The recent pullback in global stock markets has caused some concern that the bull market in equities is winding down. There is even some concern that this pullback is among the initial signs of an upcoming recession.

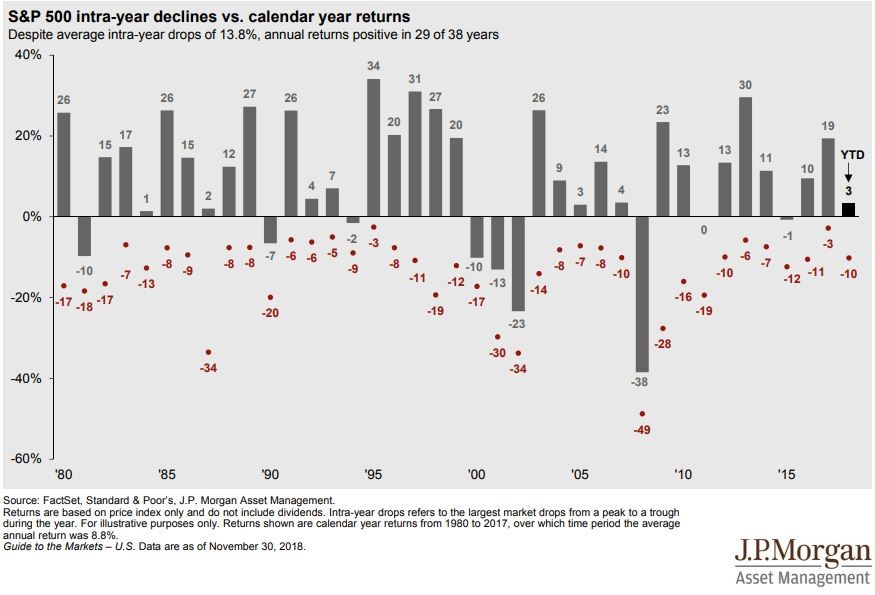

To gain some better historical perspective on the recent movement in the stock market, let’s take a look at historical intra-year market declines versus calendar year returns.1

Since 1980, the S&P 500 has dropped 13.8% from peak to trough during an average year. Despite the fact that there is a 13.8% decline in the market in an average year, the S&P 500 has posted positive returns in 29 of the past 38 years. A pullback like the one we’re experiencing right now is not at all unusual nor is it necessarily a sign of an upcoming recession.

A Long-Term Approach

During this sell-off it may be tempting for investors to ask themselves the question, “is now a good time to sell all of my equities and go into cash?” A better question to ask would be “is my long-term allocation between stocks and bonds (and cash) appropriate for me?”

Remember that pullbacks like we’re experiencing now have historically occurred just about every year. If the recent volatility is too much to bear, an investor could consider making an adjustment to their long-term allocation by having a greater bond exposure and a reduced equity exposure. This is a long-term approach that can help the investor’s peace of mind not only now but during inevitable future market downturns.

