March 9, 2009 marked the end of one of the worst bear markets in stock market history, and the beginning of the bull market we’re currently in. Now 5 years and +177% later,1 many investors are wondering what the future holds. Is the market now overpriced? Is the next bear market around the corner?

History can often help answer these types of questions, so we’ll take a look back at past bull markets to draw insight into the current environment.

How Long Do Bull Markets Last?

The average span of a bull market is a little under four years, but according to JP Morgan US Chief Equity Strategist Tom Lee, “averages don’t tell you anything.”1 Here’s one reason why:

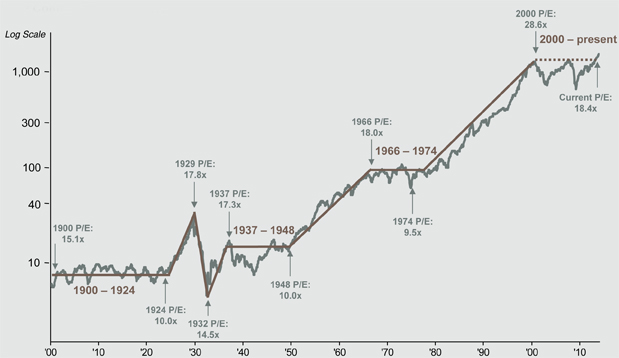

Stock Market Since 1900 (S&P 500 Composite Index)

(Click chart for larger version)

Source: Shiller, FactSet, J.P. Morgan Asset Management. Data shown in log scale to best illustrate long-term index patterns. P/E ratios shown at price peaks and troughs use trailing four quarters of reported earnings and are shown as a one year average. Past performance is not indicative of future returns. Chart is for illustrative purposes only. Guide to the Markets – U.S. Data are as of 12/31/13.

As you can see from the chart, there are long stretches in history like from 1948 – 1966 and from 1974 – 2000, when the market rises without experiencing huge, pronounced declines. The 1990s bull market lasted 9 ½ years and posted gains of +417%, which makes this current bull market actually look fairly small by comparison.1

That being said, there have also been periods when the market has trended sideways for an extended period, as the 1900 – 1924, 1937 – 1948, 1966 – 1974, and 2000 – 2013 time frames illustrate.

Taken together, these two points beg the question…

Can the Current Bull Market Keep Going?

History tells us that the market rises more than it falls over time, and that the nature of stocks is to reach new highs, then eclipse those highs and keep on going.

The key in determining whether stocks can keep going from here falls back to establishing whether conditions are ripe for economic growth and whether corporate earnings can continue to rise. According to Tom Lee, those conditions are present.

Lee thinks that a rebound in infrastructure spending, households having improved debt situations and more cash to spend, and wealth gains from the bull market so far will continue to push economic growth and corporate earnings forward. This, he thinks, could also drive further stock market gains from here.1

Positioning Your Portfolio for the Year Ahead

We tend to agree with Mr. Lee’s assessment that economic conditions and corporate profitability trends seem to indicate that the market could continue to do well from here.

We also think, however, that there could be the normal bumps along the way. We’ve written recently about the possibility of a stock market correction, and we think it’s important to note that stocks are in a 29-month stretch without having experienced a correction of more than 10%. According to S&P Capital IQ, historically stock market corrections occur every 18 months,1 so we could be due for one in the not too distant future.

A properly diversified portfolio can help mitigate the effects of a pullback in the markets, while also enabling an investor to capture upside should the market continue to march higher. Investors should work with their financial advisors to ensure their investment portfolios are diversified across money managers, asset classes and different areas of the market, while also being allocated appropriately relative to their long-term goals.

WrapManager Can Check Your Portfolio and Discuss the Outlook for the Stock Market

One of our Wealth Managers will happily review your portfolio with you to see if you are adequately diversified, and we can talk with you about our views on the market as well as the views of the money managers we recommend to our clients. To learn more about our approach and how we can help you craft an investment plan to reach your goals, please call us today at 1-800-541-7774. Or get started on your investment plan by answering a few questions here.

Sources:

1 CNBC