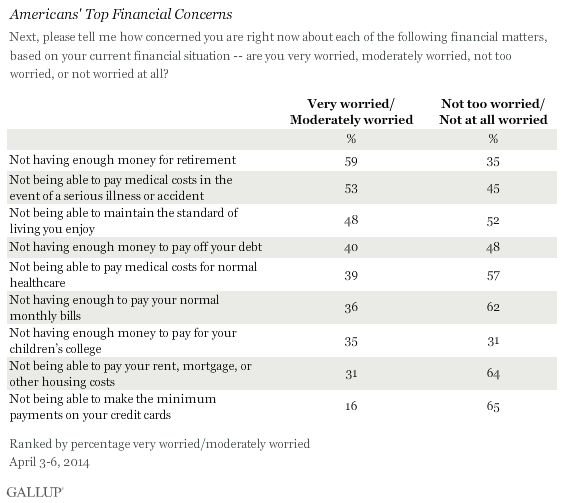

According to an April 2014 Gallup poll, 59% of Americans are concerned their nest egg is not big enough to last them through retirement. A majority (53%) is concerned about not having enough to pay medical costs in the event of a serious illness or accident, and (48%) wonder about their ability to maintain the same standard of living throughout retirement.

Thankfully good retirement income planning can help alleviate these concerns, and even help prevent them from happening in the first place.

Addressing Your Retirement Income Planning Needs in 2 Steps

Step 1: Discover if Your Nest Egg is Big Enough

First thing’s first – you have to test whether your sources of retirement income (investment portfolio, Social Security, rental properties, annuities, etc.) can meet your cash flow needs throughout your lifetime.

What to do today: Create an investment plan with your financial advisor. Share a comprehensive list of your assets with your financial advisor, and work with him or her to discuss and to map out how much you think you’ll need in each year of retirement. Include estimates for unforeseen expenses and emergency cash buffers.

What your financial advisor should do: Analyze the probability of you having enough money to last through retirement and to maintain the standard of living you want. The investment plan can show you how on-track you are, while showing potential areas for improvement to increase your probability of success.

Step 2: Make Adjustments to Improve Your Investment Approach

Whether it involves spending less, saving more or investing in more income-producing assets as found through a dividend-income strategy, your financial advisor and the investment plan can provide you with suggestions to improve your financial situation.

To find out whether your retirement income strategy is sound enough to meet your cash flow needs over time, call one of our Wealth Managers today at 1-800-541-7774. You can also get started on your investment plan by answering a few questions here.