There are numerous planning considerations involved when starting or expanding your family -- lifestyle, career, living space…the list goes on. Arguably the financial component is near the top of the list. Most people planning for family know that it will impact their finances, but to what extent?

There are numerous planning considerations involved when starting or expanding your family -- lifestyle, career, living space…the list goes on. Arguably the financial component is near the top of the list. Most people planning for family know that it will impact their finances, but to what extent?

Using data compiled by the U.S. Department of Agriculture (USDA), the estimated cost for a married couple on the West Coast (with a combined income greater than $107,000) to raise two children would be a somewhat startling $775,620. Dig-in a little further, and the data suggests that around $166,000 would go towards education/child care. The family could also spend upwards of $110,000 on food alone.

The data and estimates are based on a study performed by the Department of Agriculture titled “Expenditures on Children by Families, 2015”. The USDA created a fascinating and free calculator that anyone can use to run the numbers for starting a family. You simply tell the calculator how many children you have or want, your income level, whether you’re single or married, and what region of the country you live in. And that’s it! The calculator does the rest.

Have a look and test some scenarios that may apply to your household:

USDA Child Expenditure Calculator

CNN Money created an alternate version of the calculator that is a bit more user-friendly, which you can find here:

Child Expenditure Calculator (CNN Money)

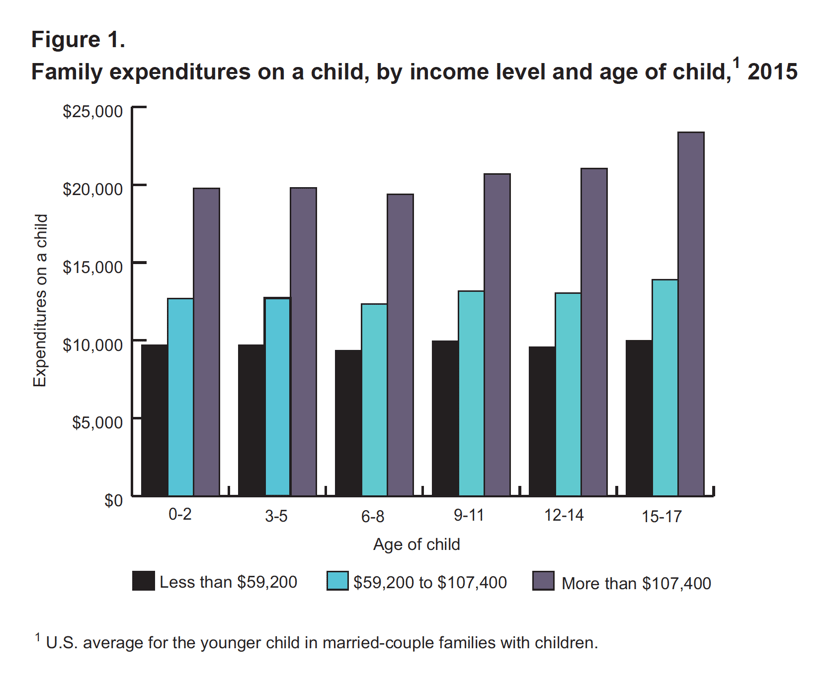

Many people using this calculator for the first time may find that the numbers feel a bit more elevated than expected. But when you consider that the average cost per year to raise a child is in the $20,000 range, it makes more sense. In the USDA chart below you can see the average family expenditures per child, sorted by income level:

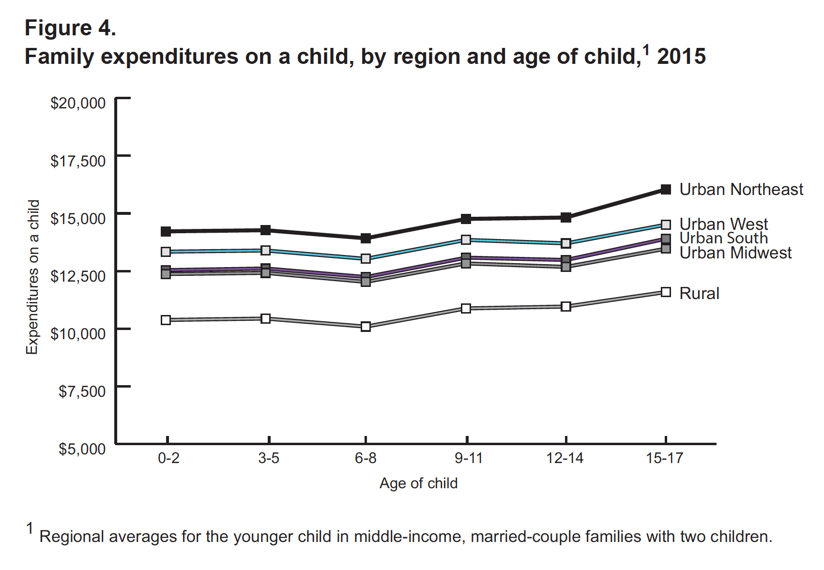

Here, you can see the costs per child sorted by region. Raising a child in an urban area can add a significant amount to the total cost over time:

Of course, these are just estimates and illustrations, but you get the idea here: having children is beautiful, life-changing, wondrous….and expensive. And anytime a facet of life – whether its having a child, planning for college, planning for retirement, buying a home, and so on, involves a meaningful financial commitment, it makes sense to include it in your financial plan.

That’s where WrapManager comes in.

Our main goal is to help our clients invest for the future, to reach long-term financial goals designed to help you attain financial security in retirement and perhaps even leave a legacy for your heirs. But getting there means making informed decisions over time about spending, saving, and budgeting, which also means ensuring you strike a balance between spending for your children’s needs and saving enough to reach your long-term objectives.

WrapManager can help.

The Wealth Managers at WrapManager can serve as your personal advisor to help you make those financial decisions and to find that balance. Reach out to us today to start the process and let us be your advocate as you plan your financial future. Call us today at 1-8000-541-7774 to get started, or send an email to wealth@wrapmanager.com.

Source: USDA