Life is full of detours and unknowns, and in many cases retirement planning is too. Sometimes people are forced to change jobs, to give financial help to family members in need, or to buckle down and save less during an economic downturn. But other times the detours are welcomed ones: a person relocates for a better paying job, gets the opportunity to do contract work during retirement for extra income, or maintains good enough health to work later into life.

Life is full of detours and unknowns, and in many cases retirement planning is too. Sometimes people are forced to change jobs, to give financial help to family members in need, or to buckle down and save less during an economic downturn. But other times the detours are welcomed ones: a person relocates for a better paying job, gets the opportunity to do contract work during retirement for extra income, or maintains good enough health to work later into life.

The bottom line is that retirement planning is different for everyone. The path to retirement we ultimately take may not be the one we originally planned.

In that sense, retirement planning is often much more than just a financial number we are trying to reach. There are trade-offs, course corrections, adjustments, surprises, and challenges (to name just a few). In this piece, we want to focus on one ‘detour’ many investors encounter – having to retire earlier than expected.

Retiring Earlier than Expected – What’s Your Back-Up Plan?

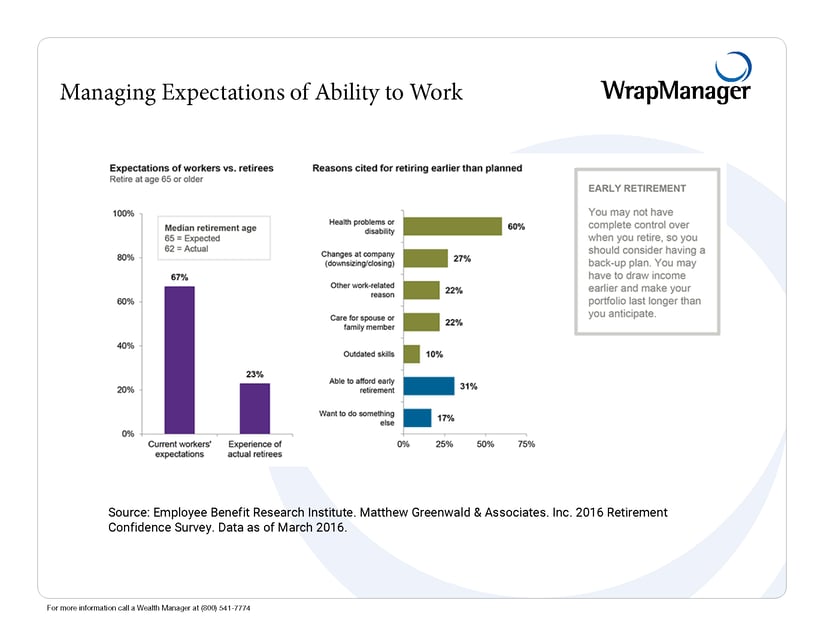

J.P. Morgan has some research findings that may surprise you. In a study, they found that 67% of current workers expect to retire at age 65 or older, but only 23% of retirees actually worked to age 65. This gap in expectations vs. reality is often a result of people’s overconfidence about their ability to work later in life.

Retirement Does Not Always Go Exactly as Planned:

But as we all know, life happens and circumstances can change for any number of reasons. The J.P. Morgan research gives several examples of changing circumstances that force people to retire earlier than expected. The problem is that folks who plan to work longer may opt to save less during their working years, figuring they can provide for their income needs through the workplace. But that’s not always the case.

Ask yourself: do you have a back-up plan if you can’t work as long as expected?

The best way to find out is by running “stress tests” on your current retirement plan, which the Wealth Managers here at WrapManager can help you accomplish. (Stress testing is a simulation technique, used by financial advisors and other investment professions, that is used to determine a portfolio's reaction to different financial situations such as ups and downs in the market, early retirement, unexpected drawdowns, etc.¹) For instance, if your current retirement plan has you working until you are 70, what happens if you have to stop working at 65? For married couples, what happens to the retirement plan if one spouse cannot work anymore? How does your income change if you start taking Social Security at 65 instead of 68? What happens if you and your spouse live to be 90 years old?

These kinds of scenarios can help you get a better understanding of where you stand and how well your portfolio would serve you under different sets of circumstances. As we mentioned before, there is really no way to know how your retirement arc is going to play out, but chances are your primary plan is going to change at some point along the way. It’s a good idea to test out different scenarios – doing so may expose gaps in your plan that need addressing, and may even inspire you to save more and cut certain expenses. And we could all use a little bit of that in our financial plans.