Over the last few months, a string of global events have tested the markets. Whether it’s the spread of Ebola, the presence of terrorist group ISIS in Iraq and Syria, or the latest in the geopolitical chess match between Russia and the West, it seems there is no shortage of events that could impact the markets and your portfolio.

Over the last few months, a string of global events have tested the markets. Whether it’s the spread of Ebola, the presence of terrorist group ISIS in Iraq and Syria, or the latest in the geopolitical chess match between Russia and the West, it seems there is no shortage of events that could impact the markets and your portfolio.

The natural question on many investors’ minds is: will these events affect the upward market trend and is it time to adjust my portfolio?

Economic Growth Outlook Remains Positive

For all the noise and market volatility these world events may cause in the short-term, it’s likely that they are just that – noise. It’s normal for events like these to affect the market in the short-run, creating blips in an otherwise upward-trending market. Over the longer-term, however, the market tends to move on economic fundamentals and corporate earnings growth, and the outlook for both remains positive.

The IMF predicts global growth of 3.85% next year,1 and US corporate earnings growth is expected to grow in the fourth quarter and in the first half of 2015. Research firm Factset notes that analysts expect Q4 2014, Q1 2015, and Q2 2015 earnings growth of 5.2%, 7.2%, and 8.4%, respectively, with revenue growth of 2.6%, 3.2%, 2.6% over the same period.2 This is positive momentum that could carry over into the stock market.

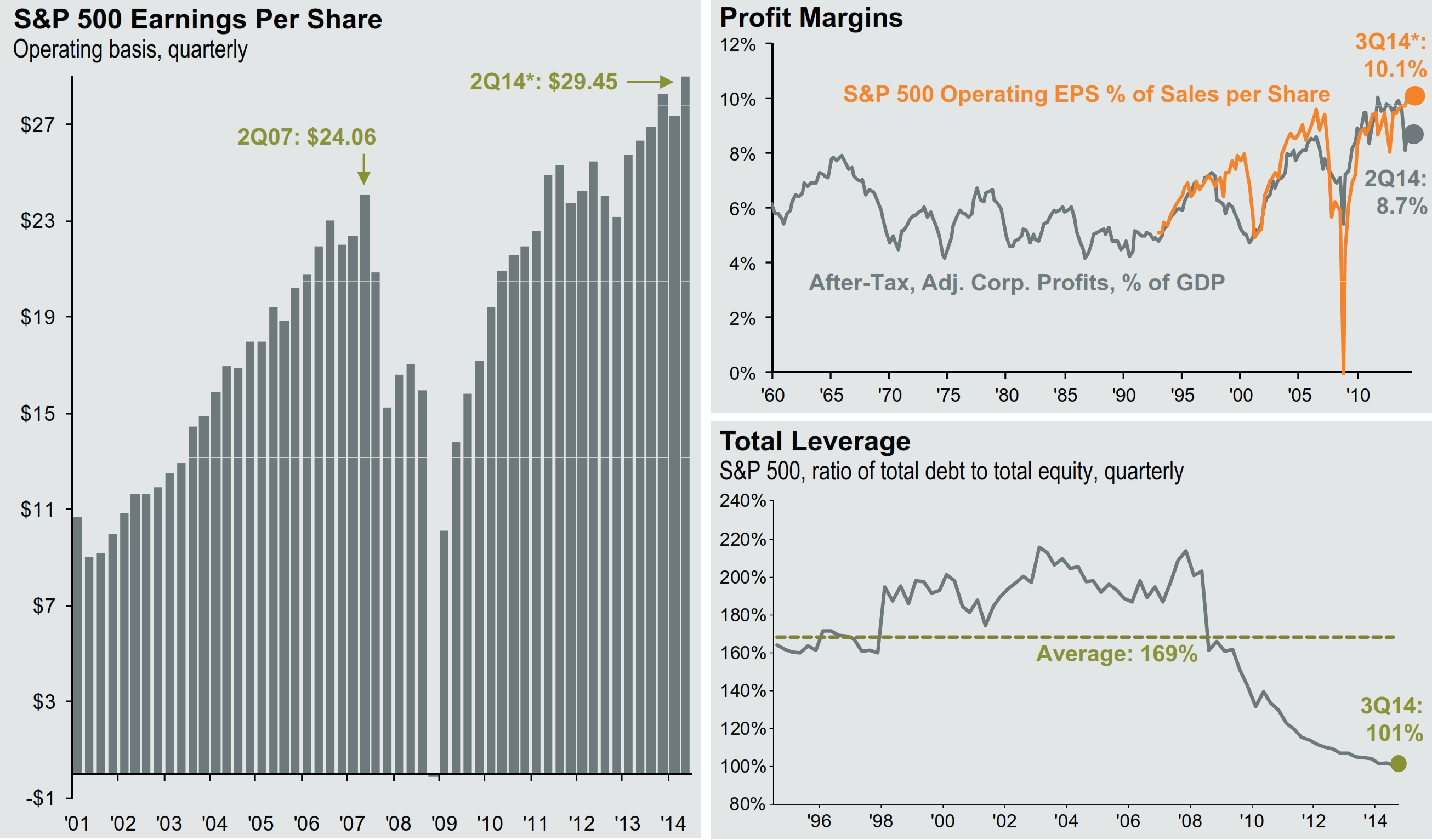

Earnings and Profit Margins are Rising, and Corporations are Holding Less Debt

(Click Chart for Larger Image)

Source: BEA, Standard & Poor’s, Compustat, J.P. Morgan Asset Management. EPS levels are based on operating earnings per share. *Most recently available data is 2Q14 as 3Q14 is a Standard & Poor’s preliminary estimates. Past performance is not indicative of future returns. Guide to the Markets – U.S. Data are as of 9/30/14.

Source: BEA, Standard & Poor’s, Compustat, J.P. Morgan Asset Management. EPS levels are based on operating earnings per share. *Most recently available data is 2Q14 as 3Q14 is a Standard & Poor’s preliminary estimates. Past performance is not indicative of future returns. Guide to the Markets – U.S. Data are as of 9/30/14.

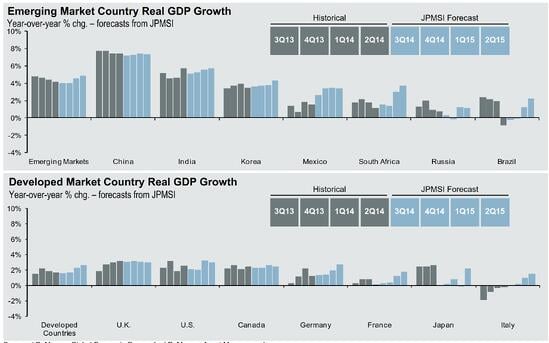

Global GDP Growth is Expected in 2015 Across Many Developed and Developing Countries

(Click Chart for Larger Image)

Source: J.P. Morgan Global Economic Research, J.P. Morgan Asset Management. Forecast and aggregate data come from J.P. Morgan Global Economic Research. Historical growth data collected from FactSet Economics. Guide to the Markets – U.S. Data are as of 9/30/14.

Even if surprise occurrences like Ebola or ISIS affect the market more than expected and lead to a stock market correction, it’s important to remember that corrections are a normal and even healthy part of a bull market cycle.

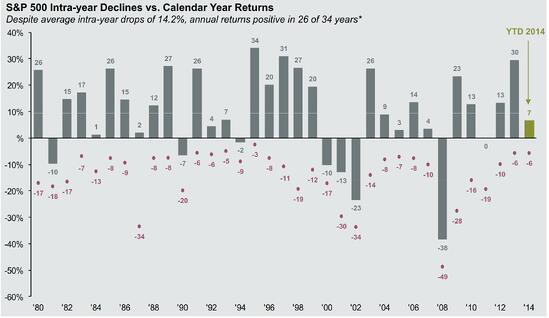

Stock Market Corrections Are a Normal Part of Bull Markets

The S&P 500 experiences average intra-year declines of 14.2%, so to see a decline in the 10 – 15% range would not be unusual.

