Whether you’re hoping to move closer to family, downsize your home, or live in a place you’ve always dreamed of, many people choose to relocate during retirement. In fact, relocating can be an effective part of your retirement lifestyle planning, especially if you consider the financial implications of your new chosen home state. As you make decisions about relocating, you can use each state’s tax rules to your advantage to potentially save thousands of dollars.

Perhaps, more importantly, you can benefit even more if you can find a state with tax rules that align well with your personal retirement goals. If you’re leaving a large sum of cash to you children, you might consider choosing a state with very low estate taxes.

Important Tax Rules to Research When Relocating

Taxes on Social Security and Retirement Plan Distributions

Taxes on social security and retirement plan distributions can vary widely from state to state. In some states certain types of retirement funds are taxed but other types are not. Additionally, tax rates on retirement funds may be significantly different state to state.

Your financial advisor can help you to estimate how much you’ll be taking in income, and this estimate can help you to know which locations could be beneficial for your personal Social Security and retirement plan distributions. For example, some states exclude all federal, military, and in-state government pensions from taxation.

Sales and Property Taxes

As you’re constructing your retirement budget, don’t forget to include state and local sales taxes and property taxes. Many people believe it’s better to live in a state without sales tax, but these potential savings can be offset by higher tax rates in other areas like income tax and property taxes.

Property taxes can be especially hard-hitting for retirees, so be sure to include an analysis of property taxes in your overall budget analysis. These tax rates vary widely, and some states offer tax breaks to full-time residents based on age and/or income. As you do your research, pay attention to two numbers: the percentage of a home’s assessed value that is subject to tax and the property tax rate.

Estate and Inheritance Taxes

No matter where you live, you’ll most likely be paying Federal estate tax. However, some states also have their own estate taxes, further reducing the amount left to your heirs. If you plan on leaving cash to your children, consider choosing a state with a low or non-existent estate tax.

Capital Gains Taxes

If you’ve been the beneficiary of successful investments, you’ll need to consider capital gains taxes as well. Most states tax both short and long-term capital gains. This makes states with no income tax especially appealing for retirees with large nest eggs.1

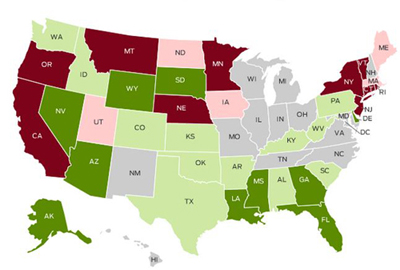

Most and Least Tax Friendly States in 2015

Below are the most and least friendly tax states in 2015, according to Kiplinger’s.1 You can view in depth information about each state’s tax rates with Kiplinger’s interactive tool, located here.

|

Most tax friendly states Alaska Nevada Arizona Wyoming South Dakota Louisiana Mississippi Georgia Florida Delaware |

Least tax friendly states California Oregon Nebraska Montana Minnesota New York Vermont Connecticut New Jersey Rhode Island |

These lists are helpful in determining which states are tax friendly overall, but pay attention to which tax advantages would benefit your financial situation the most. In other words, just because one state is generally very tax friendly, doesn’t mean it’s the most tax friendly state for you.

To learn more about which states are friendly for your retirement lifestyle planning, call one of our Wealth Managers at 1-800-541-7774 or contact us here.

To the extent this presentation includes any state or federal tax advice, the presentation is not intended or written by WrapManager, Inc. to be used, and cannot be used, for the purpose of avoiding federal tax penalties. WrapManager, Inc. does not advise on any income tax requirements or issues. Use of any information presented by WrapManager, Inc. is for general information only and does not represent tax or legal advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.

Sources:

1. Kiplinger