There’s a popular saying that people often use to characterize or describe human behavior: “we are our own worst enemies.” This phrase probably wasn’t created with the original intent of describing investor behavior, but one thing’s for sure—it often hits the nail on the head.

There’s a popular saying that people often use to characterize or describe human behavior: “we are our own worst enemies.” This phrase probably wasn’t created with the original intent of describing investor behavior, but one thing’s for sure—it often hits the nail on the head.

You have probably read before that investors’ emotions often get in the way of sound long-term decision making. During times of pronounced market volatility or downturns, investors often get worried (understandably) about sustaining too many losses, and they will alter their long-term strategy as a result. In other words, experiencing declines in the market often leads to the feeling of needing to “do something to stop the losses,” which means making knee-jerk reactions.

Research shows, however, that those knee-jerk reactions can cost investors quite a bit over the long-term.

Why Investors Tend to Underperform

In their 2016 study “Quantitative Analysis of Investor Behavior,” the research firm DALBAR found that in 2015, the average equity mutual fund investor underperformed the S&P 500 by a margin of 3.66%. Their research showed that while the S&P 500 notched a modest gain of +1.38% that year, the average equity mutual fund investor actually saw losses of -2.28%.

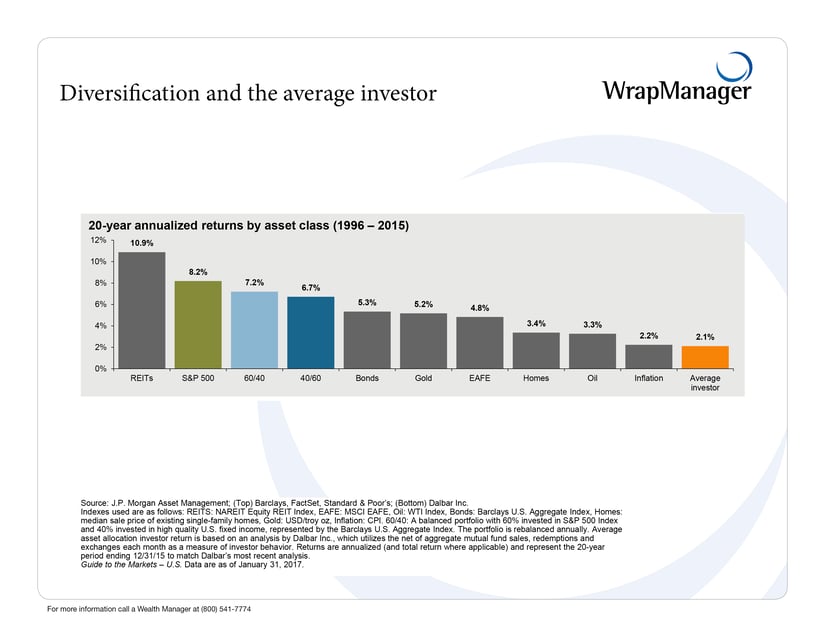

Looking over a longer stretch of time, the result unfortunately remains the same: the average investor tends to underperform. In a 20-year period ending 2015, the 20-year annualized return for the S&P 500 was +8.19% while the 20-year annualized return for the average equity mutual fund investor was a much lesser +4.67%. This means the average equity mutual fund investor was underperforming by 3.52% on an annualized basis. For many retirees, that can mean hundreds of thousands of dollars over a 20-year period.1

J.P. Morgan took this data from DALBAR and created this graphic to illustrate what this means for investors:

DALBAR’s analysis found that the #1 cause of this under performance was…you guessed it…investor behavior.1

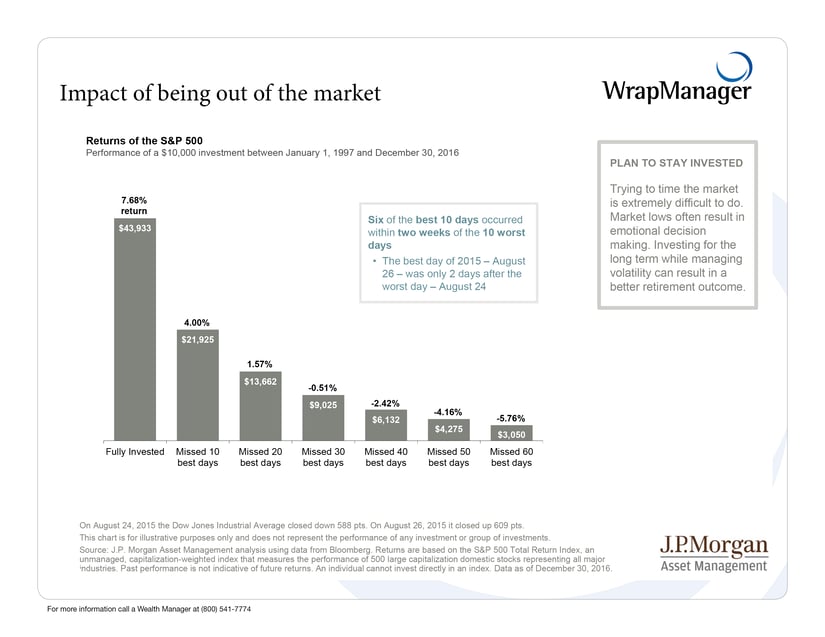

Whether it is from trying to time the market, not adequately diversifying a portfolio, or some other reason, the research suggests that investors are often their own worst enemies. J.P. Morgan has another telling graphic (below), illustrating how different the results are for an investor that simply remains invested—through good times and bad—versus other outcomes where the investor is out of the market for whatever reason. The results here speak for themselves: the investor who resisted trying to time the market and simply stayed invested—which meant staying invested through the tech bubble and the Great Recession—did just fine:

The Next Time Volatility Sets-In, Remember This

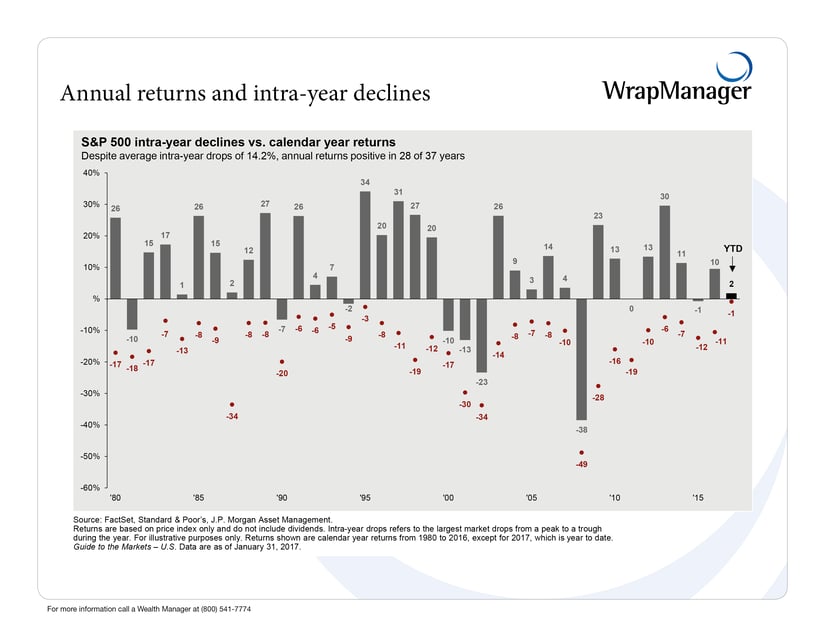

When it comes to volatility, it’s not a matter of if—it’s a matter of when. Over the last 37 years, the S&P 500 has suffered average intra-year declines of 14.1%. Last year, there was a market correction of about -11%, yet the S&P 500 finished about +10% higher.

Experiencing downside volatility comes with the territory of being an investor, but often times it is just a temporary condition that tempts investors to make a mistake—when the best course of action is to just stay the course.

In his most recent Annual Letter to Shareholders of Berkshire Hathaway, legendary investor Warren Buffet sums it up succinctly:

"During such scary periods [referring to market panics], you should never forget two things: First, widespread fear is your friend as an investor, because it serves up bargain purchases. Second, personal fear is your enemy. It will also be unwarranted. Investors who avoid high and unnecessary costs and simply sit for an extended period with a collection of large, conservatively-financed American businesses will almost certainly do well.”2

Wise words, indeed. In Buffet’s terms, this means if you have a diversified portfolio consisting of strong companies and/or highly rated bonds, the smart approach to success is simply this: to give your investment portfolio the benefit of the long-term.

To learn more about common financial behaviors and what to do when the stock market gets volatile give us a call at 1-800-541-7774 or contact us here to get in touch with one of our Wealth Managers.

Sources:

1. DALBAR’s 22nd Annual Quantitative Analysis of Investor Behavior

2. Berkshire Hathaway Annual Letter to Shareholders 2.24.17