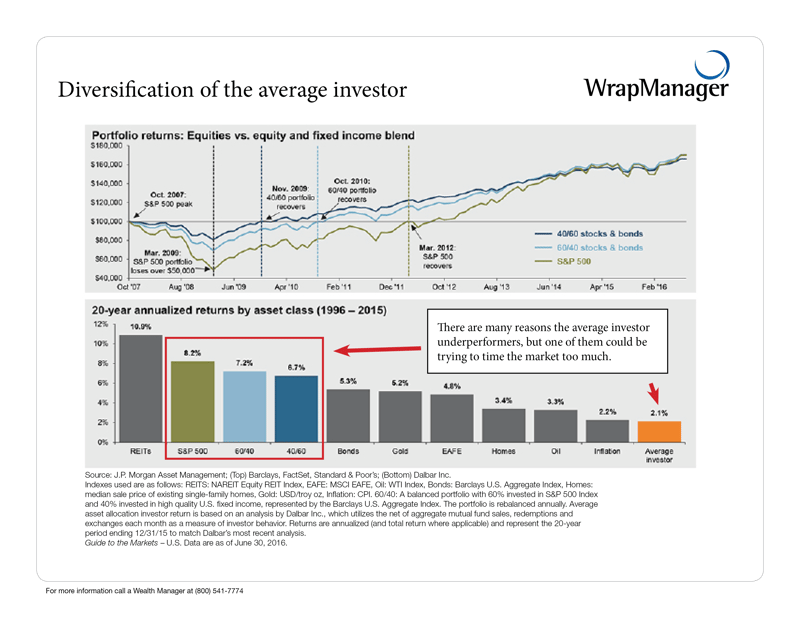

JP Morgan research gives us another lesson in market timing. As you can see in the graphic below, the average investor has significantly underperformed many asset classes and portfolio blends over the last 20 years. Some of that may be due to market timing.

Click here to see a larger image.

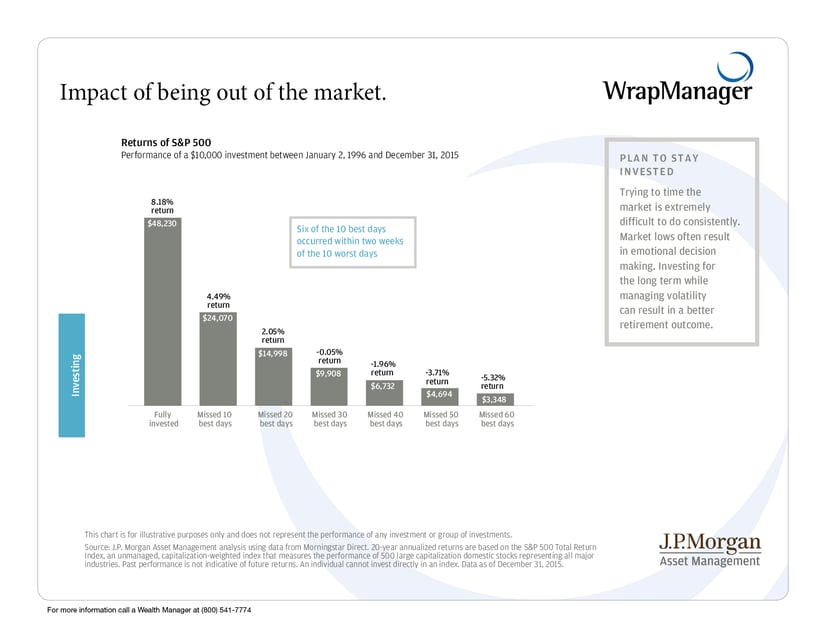

And finally, JP Morgan also presents us with one of the more classic research points that underscores the value of “time in the market” versus “timing the market.” That is, looking at what happens to a $10,000 investment when it is fully invested versus when it misses some of the best days in the market.

Click here to see a larger image

Prepare for the Next Bear Market in Other Ways

Instead of trying to time the market and predict when the next bear market is coming, it may make better sense to have a portfolio that’s designed to meet your investment objectives over your investment horizon. The goal is to have an outcome like we saw in the first JP Morgan graphic, where the return of a balanced portfolio widely outperforms that of the ‘average’ investor.

When was the last time you checked how well your portfolio is diversified and allocated relative to your risk tolerance and investment objective? One of our Wealth Managers would be happy to review your current

allocation and make suggestions. Just give us a call at 1-800-541-7774 or send us a note to wealth@wrapmanager.com to get started.

Sources: