The traditional arch of a person’s financial life is generally to work, save, retire, collect Social Security and/or pension, and make withdrawals from IRAs/investment accounts to supplement retirement income. It’s a traditional arch, but it is also a steadfast one.

The traditional arch of a person’s financial life is generally to work, save, retire, collect Social Security and/or pension, and make withdrawals from IRAs/investment accounts to supplement retirement income. It’s a traditional arch, but it is also a steadfast one.

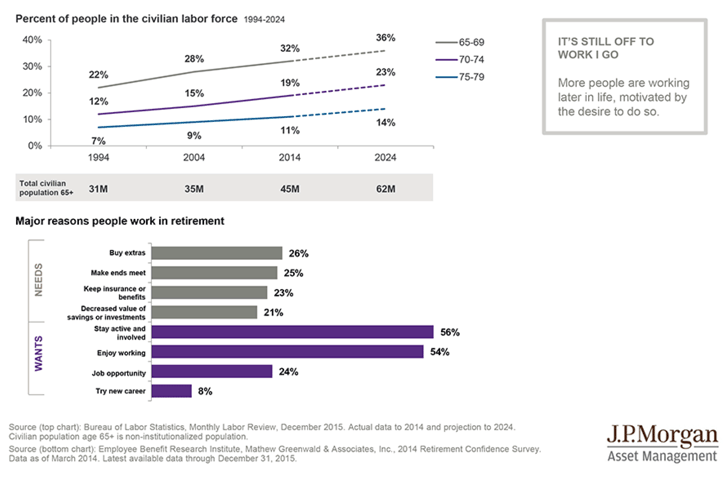

However, did you know that you could actually continue working and collect Social Security at the same time? There are rules and stipulations for doing so, which we will get into below, but the short answer is that you can! This is good news, particularly given that an increasing percentage of people are choosing to work later into life, for a variety of reasons but mostly because they enjoy working and want to stay involved:

If you are one of these people who is – or has the desire to be – working later in life, then you should be aware of some of the rules for collecting Social Security while making an income. Knowing the rules could influence how much you work, and whether triggering Social Security payments is a good idea.

How Work Affects Your Social Security Benefits

The first step is to know your “full retirement age,” which generally speaking is between age 65 and 67, depending on what year you were born. To run a quick calculation, simply use the retirement age calculator provided by the Social Security Administration.

If you’re at or older than full retirement age, then you can rest easy – you are eligible to collect your full Social Security benefit no matter what your earned income is. However, if you’re younger than the current retirement age and earn more than certain amounts, your benefits will be reduced, but not permanently! According to the Social Security Administration, your benefit will increase at your full retirement age to account for benefits withheld due to earlier earnings.

The key calculation made by the Social Security Administration is:

- If you’re younger than full retirement age and working during all of 2017, and you claim Social Security, they will deduct $1 from your benefits for each $2 you earn above $16,920.

- If you reach full retirement age during 2017, they will deduct $1 from your benefits for each $3 you earn above $44,880 until the month you reach full retirement age.1

Here’s how it works, as taken directly from the Social Security Administration (SSA): say you file for Social Security benefits at age 62 in January 2017, and your payment will be $600 per month ($7,200 for the year). During 2017, you plan to work and earn $22,000 ($5,080 above the $16,920 limit). The SSA would withhold $2,540 of your Social Security benefits ($1 for every $2 you earn over the limit). To do this, [they] would withhold all benefit payments from January 2017 through May 2017. Beginning in June 2017, you would receive your $600 benefit and this amount would be paid to you each month for the remainder of the year. In 2018, [they] would pay you the additional $460 withheld in May 2017.

In another example, say you weren’t yet at full retirement age at the beginning of the year, but reach it in November 2017. You earned $45,900 in the 10 months from January through October. During this period, we would withhold $340 ($1 for every $3 you earn above the $44,880 limit). To do this, we would withhold your first check of the year. Beginning in February 2017, you would receive your $600 benefit, and this amount would be paid to you each month for the remainder of the year. In 2018, [they] would pay you the remaining $260 withheld in January 2017.1

Social Security Can be Complicated – Reach Out to WrapManager for Help

There are other stipulations people need to be aware of, such as what to count as income/earnings and whether your spouse’s income factors into the equation. Sorting through the morass of Social Security and taxes can be exhausting. That’s why we would encourage you to reach out to a Wealth Manager here at WrapManager if you have questions or want to discuss your retirement income strategy. We’re here to help.

Reach out to us today at 1-800-541-7774 or start a conversation over email at wealth@wrapmanager.com.

Source: