You’ve arrived at (or are fast approaching) retirement and you’ve worked hard to get here. Congratulations! We’ve prepared a list of items to consider and take care of to start your retirement with confidence. Think about this new stage in two ways:

You’ve arrived at (or are fast approaching) retirement and you’ve worked hard to get here. Congratulations! We’ve prepared a list of items to consider and take care of to start your retirement with confidence. Think about this new stage in two ways:

1) Defining your goals and establishing all the great things you want to do; and,

2) Structuring your financial life so you can make it all happen

Just a little bit of time and planning can help make your retirement even more enjoyable and smooth.

Retirement Planning Strategy: 13 Steps for Success

1) Build an Investment Plan with Your Financial Advisor

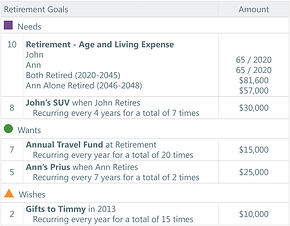

An investment plan is your ultimate guidebook for retirement – the roadmap you can reference to see where you are on your retirement journey and to help you navigate issues that arise along the way. A comprehensive investment plan should include the following features:

-

A snapshot of your complete financial picture: investment accounts, assets, liabilities, goals, future expenses, and estate planning needs/desires

Example Plan

(Click image for larger version)

Source: Money Guide Pro

-

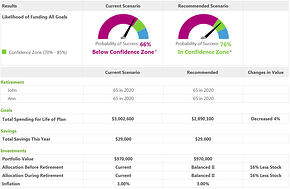

Help you determine the amount of growth and appropriate asset allocation needed to reach your goals

-

Projects the probability of achieving your goals

-

Changes with you: How will your progress be affected if you decided to buy a second home in 5 years or make a large charitable donation?

Investment Plan Example Result Summary

(Click image for larger version)

* The Confidence Zone is the range of probabilities that you and your advisor select as your target range for the Probability of Success result in your Plan. Source: Money Guide Pro

2) Establish a Retirement Income Plan

A financial advisor can help you determine and maximize your various retirement income streams, such as social security, pension elections and investment account withdrawals. Equally important is deciding which accounts to withdraw from first.

3) Maximize and Optimize Your Social Security Benefits

How and when you elect to take Social Security can significantly affect the total payout you receive. Discuss with your Financial Advisor about when to claim your benefits, and assess the pros and cons of delaying benefits for you and/or your spouse. Strategies to consider:

4) Rollover Your 401(k) and Consolidate Investment Accounts

Consolidating your investment accounts in one place can have many benefits, two of which include potentially lower fees and additional transparency.

-

Online access can provide you a full view of your investment accounts in one place

- Click here for additional benefits of consolidating your investment accounts

5) Assess Your Options for Pension Election

Deciding whether to take your pension in a lump sum, or over time with periodic distributions, depends on a variety of factors such as your life expectancy and whether there is a spousal benefit. Work with your financial advisor to adjust your investment plan to see which option makes more sense.

6) Designate/Update Beneficiaries for Your Assets and Accounts

Make sure your assets are passed along to heirs the way you want them to be.

-

Review beneficiary designations at least annually and with major life events

-

Explore different beneficiary designation options, such as “Per Stirpes”

-

Consider adding the "Transfer on Death" (TOD) designation to your taxable accounts

7) Know Your Expenses and Cash Flow Needs

Creating a comprehensive list of your monthly and annual expenses will help determine your cash flow needs. Click here to find a list of common expenses to consider.

8) Address Your Debt and Liabilities

Does it make sense to pay off certain debts and free up your cash flow? Have your financial advisor run a cost-benefit analysis of paying off debt at once versus over time. Any time you are considering a purchase that could mean taking on more debt, run it through your investment plan first to measure the financial impact.

9) Decide Which Accounts to Tap First for Income

Research has shown that in many cases it could make sense to tap your tax-deferred accounts first before spending your taxable assets.1 Your financial advisor should structure your retirement income plan based on the types of accounts you have, your tax situation, and the level of cash flow you need. Read more about this here.

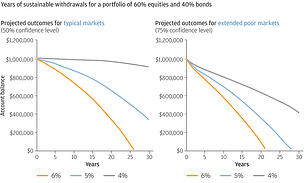

10) Be Careful with your Withdrawal Rate

Withdrawing a fixed percentage each month or year from your investment portfolio could be harmful, since that strategy doesn’t take into account varying market conditions. If the market exhibits weakness, and you continue making regular withdrawals during that time, the depletion effect on your portfolio is compounded. As such, if the market weakens it could make sense to reduce your distributions to lessen the impact:

Effects of Traditional Withdrawal Rates on a Balanced Portfolio

(Click chart for larger version)

Source: JP Morgan Asset Management. These charts are for illustrative purposes only and must not be used, or relied upon, to make investment decisions. Hypothetical portfolios are composed of US Large Cap for equity and US Aggregate for fi xed income with projected compound returns projected to be 7.50% and 4.25%, respectively. J.P. Morgan’s model is based on J.P. Morgan Asset Management’s (JPMAM) proprietary long-term capital markets assumptions (10 – 15 years). The resulting projections include only the benchmark return associated with the portfolio and does not include alpha from the underlying product strategies within each asset class. The yearly withdrawal amount is set as a fi xed percentage of the initial amount of $1,000,000 and is then infl ation adjusted over the period. Allocations, assumptions and expected returns are not meant to represent JPMAM performance. Given the complex risk/reward trade-offs involved, we advise clients to rely on judgment as well as quantitative optimization approaches in setting strategic allocations. References to future returns for either asset allocation strategies or asset classes are not promises or even estimates of actual returns a client portfolio may achieve.

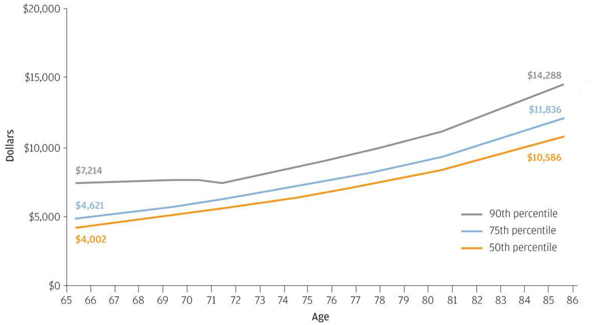

11) Review Your Healthcare and Medicare Options

Healthcare costs generally increase over time, and in some cases can account for the biggest share of spending during retirement. It is important to choose a healthcare plan for you and your spouse that is comprehensive and cost efficient.

-

Learn more about Traditional Medicare (Parts A & B), and Medicare Parts C & D

-

Make sure your advisor factors in long-term expenses associated with health care into your investment plan

-

Consider a Long-Term Care Insurance plan to help supplement potential health care expenses later in life

Estimated Annual Out-of-Pocket Health Care Costs for a 65-Year-Old Retiring in 2014

(Click chart for larger version)

For illustrative purposes only. Source: JP Morgan Asset Management, Employee Benefit Research Institute (EBRI), January 17, 2014. Based on national average cost estimates for Medicare Parts A, B, D and Medigap Plan F. EBRI derived inflation estimates from US CBO estimates. On average, health care costs are estimated to increase 5.0% for the 50th percentile, 4.8% for the 75th percentile and 3.5% for the 90th percentile. Vision, dental and long-term care expenses are not included. Assumes continued implementation of the Patient Protection and Affordable Care Act. The costs at 90th percentile actually dip down in 2019 due to the implementation of the Medicare prescription drug “donut hole” being filled in as applied to Medicare prescription drug costs.

12) Beware of being too Conservative or Aggressive

Many investors starting retirement mistakenly become too conservative with their investment portfolios. The issue is that people are living longer, and in some cases cash flow needs rise later in life. Additional growth is often needed to keep up with cash flow needs and to outpace inflation.

On the other hand, being too aggressive could mean you’re not diversified enough, or are taking too much risk. To find the middle ground, your asset allocation should be dynamic and based on your comprehensive investment plan.

13) Create an Estate Plan with Necessary Documents

These can help you make sure that your hard-earned money is distributed as you wish. Be sure to discuss your estate plans with your family so everyone is on the same page and there are no surprises. If you don’t have a will or trusts set up already, consult an attorney and consider discussing your plans with a Certified Financial Planner to establish the best course of action for getting your documents and accounts in order.

Have a Wealth Manager Walk Through Each Step With You

Our Wealth Managers can help you with each phase of the retirement planning process and build a comprehensive investment plan for you. Get started by answering a few questions here. You can alsocontact us at 1-800-541-7774 or Wealth@wrapmanager.com.

By Gabriel F. Burczyk

Gabriel is the President of WrapManager, Inc. and Chairman of WrapManger's Investment Policy Committee.

Sources:

To the extent this presentation includes any state or federal tax advice, the presentation is not intended or written by WrapManager, Inc. to be used, and cannot be used, for the purpose of avoiding federal tax penalties. WrapManager, Inc. does not advise on any income tax requirements or issues. Use of any information presented by WrapManager, Inc. is for general information only and does not represent tax advice either express or implied. You are encouraged to seek professional tax advice for income tax questions and assistance.