The market endured a bumpy start to the year, but it also displayed strong resilience over the last few weeks to rally back into positive territory. Investors should use this experience to remember an important lesson: even when market volatility seems pronounced and temptations run high to shift away from stocks, the market can also overcome the short-term headwinds and recover quickly. The first three months of the year offer us a case and point:

Figure 1. S&P 500 Year-to-Date (the lapses in the graph are trading holidays)

Living Together: Your Retirement Plan and Volatility

We’ve been reminded already in 2016 that volatility will rear its head from time to time, and according to JP Morgan, investors should expect volatility to stick around as the market cycle matures.2 This isn’t necessarily a bad thing, and in fact it’s quite normal—volatility has been a part of equity investing for as long as anyone can remember. What it does mean, though, is that it’s becoming increasingly important to prepare not only your portfolio for future volatility, but also your willpower and your emotional approach to investing. Your fortitude is almost certain to be tested repeatedly in the coming months, and perhaps even years. So just remember to stay cool.

As JP Morgan reminds us in their report titled “Investing with composure in volatile markets,” it is quite common for investors to overreact in the short-term to worrisome news and market volatility by altering the asset allocation in their portfolio—the very asset allocation designed to help them reach their long-term goals.

When you think about it, altering your asset allocation (which is long-term in nature) as a reaction to short-term news or market movements does not make a ton of sense. History tells us that investing over longer periods and sticking with the strategy has improved the risk/return profile of an investor’s portfolio.2 Living with the volatility that comes along the way is simply a fact of life.

Case and point:

Figure 2. Negative Returns are Rare for 5-Year Period

|

The investment time horizon is a powerful tool for managing volatility RANGE OF ANNUAL TOTAL RETURNS - 1950 TO 2015 |

|

Looking at all one-year periods from 1950 - present, the S&P 500 has experienced gains as high as 47% (in 1954) and losses as low as -39% (in 2008). Clearly, an undiversified equity portfolio can experience a great deal of volatility in returns in a short period. But if you simply look past the volatility in the short-term and think about returns five years out (which is still a short time horizon for many retirees), the risk/return profile of stocks improves dramatically, with the worst five-year period since 1950 experiencing only a 2% decline. Perhaps most important is the fact that there’s never been a 20-year period in the post-war era that has experienced losses.2 Ask yourself this: is your investment time horizon—meaning the amount of time you need these assets to work for you and your family—at least 20 years?

Time Heals, But You Can Still Take Action to Control Volatility in the Short Term

One of our favorite words in investing: diversification. It still works. According to JP Morgan, “stock market volatility can be managed in a portfolio by following a disciplined diversification and rebalancing investment approach.”2 Amen.

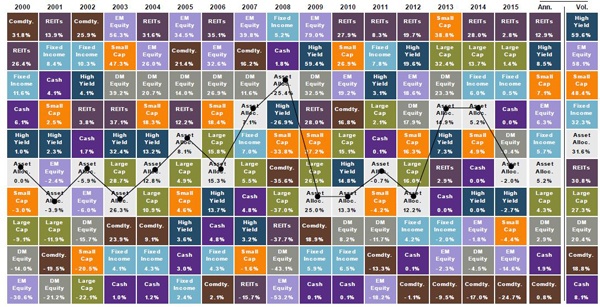

The chart below shows you how:

Figure 3. Diversification Smooths out Your Returns

The “Asset Allocation” boxes with lines connecting the dots show you how a diversified portfolio – which includes all of the listed asset classes – would have performed over time. As you can see, it stays nestled close to the middle in almost every year. It’s not going to provide big, gangbusters returns in any given year, but it’s also not going to fall to the bottom. After 15 years, it produces comparable returns (+4.8% annualized) to other asset classes, with lower volatility—two-thirds that of the stock market and almost one-third that of emerging markets.2 While diversification cannot ensure a profit or protect against loss in a declining market, it’s a potential way that volatility and your retirement plan can live together.

Conclusion

In every year since 1995, the market has experienced at least one 5% pullback. But in spite of this, the market has tended to fully recover within three months. Indeed, the volatile and uneven returns experienced on a daily basis have historically smoothed out over longer periods. While past performance is not indicative of future results, if investors can stay focused on their longer time horizons, chances are they can also improve the risk/return profile of their portfolio.2

The question for investors is: is your portfolio adequately diversified to give you a chance at positive returns over time, with less volatility? One of our Wealth Managers can help you answer that. You can give us a call today or shoot us an email, and we can schedule some time to talk and review your portfolio. Reach out to us at 1-800-541-7774 or contact us here to get started.

Sources:

1. Federal Reserve Bank of St. Louis

2. JP Morgan

3. JP Morgan