Investor education materials focused on retirement planning tend to try and answer the essential questions: how do you get yourself retirement-ready from a savings and investment standpoint? And, when are you planning to retire? These are the critical questions that define everything from how much you defer to your company retirement plan to how you structure your portfolio. In short, digging into these questions creates a solid foundation for retirement planning.

Investor education materials focused on retirement planning tend to try and answer the essential questions: how do you get yourself retirement-ready from a savings and investment standpoint? And, when are you planning to retire? These are the critical questions that define everything from how much you defer to your company retirement plan to how you structure your portfolio. In short, digging into these questions creates a solid foundation for retirement planning.

But the question missing from this foundation is arguably just as critical to the planning process, yet it often gets left out. That question is:

Where do you plan on retiring?

There are many factors to consider when deciding where to retire—proximity to family, quality of life (quality of golf courses), proximity to a major airport, cost of living, demographics, quality, and access to healthcare, and perhaps most importantly, taxes.

Finding the perfect balance of each factor is difficult, but not impossible! One idea would be to make a list of the factors that are most important to you versus those that matter less and then set about checking off the boxes on that list.

To that end, the website WalletHub has evaluated the best and worst states in which to retire, based on 31 key indicators examining affordability, health-related factors, and overall quality of life. You can check out their findings below with the darkest states being most retirement-friendly. You can review their entire findings in Best and Worst States to Retire -- and you can sort the rankings based on the criteria that matter to you most, like healthcare for instance.

The top 5 retirement states from the study were Florida (no surprise there!), Wyoming, South Dakota, Iowa, and Colorado, in that order.

