Recent stock market volatility has given way to renewed curiosity over when the Federal Reserve (Fed) will start to raise interest rates in the U.S. A recently released poll by the National Association of Business Economics showed that just 37% of surveyed economists believed the Fed would hike rates in September, meaning that a majority of those surveyed think it will come even later in the year (if not next year).1

The question on many investors minds, however, isn’t so much when the Fed will start to raise interest rates, but how it will affect the economy and the stock market.

Theoretically, as the Fed starts to raise interest rates, it becomes incrementally more costly for businesses and individuals to borrow money—meaning that economic activity could feel some headwinds over time. Investors often worry that rising interest rates could thus mean choking off the already fragile economic expansion, and that a slowing economy could mean falling stock prices.

History Shows that Rising Interest Rates Doesn’t Necessarily Mean Falling Stock Prices

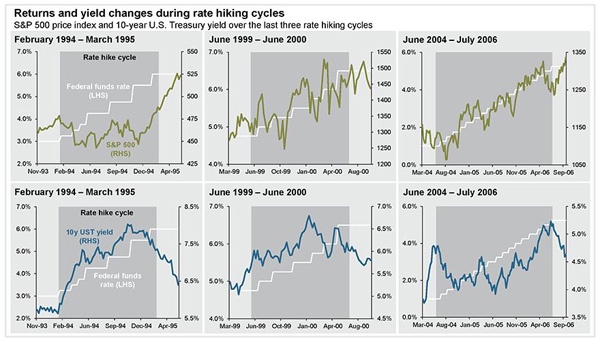

But history tells us that the opposite’s been true in previous interest rate hike cycles. As you can see in the top row of the chart below (green lines), during the last three rate hiking cycles the S&P 500 has actually risen!To be sure, rising stock prices didn’t come without a good deal of volatility along the way, but start-to-finish stocks delivered positive performance even as the Fed raised interest rates. In other words, the possiblity of the Fed raising interest rates in September or later should not automatically spell doom for investors. In fact, if history serves as an indication, it could be a good thing! Economic growth has also been able to withstand past interest rate hikes. From March 1994 to March 1995 (while the Fed was raising rates), U.S. GDP grew from 9.75 trillion to 10.09 trillion. From June 1999 – June 2000 that figure grew from 11.96 trillion to 12.59 trillion, and from June 2004 – June 2006 it expanded from 13.71 trillion to 14.59 trillion.2 The thinking that rising interest rates is bad for the economy does not necessarily hold water here either.

As for bonds, yields rose in each of the three past rate hike cycles, meaning that bond prices were generally falling over the same period. This past trend is something fixed income investors should keep in mind as the Federal Reserve starts to raise interest rates in the near future, as it could mean making some adjustments to the fixed income portion of your investment portfolio.

What if the Fed Delays Raising Interest Rates This Year?

When it comes down to it, the Fed faces a tricky position with interest rates. Recent volatility, low inflation (PCE inflation was 1.2% year-over-year through July, well below the Fed’s 2% target), a stronger dollar, downward pressure on commodities prices, and weak wage growth could indicate that the economy is a bit too fragile to face a rate hike.3 The market may prefer the Fed to wait. But, if they don’t and we see a rate hike this year, at least history suggests it does not necessarily spell doom for stocks.Is Your Portfolio Positioned for Rising Interest Rates? Ask a Wealth Manager

No one can say for sure when the Federal Reserve will start to raise interest rates, but the general consensus—and according to the Fed itself—is that interest rate increases are likely to come in the not-too-distant future. Whether that means one month or six months from now is impossible to know.

Regardless, we think it makes sense for investors to take steps today to prepare investment portfolios for rising rates. While past performance isn't necessarily indicative of future results, our Wealth Managers would be happy to review your portfolio to make suggestions on potential adjustments you can make to position your assets for a rising rate environment—just give us a call at 1-800-541-7774 or contact us here to get started.

Sources:

2. Multpl