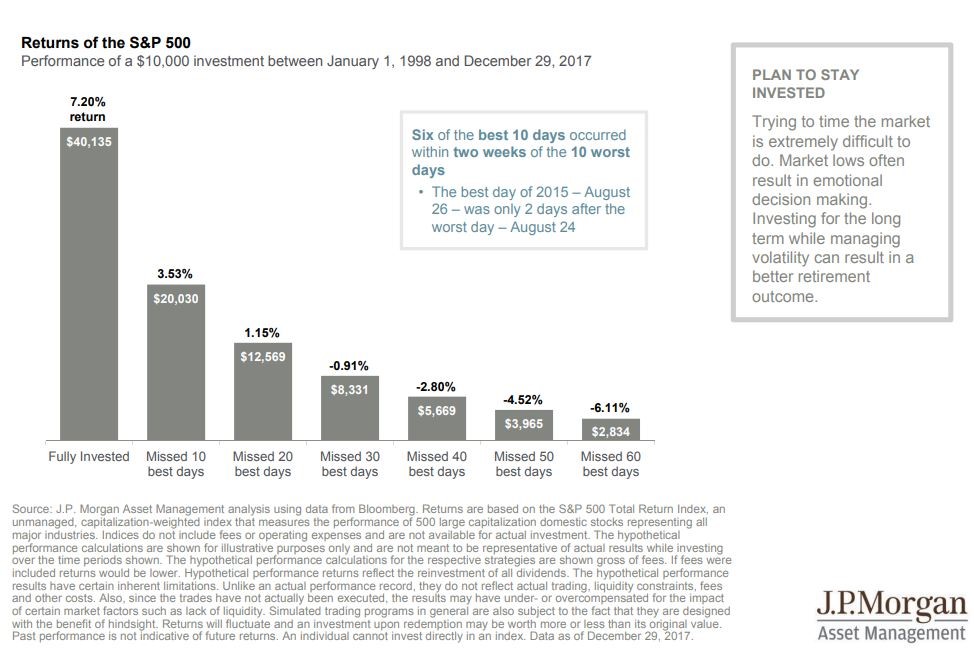

A short-term approach to timing the market and panic-selling out of equities and into cash can be full of pitfalls. Markets can sometimes rebound quite quickly from sell-offs, leaving the potential for a market timer to experience downside and little to none of the recovery.

As illustrated below, being out of the market can lead to the possibility of missing out on the best days of returns. For example, the best day of 2015 was only 2 days after the worst day of 2015. An investor who took a short-term market timing approach and sold out of equities following the worst day of 2015 would’ve missed out on the best day of the year. 2

Remember, to successfully time the market an investor would need to predict the correct exit point and the correct re-entry point. Repeating this process every year during every pullback will almost certainly hurt returns over time. A better plan of action is to develop a long-term allocation that an investor is comfortable with. A proper allocation can help investors endure the inevitable pull backs in the market without playing a guessing game about upcoming short-term movements in equity markets.

But is a Recession Imminent?

Another question investors may be asking themselves is “Shouldn’t I sell equities with a recession possibly right around the corner?” There are currently few warning signs of a recession looming on the horizon.

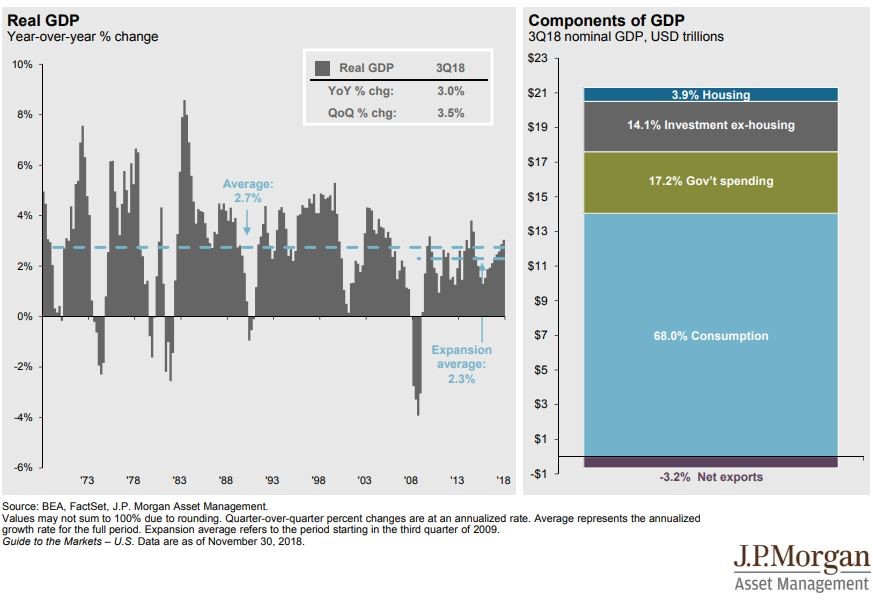

GDP growth is still healthy3:

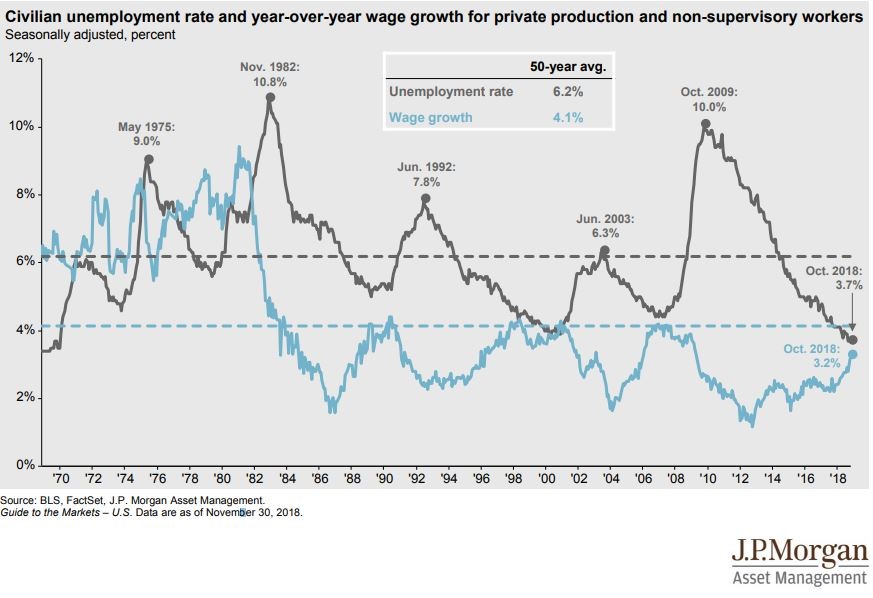

Unemployment is near historical lows4:

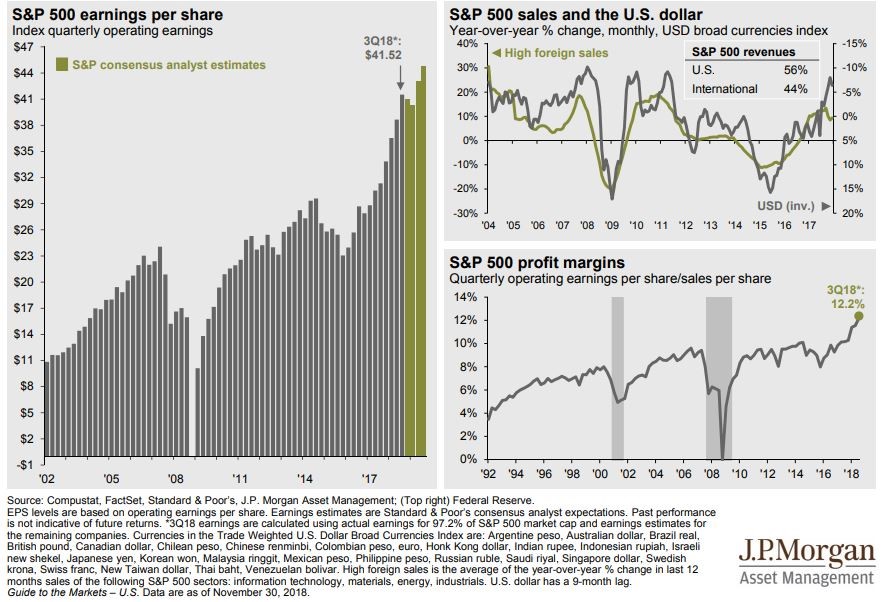

Corporate earnings remain very strong5:

While it is certainly possible that GDP growth could slow in 2019, it seems unlikely that it would go from 3% year-over-year growth to negative growth in the near future given the overall strength of the economy.

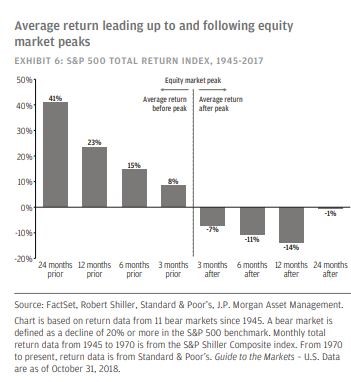

A market-timing investor who tries to sell out of equities in front of a recession can run the risk of selling too early. Over the last 11 bear markets since 1945, the 12 months preceding the market peak, the S&P 500 has returned an average of 23% in the year before the peak6.

Again, a long-term approach with the right allocation between stocks and bonds can give the investor the ability to withstand challenging market environments in the future with greater peace of mind.

For long-term investors, possibly the biggest risk they face is a self-inflicted error such as panic selling during a market pullback when the underlying fundamentals are strong. While past performance is not indicative of future results, long-term investors should not base their investment decisions solely on short-term volatility.

About the Author: A member of the WrapManager Investment Policy Committee, Doug Hutchinson, CFA® is responsible for developing and refining our money manager due diligence and review standards. He is also responsible for monitoring and evaluating current and prospective money managers.

Doug graduated from the University of California, Santa Barbara with a BA in Business Economics. He is a CFA® Charterholder and an active member of the CFA® Society of San Francisco.

Sources:

1 JPMorgan Guide to the Markets as of November 30, 2018, Page 14

2 JPMorgan 2018 Guide to Retirement, Page 40

3 JPMorgan Guide to the Markets as of November 30, 2018, Page 19

4 JPMorgan Guide to the Markets as of November 30, 2018, Page 24

5 JPMorgan Guide to the Markets as of November 30, 2018, Page 7

6 JPMorgan The Investment Outlook for 2019, Page 9