Many investors need to own fixed income in their portfolios to provide income and reduce volatility. But what percentage of fixed income is the ideal amount?

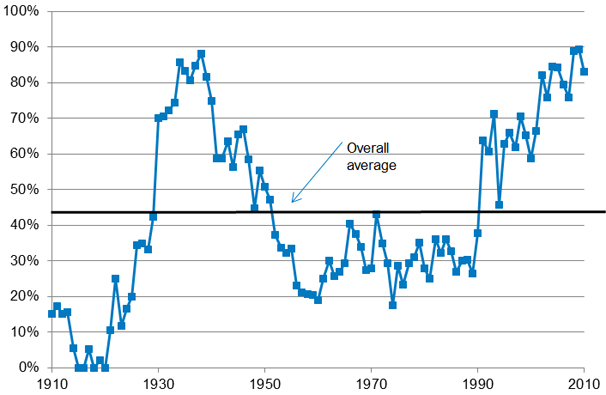

Research conducted by BlackRock suggests that the optimal allocation to bonds actually fluctuates widely over time. Since 1900, the average optimal allocation to bonds as shown in the chart has been about 43%. But as you can see below, there were long periods when owning more bonds made sense (when the blue line is above the overall average), as well as stretches where owning much less than 43% in fixed income was considered optimal, like in the 60’s, 70’s and 80’s.1

Average Optimal Allocation to Bonds

10-Year Periods, Using 1900-2010 Annual Data, Cross-Country Averages

(Click chart for larger version)

Source: BlackRock

Over the last 20 years, bonds have seen strong performance, even to the point of some experts referring to it as a “bond bubble.” Many market specialists have now concluded that the strong sell-off of bonds in 2013 marked the end of the bond bubble,1 and that the optimal allocation to bonds might start to decline again.

We’ve written about this before in our piece titled, “It's Time to Talk With a Financial Advisor About Your Fixed Income Strategy.” In that piece, we discuss the possibility of bonds underperforming going forward, and we urge investors to review their fixed income allocations with their financial advisors.

Finding Your Optimal Fixed Income Allocation

The data in the chart above is based purely on market returns, meaning an investor would have to time the fixed income market in order to get it just right. Much like with the stock market, this is very difficult to do, and investors that attempt to time the market can end up hurting themselves.

We believe your fixed income allocation should be based on your specific financial situation and goals. After all, fixed income is also about producing income and reducing volatility and risk in your portfolio over time, not just about delivering superior returns.

If you would like to speak with one of our Wealth Managers about your fixed income allocation and our outlook for the fixed income markets from here, please give us a call at 1-800-541-7774 today.

Source: