Should an investor consider owning dividend stocks? If so, why? And when?

Should an investor consider owning dividend stocks? If so, why? And when?

In this piece, we delve into the realm of dividend stock strategies. We’ll look at why dividend stock strategies are important, how they can fit into a broader investment strategy, and why investors may want to consider them now.

What is a Dividend Investment Strategy?

Let’s start with the basics. Generally speaking, a dividend investment strategy is an investment strategy tailored to invest in dividend-paying companies. Asset managers who specialize in owning dividend-paying stocks often have different criteria for the types of companies they want to own. For example, some managers may want to own companies that pay a healthy size dividend, while others may care more about the company having a history of increasing their dividend payments over time. Or, perhaps the manager is looking for companies with a long history of consistent dividend payments versus companies that only recently started paying dividends to shareholders.

Understanding the nuances that drive a dividend stock manager to make security selection decisions can be critical, especially when an investor is researching and considering which manager to hire. WrapManager is here to guide you through this process.

One such manager, Federated Investors, states that their goal is to offer a “portfolio of carefully selected high-dividend-paying stocks, which offer the potential for reliable monthly income, broad diversification among income sectors, and inflation protection through both dividend and equity growth opportunities.”

This provides a good level of initial understanding and is a good start, but what about the process of analyzing their holdings, performance team, management team, and so on. That’s where WrapManager can step in and help. If you'd like more information on Federated Investors, go here to request a report.

What are the Advantages of Investing in Dividend Stocks?

There could be a few potential advantages that dividend strategies offer. For one, many of the companies that pay dividends tend to have some of these attractive characteristics, according to Federated Investors:

- Tend to be solid and well-established companies;

- Their stock prices tend to be less volatile than non-dividend-paying companies;

- Have historically paid a sizable portfolio of their returns in cash, and as a result, may help cushion a portfolio’s downside impact over time.

We might add that in some cases, dividend-paying companies have strong balance sheets, which could also imply that they are stable businesses. That can be an important feature for some investors.

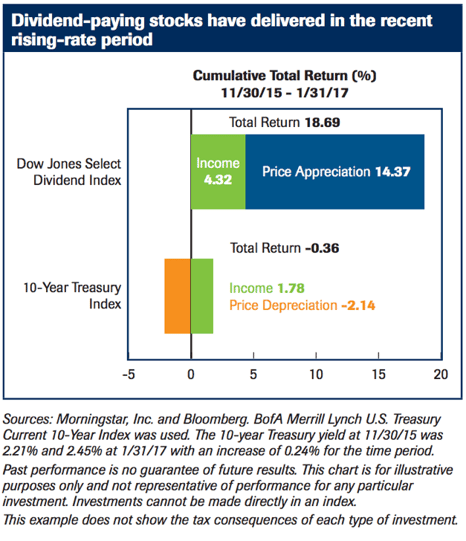

In the low interest rate environment we’re in today, many investors have been frustrated by the lack of yield bearing securities (like bonds or CDs). Dividend income can potentially fill those shoes by providing cash flow to a portfolio where it is otherwise missing. What’s more, dividend stocks have been able to provide some additional income while also delivering price appreciation benefits for investors, particularly in recent years.

Are there Any Disadvantages or Risks to Consider?

Perhaps the most important fact to consider is: at the end of the day, dividend-paying stocks are just that - stocks. They are inherently volatile, and subject to the ups and downs of normal market cycles. In some cases, dividend-paying stocks may not experience the same capital appreciation potential as non-dividend-paying stocks.

Another important note is that companies are not beholden to the dividends they declare. Companies are free to reduce or eliminate dividend payments as they see fit, so the value of a dividend-paying stock can change over time. It’s important to monitor dividend payments closely, which is another reason hiring a dividend investment manager makes sense for many investors.

WrapManager Can Help You Research and Evaluate Dividend Investment Managers

Curious if your portfolio may benefit from a dividend investment strategy? Have a portfolio that you’d like to re-evaluate? The next step is to talk to one of our Wealth Managers. We're happy to put together a presentation of various dividend investment managers, discuss the pros and cons of each one with you, and help you decide if any may be a good fit for your personal goals. We have research on thousands of asset managers of all types, and dividend strategies are a key category. Get started by calling us at 1-800-541-7774 or send a note to wealth@wrapmanager.com with your inquiry. We’re happy to help.

Source: Federated Investors