The stock market overcame some volatility early in the year but continued to trend higher. As the market has reached new all-time highs, many investors are wondering if it’s too late to put additional cash to work. Others have indicated they’re still waiting for a possible stock market correction before making any decisions.

One thing remains clear – despite what happens in the market and when, it’s likely you still need your portfolio growing and generating retirement income over time.

There are two types of money manager strategies that could ease concerns about where the market’s headed while positioning your portfolio for a variety of outcomes. Tactical Money Manager Strategies are designed to temper the effects of a market decline while trying to capture growth, and Dividend Income Money Manager Strategies aim to generate income while reducing volatility.

Let’s take a look at both.

Dividend Income Strategies: Striving for Equity-Like Returns with Less Volatility

Dividend money manager strategies can help generate retirement income and help cushion your portfolio during market declines.

Research from dividend money manager Federated Investors, Inc. has shown that a portfolio of high dividend-paying stocks can:

1. Produce Attractive Total Returns

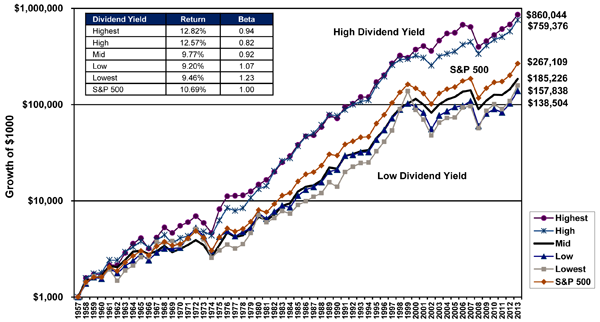

From July 1, 1996 to June 30, 2013, a high dividend paying stock strategy generated an average annualized total return of 10%, which is 2.78% higher than the 7.22% annualized return realized by the S&P 500.

Dividend Yield and Relative Performance (1957-2013)

(Click chart for larger version)

Source: Federated Investment Counseling, Jeremy Siegel, Future for Investors (2005), With Updates to 2013. Each stock in S&P 500 is ranked from highest to lowest by dividend yield on December 31st of every year and placed into “quintiles,” baskets of 100 stocks in each basket. The stocks in the quintiles are weighted by their market capitalization. The dividend yield is defined as each stock’s annual dividends per share divided by its stock price as of December 31st of that year. Beta is a measurement of an index’s trailing 36-month returns in relation to the appropriate market index. As of 12/31/13. This chart is for illustrative purposes only and is not representative of performance for any specific investment. Past performance does not guarantee future results.

2. Offer Lower Levels of Long-Term Volatility (measured by beta in the above chart)

Since high dividend-paying stocks produce some of their returns in the form of cash, they may also help cushion your portfolio’s downside when the broader market is posting losses.1

3. Generate Income in Your Portfolio

You can potentially use this income to help supplement – or even provide for – your retirement income needs.

Federated Investors’ Strategic Dividend Strategy

We currently recommend the Federated Strategic Value Dividend Strategy as a dividend money manager as appropriate to clients. The strategy’s objective is to provide a high level of current income, long-term capital appreciation driven by dividend growth and lower downside risk.2

Request more information about Federated Investors here.

Tactical Money Manager Strategies: Designed to Limit Portfolio Losses

Often, investors who are acutely focused on avoiding market declines will take an overly “protective” approach to investing, limiting the growth potential of their portfolios. Others feel they either have to be fully invested in the stock market or waiting on the sidelines. This is where tactical money manager strategies, designed to provide you with exposure to equities during good times, while maintaining the ability to go to cash or cash equivalents, could make sense.

One such tactical money manager is Newfound Research LLC. Their risk-managed strategies aim to “protect and participate,” and believe “risk management strategies that focus solely on protection will potentially lag so far behind in participation that the total return over a full market cycle will underperform a passive strategy.” They seek to protect on the downside, while participating in the upside.3

Newfound’s Risk-Managed Global Sectors

The Newfound Risk-Managed Global Sectors strategy is a tactical money manager strategy we recommend to clients when appropriate. It’s a 100% rule-based managed ETF portfolio that seeks to participate in the strong growth profile of a long-only, un-levered global equity portfolio while still protecting capital through rules that allow the portfolio to move to a 100% cash position.3

Request more information about Newfound Research here.

Next Steps: Evaluating and Adjusting Your Portfolio

A dividend-income strategy and a tactical strategy could make sense as part of your overall portfolio if you’re unsure about where the market is headed or concerned about your portfolio in the current market environment. These strategies should be used alongside other money manager strategies as part of your diversified investment portfolio.

If you would like for us to examine your portfolio to illustrate how adding a dividend-income and/or tactical strategy could benefit your portfolio, give one of our Wealth Managers at call at (800) 541-7774 or get started by answering a few questions here.

By Gabriel F. Burczyk

Gabriel is the President of WrapManager, Inc. and Chairman of WrapManger's Investment Policy Committee.

Sources:

2 Federated Investors

3 Newfound Research LLC

There are no guarantees that dividend paying stocks will continue to pay dividends. In addition, dividend paying stocks may not experience the same capital appreciation potential as non-dividend paying stocks.

Strategy descriptions listed represent a brief outline of the portfolio’s objective. There is no guarantee that any manager or product will be successful in achieving the objective described. The strategy used by the money manager listed is not suitable for all investors. This material does not represent a personalized recommendation and does not reflect individual investor’s risk and return goals nor does it serve as the receipt of, or a substitute for, personalized advice from WrapManager, Inc. or any other investment professional.