Source: Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. *Returns shown are calendar year returns from 1980 to 2013 excluding 2014 which is year-to-date. Guide to the Markets – U.S. Data are as of 9/30/14.

Source: Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. *Returns shown are calendar year returns from 1980 to 2013 excluding 2014 which is year-to-date. Guide to the Markets – U.S. Data are as of 9/30/14.

With a properly diversified portfolio, an experienced financial advisor and your wealth management plan, you can feel be better prepared to handle short-term volatility.

Investors Are Still Tempted to React to World Events

It’s normal for investors to worry when stories appear that seem like they could alter the market’s direction. But as Dr. Kelly of JP Morgan Asset Management points out, many investors have a “perception problem,” which makes many investment decisions news-driven instead economically-driven. This is the reason why JP Morgan thinks the Consumer Sentiment Index is about 10 points lower than it should be given current levels of inflation, growth, and employment, and also why 49% of Americans believe we’re currently in a recession.3

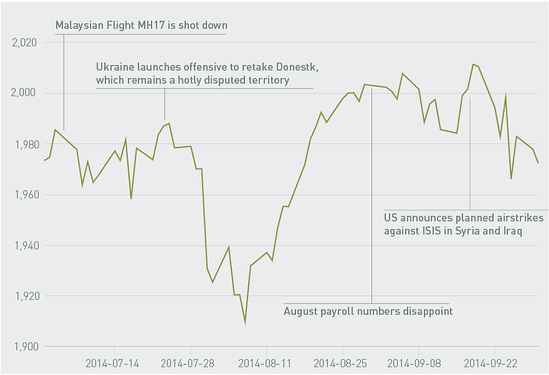

The chart below shows how the market has reacted to some of the recent news, and it’s clear to see that market volatility has coincided with the onset of these events:

Tracking the Impact of World Events on the S&P 500

Sources: CNBC, Fox News, CBS News, Reuters.

It’s natural to consider portfolio strategy adjustments in light of the above events, but remember to ask: will this event affect global economic growth significantly enough to push the market off course for the long-term?

The strong and improving fundamentals mentioned before should outweigh these events in the medium to longer term, which have already started to show - the S&P 500 is once again at an all-time high.

Positioning Your Portfolio for Future Volatility

Global events like these often trigger stock market volatility and even a stock market correction. As long as the longer-term economic fundamentals remain positive, there’s a good chance that the market can overcome the adversities met along the way.

A properly diversified portfolio is a first step to weathering downside volatility. Many investors also utilize wealth management strategies that have a goal of limiting losses if the market experiences a prolonged decline. Tactical money manager strategies are designed with that in mind and should be considered if appropriate given your financial situation and investment objectives.

If you have any questions about the current state of the market or the economy, or would like to review your investment plan, please do not hesitate to contact your Wealth Manager at 1-800-541-7774. You can also start the conversation over email here: wealth@wrapmanager.com.

By Gabriel F. Burczyk

Gabriel is the President of WrapManager, Inc. and Chairman of WrapManger's Investment Policy Committee.

Sources:

2 FactSet

Strategy descriptions listed represent a brief outline of the portfolio’s objective. There is no guarantee that any manager or product will be successful in achieving the objective described. The strategy used by the money manager listed is not suitable for all investors. This material does not represent a personalized recommendation and does not reflect individual investor’s risk and return goals nor does it serve as the receipt of, or a substitute for, personalized advice from WrapManager, Inc. or any other investment professional.

Diversification does not guarantee profit or protect against loss in declining markets.