Let’s start with a more basic question: what is a tactical money manager? To answer that, an investor must first understand “tactical asset allocation,” which is an active management portfolio strategy that aims to capitalize on certain anomalies and/or events in the markets.

Let’s start with a more basic question: what is a tactical money manager? To answer that, an investor must first understand “tactical asset allocation,” which is an active management portfolio strategy that aims to capitalize on certain anomalies and/or events in the markets.

Many tactical money managers try to actively trade around such anomalies to gain a leg-up and produce what’s known as ‘alpha’ in a portfolio. Often times, the tactical money manager sees a situation in the market – whether it be bullish or bearish – and attempts to navigate a portfolio through it, with the aim of making a profit or avoiding a loss. In many cases, the manager may allocate back to the original asset mix once the ‘event’ passes, but not always.

Tactical asset allocation strategies sound great, but in some cases, they may not be additive of value simply for being tactical by design. For instance, in years like 2017 when the market has risen steadily and strongly, there may not be much use for trying to trade in-and-out of the markets to capitalize on anomalies. In a year when the market does well with little volatility, it may just be better to stay put.

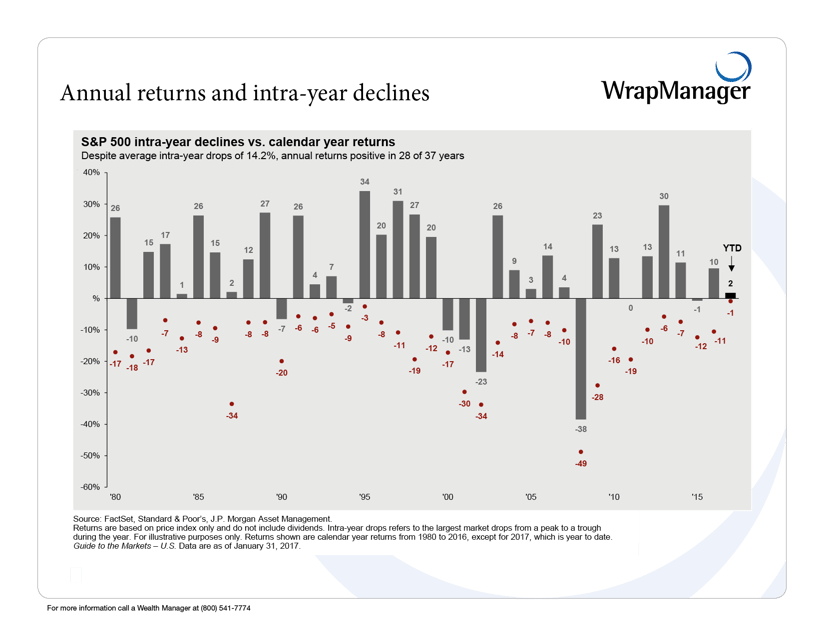

However, years like 2017 are pretty rare. Check out the J.P. Morgan graphic below that shows S&P 500 returns dating back to 1980. The graphic shows year-end returns for each year (gray bars), but also shows how much the market pulled back during the year (red dots). As you can see, the market has not declined less than 3% in a given year since 1995. And 1995 and 2017 mark the only years of the last 37 where the market has not declined at least 5%. A year with little downside volatility is rare based on historical data, the market could very well return to its old ways soon.

In other words, in certain periods, having a tactical money manager in a diversified portfolio could make sense, potentially adding some value.

Where Can You Find Tactical Money Manager Strategies?

Many of the money managers WrapManager works with offer tactical money manager strategies. That said, not all investment strategies work in the best interest for all investors.

That’s why WrapManager helps qualified investors with $500,000+ in investable assets define their investment goals, and then we create an investment portfolio that will help you achieve those goals.

If you are interested in getting more information on tactical money manager strategies that could benefit your portfolio, we can spend time with you discussing their investment philosophies, performance and benchmarks.

Not All Tactical Money Managers are Created Equal

Research is a critical part of investment management and there is plenty to learn about a money manager before you decide to hire them. WrapManager is here to essentially do that research for you, and to serve as a sounding board as you evaluate your options and ultimately make your decisions. Partner with us as you conduct due diligence by calling 1-800-541-7774 or sending an email with your questions or requests to wealth@wrapmanager.com.

Source:

JP Morgan