When Taxes Matter Most…

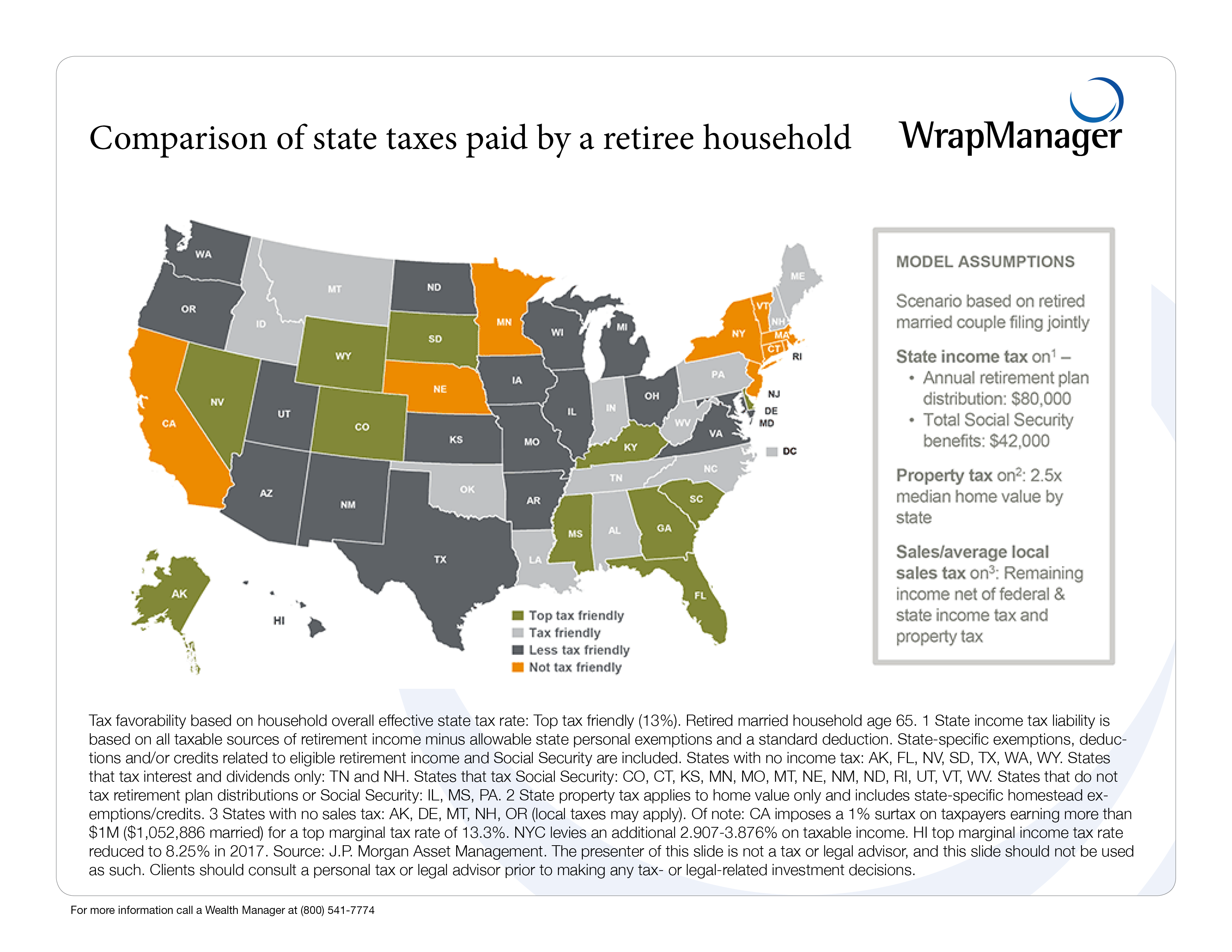

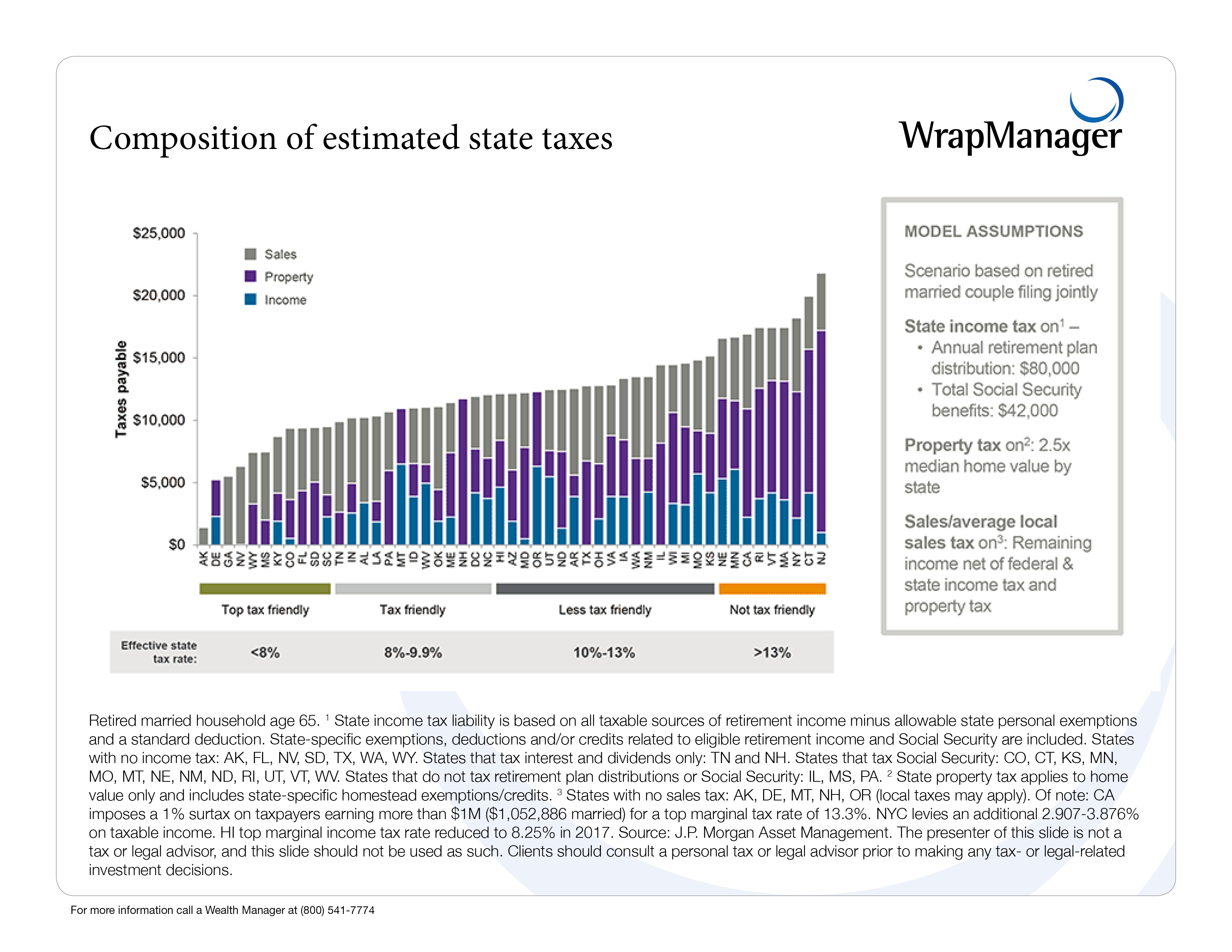

For many retirees, the ‘where to retire’ question gets answered by a single factor: taxes. J.P. Morgan analyzed each state by income tax (based on retirement plan distributions), potential taxes on Social Security, property taxes, and sales and local taxes. With that research, they produced two nifty graphics that paint a very clear picture of states that are the most tax-friendly versus those that are the least tax friendly. For many retirees, this tax treatment could greatly influence—or even determine—where to retire.

Green and Light Gray States are More Tax-Friendly… Dark Gray and Orange States are Less

This Graphic Breaks Down the Composition of Taxes for Each State

According to the data, Arkansas, Delaware, Georgia, Nevada, and Wyoming are the most tax-friendly states in which to retire, whereas New Jersey, Connecticut, New York, Massachusetts, and Vermont are the least tax-friendly.

Let’s Start the Conversation about Where to Retire

If you have never spoken with a financial advisor about the pros and cons of retiring in a certain area or a specific state, maybe now is a good time to start.

The Wealth Managers at WrapManager can work alongside you to research the benefits/factors you’re looking for in retirement, and we can analyze which locations may offer the best fit. Call us today to get started, at 1-800-541-7774 or start the conversation over email at wealth@wrapmanager.com.